New Delhi: The Narendra Modi government stepped on the accelerator of reforms Wednesday and approved strategic sales of its stake in five public sector companies, cleared the industrial relations code to push labour reform and gave temporary relief to telecom firms by deferring payment for spectrum.

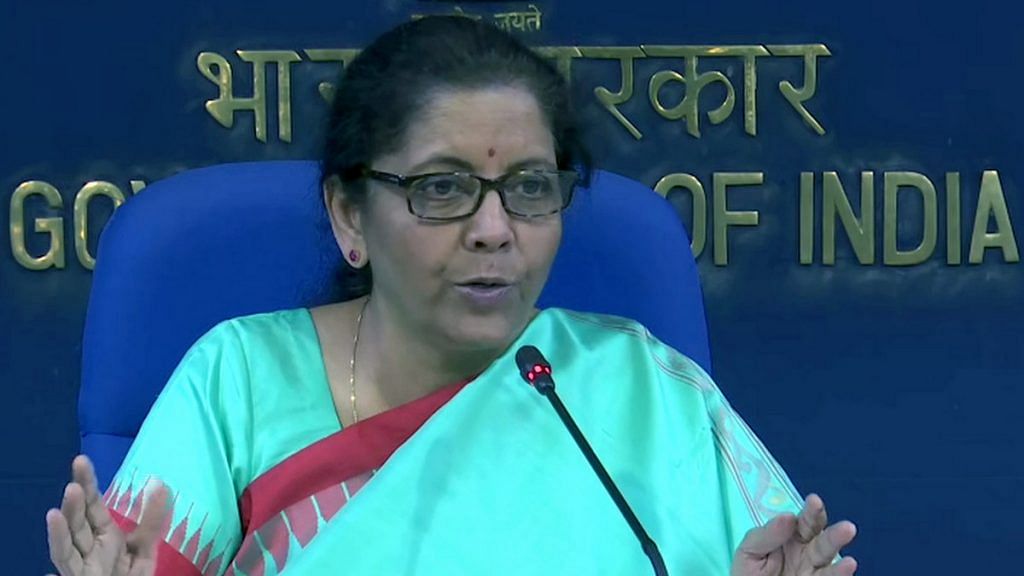

The government’s stake in Bharat Petroleum Corporation Limited (BPCL), the Container Corporation of India (CONCOR) and the Shipping Corporation of India will be sold, and management control in these firms will be handed over to the buyers, Finance minister Nirmala Sitharaman announced at a late evening press conference.

The other two firms up for strategic sale are THDC India and the North Eastern Electric Power Corporation, which will be sold to state-run National Thermal Power Corporation (NTPC).

The government will also reduce its stake in some select public sector enterprises below 51 per cent, but retain management control.

In addition, the cabinet approved the industrial relations code that will be tabled in the ongoing winter session of Parliament, as part of the proposed labour reforms.

The government also decided to provide a partial reprieve to the beleaguered telecom sector by deferring receipts of the spectrum auction instalments due from service providers for the years 2020-21 and 2021-22.

Also read: India has met its disinvestment target only once in the last 10 years

The stakes to be sold

The cabinet approved the disinvestment of 53.29 per cent stake in BPCL, except for the firm’s stake in the Numaligarh refinery in Assam. This refinery will remain in the public sector and will be taken over by another state-run firm, Finance Minister Sitharaman said.

The government will sell 30.8 per cent stake out of its existing 54.8 per cent stake in the Container Corporation of India, and will cede management control to the strategic buyer.

The government is of the view that the Container Corporation is integrally linked to the railways, and it is important that government retains some stake. However, the management control will be unencumbered, said Disinvestment Secretary Tuhin Kanta Pandey.

Significance of the decision

The decision comes at a time when tax revenues are slowing down on the back of a slowing economy, exerting pressure on the government’s fiscal deficit.

Data released by the Controller General of Accounts showed that tax collections in the first six months of this fiscal were only around one-third of the full-year targets. The slowdown in growth, both in direct and indirect tax collections, had cast doubts over the government meeting its fiscal deficit target of 3.3 per cent of gross domestic product, especially at a time when economic growth is decelerating.

The full year growth is likely to be around 5-5.5 per cent, according to estimates by economists.

The government has budgeted to collect Rs 1.05 lakh crore in disinvestment proceeds in the current fiscal year, including from the sale of Air India. However, it has managed to collect only around Rs 17,000 crore so far, according to the finance ministry’s Department of Investment and Public Asset Management.

It remains to be seen if the stake sale will face opposition from the employees of these firms, and proponents of the ‘swadeshi’ philosophy, such as the RSS-affiliated Swadeshi Jagran Manch, which had opposed the government’s decision to sell its stake in Air India.

It was the BJP-led Atal Bihari Vajpayee government that had spearheaded the first major disinvestment drive by selling strategic stakes in many state-run enterprises, including Hindustan Zinc and BALCO.

Also read: Fiscal stress offers Modi govt great opportunity to push disinvestment