New Delhi: Finance Minister Nirmala Sitharaman Saturday announced lower personal income tax slabs, but subject to taxpayers foregoing various deductions available to them.

The move is on the lines of a Rs 1.45-lakh crore tax relief that the Modi government had announced for companies in September last year, when corporate taxes were reduced by nearly 10 percentage points but subject to the taxpayers not availing any deductions like tax holidays.

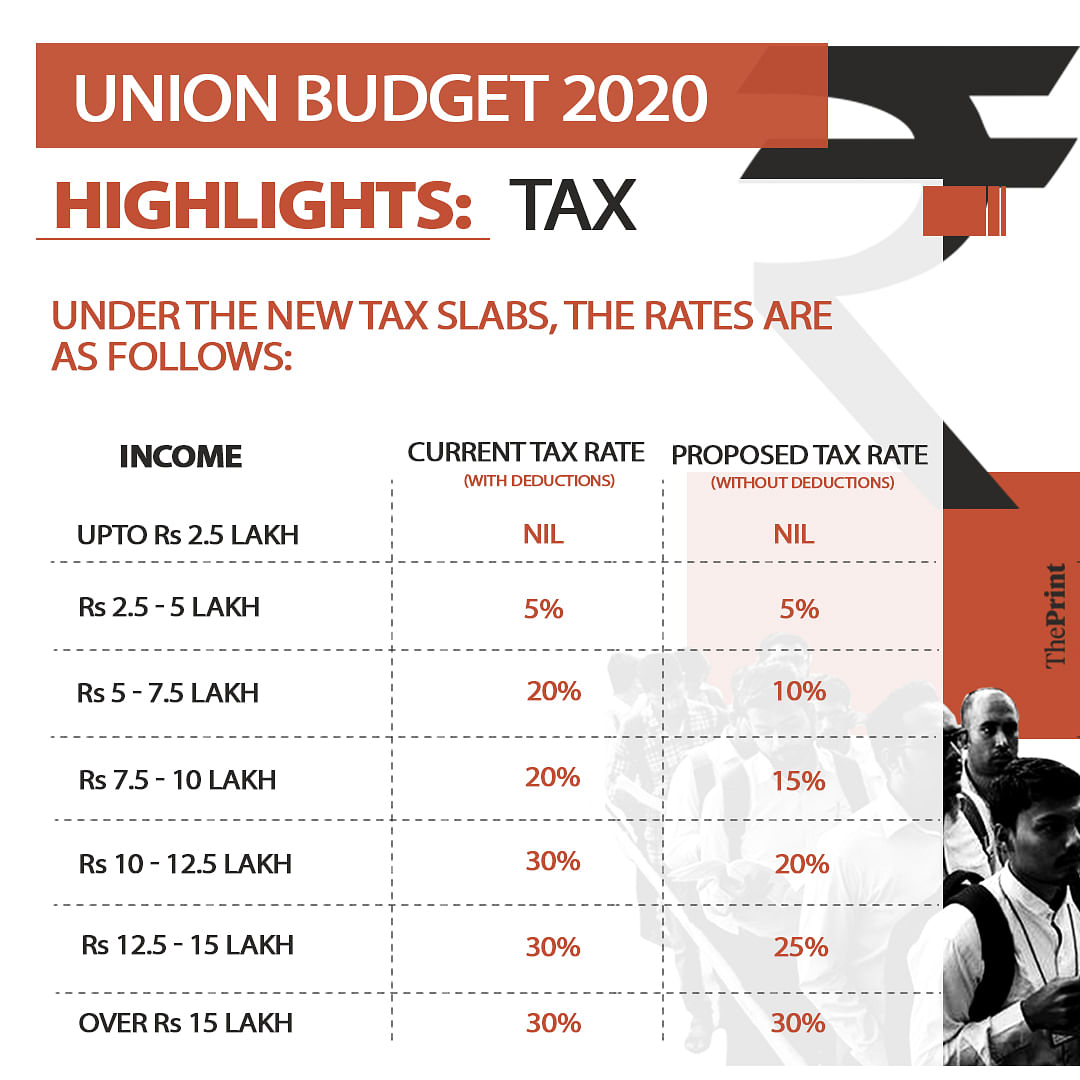

According to the new tax slabs proposed in Union Budget 2020, those earning income between Rs 5 lakh and Rs 7.5 lakh will be taxed at 10 per cent as against an applicable tax rate of 20 per cent with deductions. Those earning an annual income of Rs 7.5 lakh to Rs 10 lakh will be subject to a tax rate 15 per cent as against a tax rate of 20 per cent.

