New Delhi: In a big relief to the Indian middle class, individuals earning up to Rs 12 lakh—or Rs 12.75 lakh with standard deductions—will now pay zero tax. Finance Minister Nirmala Sitharaman announced major reforms in the New Income Tax regime in Parliament Saturday while presenting the Union Budget 2025.

In her speech Saturday, Sitharaman said the move will “substantially reduce the tax burden on the middle class and leave more money in their hands”.

Under the revised tax slabs, there will be no tax on an income of up to Rs 4 lakh.

Between Rs 4 and Rs 8 lakh, the tax will be five percent; between Rs 8 and Rs 12 lakh, it will be 10 percent; between Rs 12 lakh and Rs 16 lakh, it will be 15 percent; between Rs 16 lakh and Rs 20 lakh, it will be 20 percent; between Rs 20 lakh and Rs 24 lakh, it will be 25 percent, and above Rs 24 lakh, the tax will be 30 percent.

The announcement was met with thunderous applause from Bharatiya Janata Party MPs, which was led by Prime Minister Narendra Modi.

“To taxpayers upto 12 lakh of normal income, other than special rate income such as capital gains, the tax rebate is being provided in addition to the benefit due to slab rate reduction in such a manner that there is no tax payable by them,” the finance minister said.

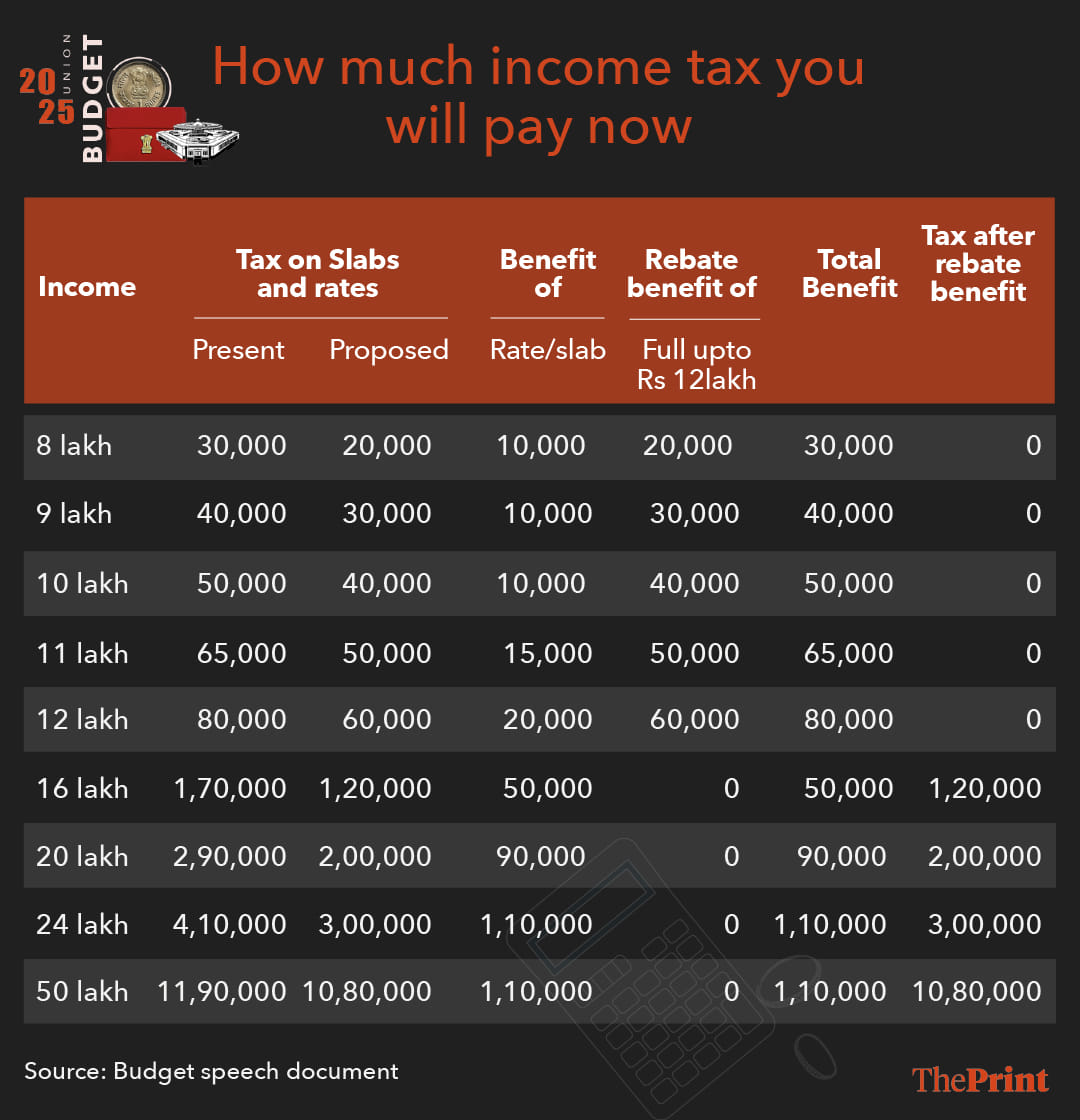

Illustrating the total tax benefit of reforms with examples, she said, “A taxpayer in the new regime with an income of 12 lakh will get a benefit of 80,000 in tax—which is 100 percent of the tax payable as per existing rates.”

“A person having an income of 18 lakh will get a benefit of 70,000 in tax—30% of tax payable as per existing rates. A person with an income of 25 lakh gets a benefit of ` 1,10,000—25% of his tax payable as per existing rates.”

The government also raised the Tax Deducted at Source (TDS) exemption limit on rent from Rs 2.40 lakh to Rs 6 lakh in the Union Budget 2025. This adjustment is expected to ease financial burdens on renters and streamline the compliance process for property owners, ultimately facilitating smoother rental transactions.

The tax deduction limit for senior citizens was doubled from Rs 50,000 to Rs 1 lakh.

Additionally, the Tax Collected at Source (TCS) threshold on foreign remittances under the Liberalised Remittance Scheme (LRS) was increased from Rs 7 lakh to Rs 10 lakh. This reform aims to reduce compliance difficulties for individuals sending money abroad, providing greater flexibility for international financial transactions.

Poonam Upadhyay, director at credit rating agency Crisil Ratings, said, “The proposed hike in tax collected at source threshold on remittances under the Reserve Bank of India’s Liberalised Remittance Scheme from Rs 7 lakh to Rs 10 lakh should benefit the travel and foreign exchange sectors.”

“It will provide tailwinds for the outbound tourism and airline sector. Students and individuals seeking medical treatment will also benefit.”

The updated tax framework is expected to alleviate the financial strain on middle-income earners, especially those with annual incomes between Rs 7-12 lakh. With reduced tax rates in the Rs 12-24 lakh bracket, individuals can expect a higher take-home salary, potentially leading to increased consumer spending and driving economic expansion.

Additionally, the streamlined tax system removes the complexity of numerous deductions and exemptions, simplifying the tax filing process and enhancing transparency.

Through these reforms, the government said, it seeks to foster formalisation, ease tax compliance, and stimulate economic growth. By establishing the new tax regime as the default choice, the system becomes more user-friendly for taxpayers, aligning with the government’s goal of boosting domestic consumption and ensuring economic stability.

(Edited by Sanya Mathur)

Also Read: Greenfield airports, canal project aid & makhana board. Union Budget gives poll-bound Bihar a boost