New Delhi: India’s economic recovery will be gradual as efforts to reopen the economy are confronted with rising Covid-19 infections, the Reserve Bank of India Governor Shaktikanta Das said Wednesday.

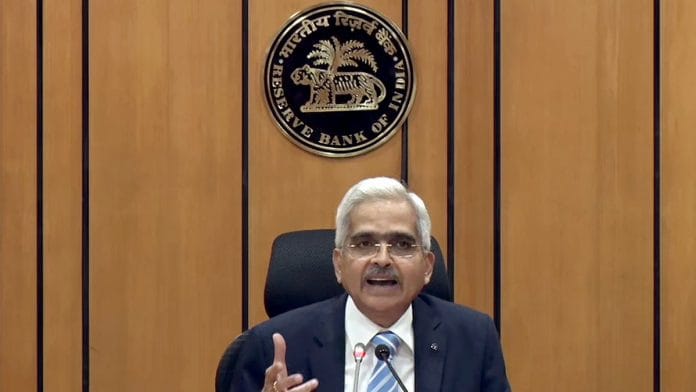

Addressing a virtual event organised by industry body FICCI, Das said the central bank remains ‘battle-ready’ to take measures to support the economy as and when needed.

He said that high frequency indicators of agricultural activity, the purchasing managing index (PMI) for manufacturing and private estimates for unemployment point to some stabilisation of economic activity in the second quarter while contractions in several sectors are also easing.

“The recovery is, however, not yet fully entrenched and, moreover, in some sectors, upticks in June and July appear to be levelling off. By all indications, the recovery is likely to be gradual as efforts towards reopening of the economy are confronted with rising infection,” he said.

The RBI governor’s remarks come at a time when the finance ministry has expressed optimism about the Indian economy witnessing a V-shaped recovery as consumers resume discretionary spending once there is certainty over the vaccine.

However, with no certainty around the vaccine and infections in India rising steadily, economists have expressed doubts about discretionary spending resuming anytime soon. They have batted for a fiscal stimulus for aiding economic recovery.

The Indian economy contracted by a record 23.9 per cent in the April-June quarter as the Covid-19 pandemic and the subsequent lockdown brought economic activity to a complete halt.

For the full year, the Indian economy is expected to contract by 10-15 per cent.

Das said that the immediate policy response to Covid in India has been to prioritise stabilisation of the economy and support quick recovery, but added that policies for durable and sustainable high growth in the medium-run after the crisis are equally important.

Also read: Why lockdown can save the RBI from explaining ‘failure’ to fight inflation to govt

‘Depositors’ interest of utmost importance’

Speaking at the event, many industrialists demanded further relaxation in the recently announced resolution framework for firms adversely impacted by the pandemic. The details of the resolution framework were announced by the RBI earlier this month on the recommendations of the KV Kamath committee but are likely to exclude many stressed firms due to the stringent norms.

Responding to requests of relaxation, Das said the resolution framework has to be a careful and balanced call on the part of the RBI.

“The primary concern of the banking system has to be protection of depositors interest. There are crores of depositors while the number of borrowers may only be in lakhs….Financial stability of the banking sector has to be kept in mind,” he said. “We don’t want a repeat of the situation seen a few years back when NPA levels of banks had gone up steeply.”

He added that the central bank is conscious of the fact that the novel coronavirus has adversely impacted businesses and said the focus is to enable businesses which are otherwise viable but facing problems due to cash flows drying up.

Bond yields at 10-year low

Das said that the steps taken by the RBI to ensure ample liquidity has meant that despite a large government borrowing programme, bond yields have been low.

“Despite substantial increase in the borrowing programme of the Government, persistently large surplus liquidity conditions have ensured non-disruptive mobilisation of resources at the lowest borrowing costs in a decade,” he said.

He added that the central bank is carefully monitoring the markets and will take whatever measures necessary.

Also read: Loan restructuring plan will help revive economy, RBI Governor Shaktikanta Das says

‘Fragility of NBFCs a concern’

Das said that the fragility of non-banking finance companies (NBFCs) remains a concern for the central bank.

He mentioned how the central bank followed a ‘light touch policy’ for NBFCs till the IL&FS crisis hit in 2018. Till then, the regulations for banks were much more stringent as compared to NBFCs, he said.

Das also pointed out how the central bank gradually increased regulations for NBFCs from January 2019.

The effort of the central bank is to ensure that no large NBFCs fail and avoid a repeat of the IL&FS crisis, he added.

Also read: NBFC crisis is a big hurdle in India’s path out of the pandemic