India’s bankruptcy code is new, and it’s a well-worn tradition of common law for new legislation to be made roadworthy by litigation, both real and frivolous.

Kumar Mangalam Birla just treated India’s new bankruptcy law with utter disdain. But before you dismiss this as yet another instance of a billionaire behaving badly, think of the huge favor he’s doing the legal system.

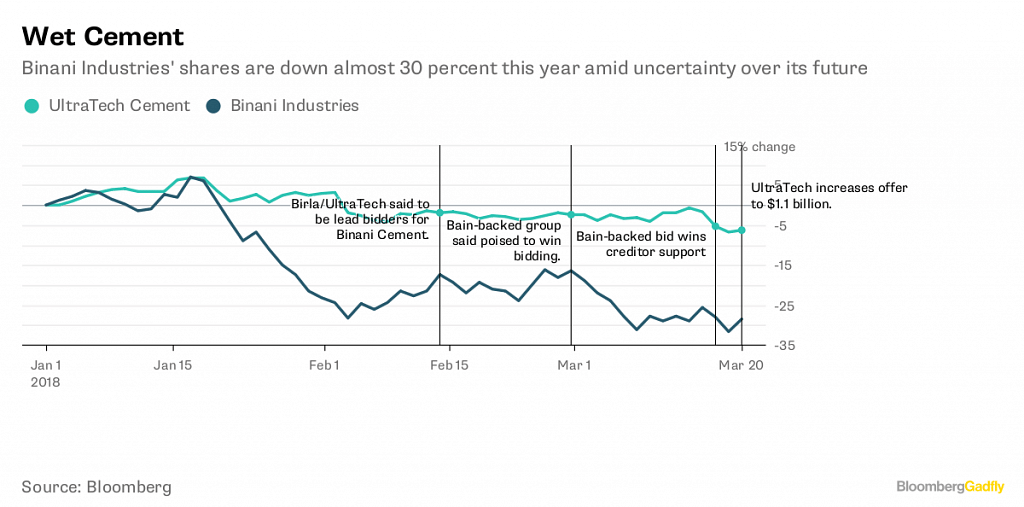

Normally, Birla’s 72.7 billion rupee ($1.1 billion) offer to Binani Industries Ltd. for its 98.4 percent stake in Binani Cement would be unremarkable. Birla’s UltraTech Cement Ltd., already the country’s largest cement producer, gets to ramp up in anticipation of a much-awaited recovery in housing construction. Binani also has capacity in China and Dubai.

But this isn’t a normal deal. Binani Cement is insolvent, and therefore belongs to creditors and not Binani Industries. What’s more, the lenders — mostly state-run banks — have already accepted a Bain Capital-backed bid by Dalmia Bharat Ltd. UltraTech’s petulant refusal to concede defeat came before the National Company Law Tribunal could give the deal its blessing.

It’s one thing for Birla to complain that the sale to Dalmia-Bain wasn’t transparent. But to make a counteroffer to the original owners, whose rights to make decisions for the cement unit ended the day the tribunal admitted the business into bankruptcy, smacks of disregard for the law.

That’s actually a good thing. India’s bankruptcy code is new, and it’s a well-worn tradition of common law for new legislation to be made roadworthy by litigation, both real and frivolous. It’s the courts’ job to interpret the original intent of lawmakers and fill in the gaps. Many of life’s important questions — like whether the tomato is a vegetable or fruit — are decided by legal disputes.

So here are some questions for India’s courts, which will obviously have to get involved now.

Will they see the UltraTech bid as a violation of creditors’ rights to dispose of an insolvent asset? Or will they take the view that the ends justify the means, and that since the aim of the bankruptcy code is to maximize recovery rates for lenders, Birla’s offer — regardless of to whom it was made — is valid?

The lenders may indeed be tempted to say yes to UltraTech. Not only does its proposal impose no haircuts on them, but bankers may also be hesitant to annoy Birla, who’s a much bigger fish than Dalmia. However, if the creditors’ committee is allowed to change its mind, shouldn’t Dalmia-Bain be entitled to a breakup fee at least?

Finally, there’s the question of fairness. Recovery rates of 100 percent shouldn’t be a matter of unalloyed joy for lenders. For one thing, such an outcome suggests Binani Cement was merely illiquid, not insolvent. It’s a matter of concern that controlling shareholder Binani Industries couldn’t be persuaded by lenders to bring in more equity to service their loans. Now, should the Birla offer get approved, the same shareholder will make money after settling bankers’ dues.

State-run Indian banks impose real costs on taxpayers when they make loan-loss provisions on nonperforming assets like Binani Cement. Every year, a cash-strapped government has to bring in new capital. At $32 billion, the latest India bank recapitalization plan is a large one. Lenders can write back extra provisions; taxpayers’ gains are limited to having to provide less money to banks in future.

That’s inadequate. To make deals more honest, successful bidders for insolvent assets should perhaps be prohibited from compensating original shareholders. Any winner who pays more than 100 percent of creditors’ claims should write the check for the extra portion to the government instead.

A simple but uncharitable interpretation may be that Birla is a sore loser. Still, when it’s used to test common law, greed may still be a force for good — Bloomberg