Bengaluru/Mumbai: India is witnessing its first hostile takeover attempt of a software developer, a move the target says is a “grave threat” to its future.

Larsen & Toubro Ltd., Asia’s second-largest engineering firm by value, agreed to buy 20.3 per cent of Mindtree Ltd . for about Rs 32.7 billion ($480 million) and plans to acquire a controlling stake for as much as Rs 107.3 billion. V.G. Siddhartha, the largest shareholder in Mindtree through Coffee Day Enterprises and affiliated entities, agreed to sell the original stake for Rs 980 apiece.

Mindtree management, including its chief executive officer, say the company’s success lies in being able to build long-term relationships with clients and partners, ties they argue would be jeopardized by the Larsen’s acquisition. Proxy adviser Institutional Investor Advisory Services India Ltd. waded into the debate calling for Mindtree’s independent directors to guide investors on the merits of the offer.

“Hostile bids are uncommon in the professional services business since people are the key assets,” Kawaljeet Saluja and Satishkumar S, analysts with Kotak Institutional Equities wrote in a note to clients Tuesday. “These assets are not easy to manage in such situations.”

Mindtree, which counts United Technologies Corp. and Dutch phone company Royal KPN NV as its clients, had also attracted interest from private equity firms including Baring Private Equity Asia and KKR & Co., people familiar with the matter said previously.

“It is not necessary that Mindtree’s independent directors tow the line with the company’s promoters,” IiAS says in the note. If Mindtree’s leadership and key staff leave taking some clients with them upon the takeover, it could have damaging consequences for the business, IiAS said.

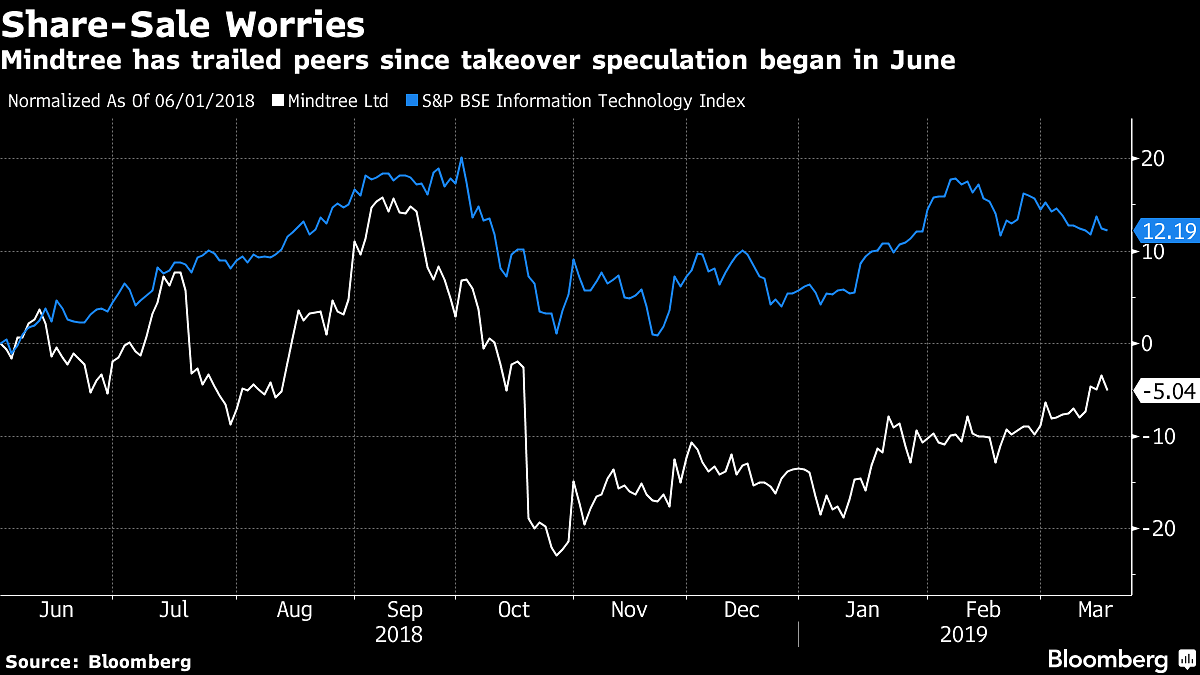

The software developer’s shares fell 1.7 per cent to Rs 946 at 12:21 p.m. in Mumbai. Larsen’s shares declined for a second day, dropping 2.2 per cent. The engineering company said it plans to keep Mindtree a listed entity and that the target’s services complement the business of its software unit, Larsen & Toubro Infotech Ltd.

“The attempted hostile takeover bid of Mindtree by Larsen & Toubro is a grave threat to the unique organization we have collectively built over 20 years,” according to a statement from the executives, which include CEO Rostow Ravanan and Executive Chairman Krishnakumar Natarajan. “We don’t see any strategic advantage in the transaction and strongly believe that the transaction will be value destructive for all shareholders.”

Mindtree last week said it will consider buying back shares, in a bid to deter any buyers. Co-founder Subroto Bagchi, who also signed Tuesday’s management statement, said in a tweet Sunday he’s returning to the company to protect it from being taken over.

Larsen’s Chief Executive Officer S.N. Subrahmanyan said the company “would go out of the way” to make a success of the investment. “Emotionalities have to be overcome going forward,” he said at a media briefing in Mumbai.

Also read: Padma Vibhushan for AM Naik who fought Ambani and Birla to lead L&T’s defence strides