New Delhi: In a significant step-back from its earlier decision, the Ministry of Finance late Wednesday evening announced that credit card transactions conducted abroad would continue to be exempt from the tax collected at source (TCS) on foreign transactions.

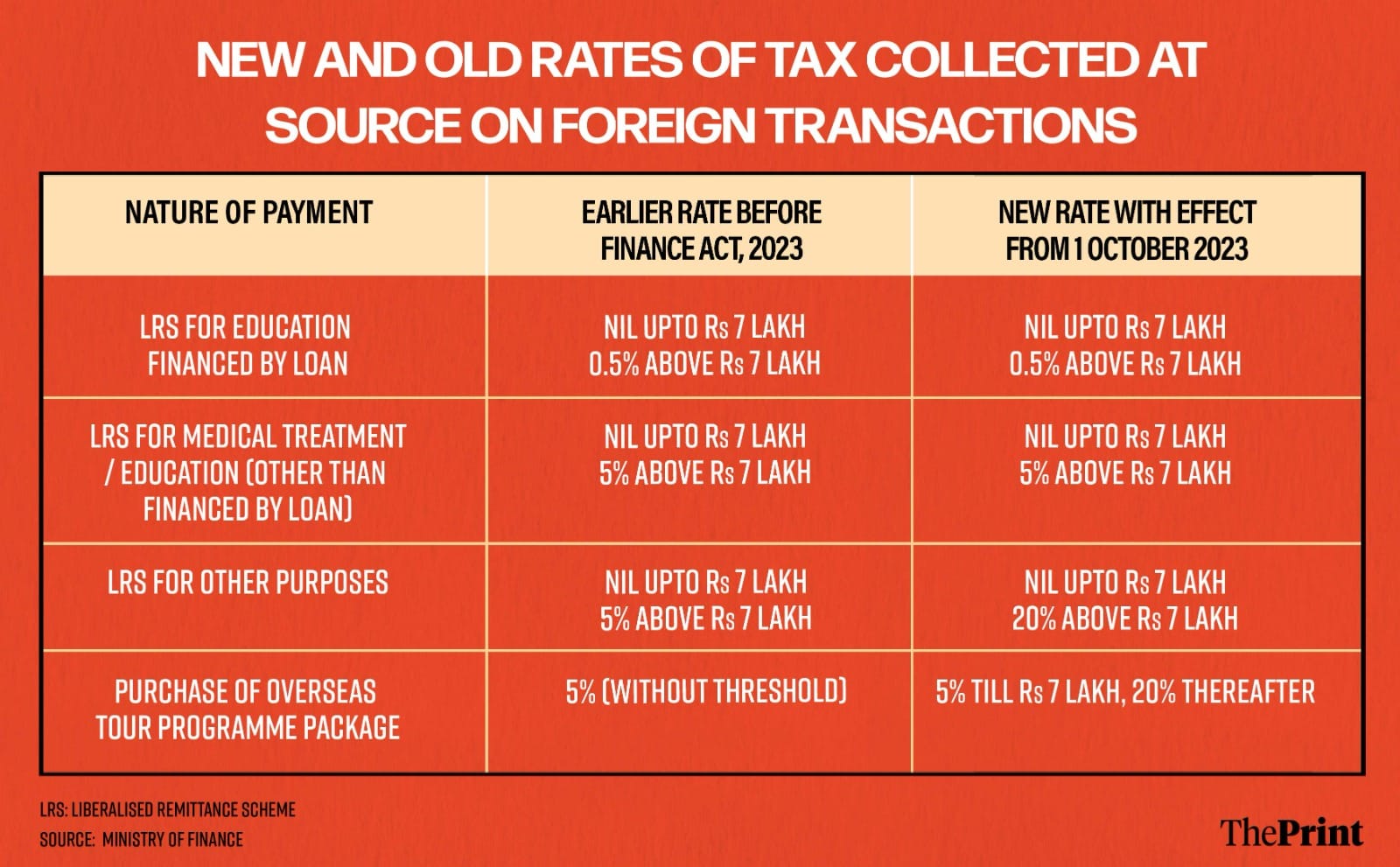

Further, the higher rate of TCS of 20 percent on most foreign transactions, earlier meant to be effective from 1 July, will now be applicable from 1 October, but only for amounts exceeding Rs 7 lakh in a financial year. Foreign expenditure on education and health will continue to attract lower rates.

Finance Minister Nirmala Sitharaman had in Budget 2023 announced that the rate of TCS on foreign transactions would be increased to 20 percent, and would include payments made on the purchase of foreign tour packages. In the announcement, she had removed the earlier Rs 7 lakh limit, which meant that the 20 percent TCS would apply to all foreign transactions, except those made for medical or education purposes. This was to come into effect from 1 July.

A few months later, in May, the Ministry of Finance issued a notification including international credit card transactions within the ambit of the TCS system. This has now been reversed.

“To give adequate time to banks and card networks to put in place requisite IT based solutions, the Government has decided to postpone the implementation of its 16th May 2023 e-gazette notification,” the Ministry of Finance said in a release issued Wednesday. “This would mean that transactions through international credit cards while being overseas would not be counted as LRS [Liberalised Remittance Scheme] and hence would not be subject to TCS.”

Separately, however, the Finance Ministry also made a distinction between credit card transactions when made while abroad, and when made while in India. While credit card transactions made while the user is abroad will not attract TCS, international payments using a credit card made while the user is in India would attract TCS if they cross the Rs. 7 lakh threshold.

Also read: Modi govt has a split personality—innovative on disinvestment, regressive on credit card spends

Rs 7 lakh threshold restored

Wednesday’s release also said that the threshold of Rs 7 lakh per financial year per individual will be restored for TCS on foreign transactions, through all modes of payment (this limit had been restored days after the May announcement, only for debit and credit card transactions), regardless of the purpose.

“Thus, for the first Rs 7 lakh remittance under LRS, there shall be no TCS,” the release said. “Beyond this Rs 7 lakh threshold, TCS shall be 0.5 percent (if remittance for education is financed by education loan), 5 percent (in case of remittance for education/medical treatment), and 20 percent for others.”

When it comes to the purchase of overseas tour packages, the TCS will continue to apply at the rate of 5 percent for the first Rs 7 lakhs per individual per financial year, and the 20 percent rate will only apply for expenditure above this limit.

“The increase in TCS rates; which were to come into effect from 1 July, 2023 shall now come into effect from 1 October, 2023,” the release said. “Till 30 September, 2023, earlier rates (prior to amendment by the Finance Act 2023) shall continue to apply.”

(Edited by Poulomi Banerjee)

Also read: Indian banking system seeing improving health despite challenging global scenario, RBI report finds