Washington: The US Federal Reserve, in its latest monetary policy meeting, voted to leave the key interest rate unchanged at 5.25-5.50 per cent, maintaining the policy rate for the seventh straight time on the trot.

During the COVID-19 pandemic, the interest rates were near zero.

Raising interest rates is a monetary policy instrument that typically helps suppress demand in the economy, thereby helping the inflation rate decline.

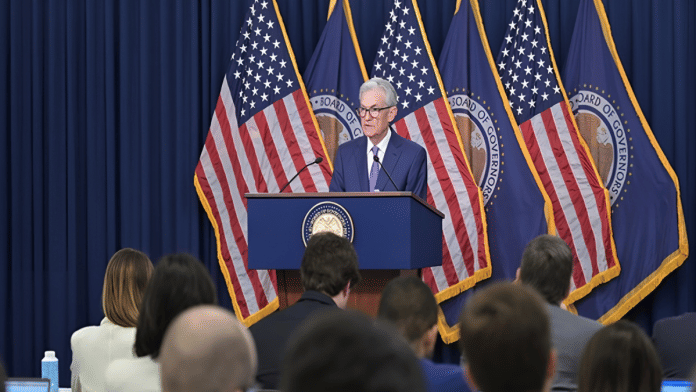

“We are maintaining our restrictive stance of monetary policy in order to keep demand in line with supply and reduce inflationary pressures. I will have more to say about monetary policy after briefly reviewing economic developments,” US Fed Chair Jerome Powell said.

Consumer price inflation in the US continued to trend down, though it remained above 2 per cent, and it a pain point for its central bank. In the 12 months through May, the inflation increased 3.3 per cent year-on-year.

“In recent months, there has been modest further progress toward the Committee’s 2 percent inflation objective,” US Fed said in its monetary policy statement this week.

The central bank seeks to achieve maximum employment and inflation at the rate of 2 per cent over the longer run.

Powell said so far this year, the inflation data have not given them that greater confidence.

“The Committee judges that the risks to achieving its employment and inflation goals have moved toward better balance over the past year. The economic outlook is uncertain, and the Committee remains highly attentive to inflation risks,” it said.

In considering any adjustments to the rate, it said it will carefully assess incoming data, the evolving outlook, and the balance of risks.

“The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent,” it said.

US Fed officials now pencil in just one rate cut this year, followed by four cuts next year. This time, in its monetary policy statement, it “modest further progress toward the 2 per cent inflation objective”, against its previous statement that had said “lack” of further progress. So, there has been a change in language.

Meanwhile, US inflation fell to 3.3 per cent in May, raising expectations of early interest rate cuts.

After the rate decision and inflation data, the S&P 500 hit fresh highs, topping 5,400 points. Stocks are expected to keep rallying regardless of policy decisions, analysts say.

The US Fed also put out its Economic Projections, and monetary policy participants generally expect GDP growth to slow from last year’s pace, with a median projection of 2.1 percent this year and 2.0 percent over the next two years.

This report is auto-generated from ANI news service. ThePrint holds no responsibility for its content.