People with annual income of Rs 10 lakh to Rs 12.5 lakh will now be subject to a tax rate of 20 per cent; between Rs 12.5 lakh to Rs 15 lakh at 25 per cent; and over Rs 15 lakh at 30 per cent. The applicable tax rate for all these three slabs was 30 per cent in the deduction regime.

The new tax slabs will be voluntary and taxpayers will have the option of using the existing tax slabs and avail all the deductions available to them.

Also read: Sitharaman’s education budget has FDI, making students job-ready, Rs 5,000-cr allocation rise

No deductions allowed

The deductions that the taxpayers will have to forego have been spelt out in the memorandum to the budget documents.

At present, taxpayers get many deductions in the computation of income tax — like a standard deduction of Rs 40,000 and Rs 1.5 lakh of savings under section 80 (C) of the I-T form.

According to the memorandum, taxpayers won’t be able to avail many of the deductions under the new slab. These include the house rent allowance, leave travel concession, any deductions under chapter VIA like section 80 (C), standard deduction, deduction for entertainment allowance and employment/professional tax and the Rs 2-lakh interest deduction on housing loans.

This may push many taxpayers not to opted for the lower tax slabs.

In her budget speech, Nirmala Sitharaman said this will help taxpayers file their tax returns on their own and without any difficulty. She added that substantial tax benefit will accrue to taxpayers in the new tax regime.

The government is estimating that the amount of tax revenues that it will have to give up or the tax foregone on account of the new slabs will be Rs 40,000 crore.

Sitharaman also announced that faceless appeals online will be allowed on the lines of faceless assessment to minimise harassment to taxpayers.

To boost the housing sector, tax breaks available to affordable housing were extended by one year and developers constructing affordable houses have been given a one-year tax holiday.

Also read: Nirmala Sitharaman raises FY20 fiscal deficit projection to 3.8%, FY21 target set at 3.5%

Nothing is benifited. One hand they guve and in another hand looted fully….

Who rich they r benifited…… And people who r poor taking all benifits of govt provision and we tax payer pay for these people to livelhood.

If corporate is in problem wavier of loan. If farmers r in problem wavier of loan.

What aboht salaried people? No concession. And above all removed all deduction too.

Great…

Calculate benifits with 7 lakhs net profite with old method having befit of deductions and same by new method

The exemptions that can be foregone under the new regime, if opted would include 80C – Rs.1.50 lacs, Hsg loan interest- Rs.2 lacs, Standard Deduction Rs.40000, Medical Insurance premium Rs.25000 and house rent deductions about Rs.1 lac. The total comes to Rs.5.15 lacs. This will vary from person to person. Let us assume Gross income of Rs.15 lacs and deductions foregone of Rs.5 lacs. Tax under old regime would be Rs.1,12,500 and under new regime could be Rs.187500. For those earning Rs20 lacs, the numbers could be old- Rs.262500 vs. new- Rs. 337500. Suppose a person has income of Rs.10 lacs and no hsg loan. The exemptions forgone could be 80C- Rs.150000, Std Deduction -Rs.40,000; total Rs.190000. The numbers could be old -Rs.74500 and new Rs.75000. The moral is less the deductions being claimed, more would be inclination towards the new regime. Furthermore, the incentives towards investments in various options to save taxes could be removed. With this housing, mutual funds etc would suffer.

One reason have never applied for the FM’s job is that my lower back would not allow me to stand for two hours and forty minutes at a stretch. Would also need a rest room break, like during the interval in a film show.