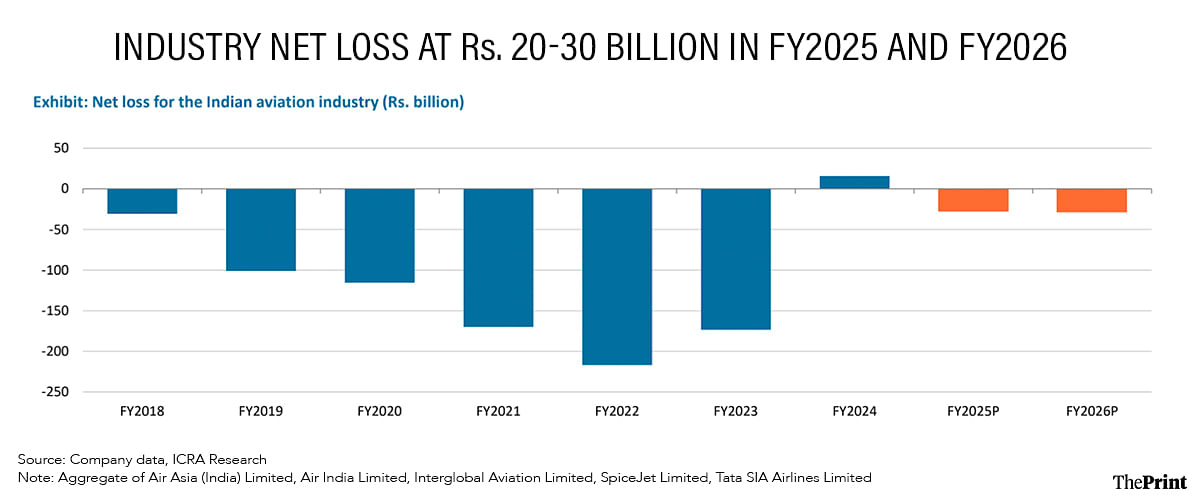

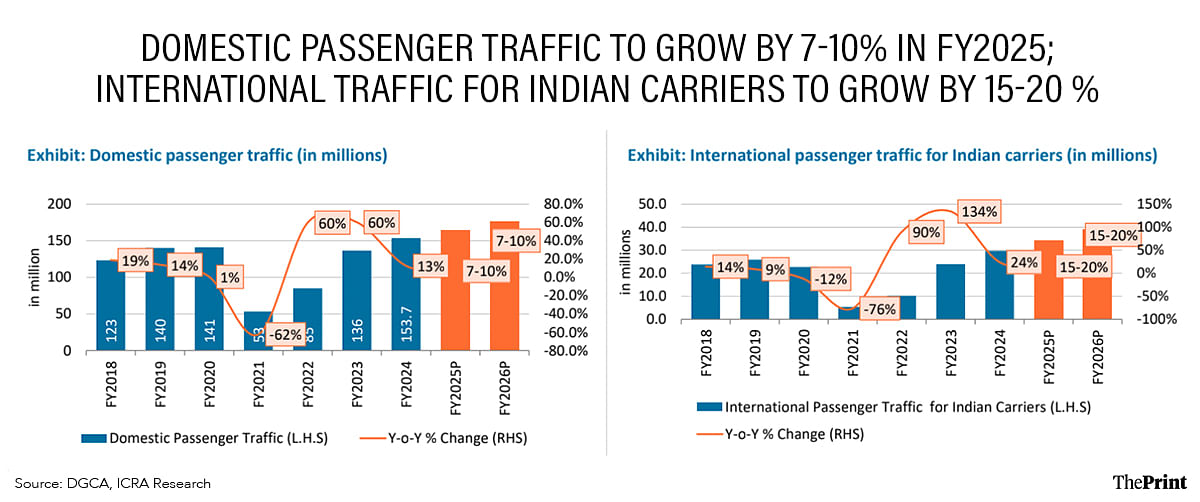

New Delhi: Even though domestic air passenger traffic is forecast to grow 7-10 percent in the current year to reach 164-170 million, the Indian airline industry as a whole is expected to post losses of Rs 2,000-3,000 crore this financial year and the next, after having briefly reverted to profitability in FY24, according to ratings agency ICRA.

“While the industry reported a net profit of Rs 10 billion (Rs 1,000 crore) in FY24, supported by a sharp decline in aviation turbine fuel (ATF) prices while maintaining higher yields, the same was not estimated to sustain,” Kinjal Shah, Senior Vice-President & Co- Group Head, ICRA, said during a webinar Tuesday. The webinar, organised by the ratings agency, was titled ‘Indian Aviation Industry: Navigating Towards Clearer Skies, Losses to Remain Range-Bound.

Passenger yields are the average fare per mile, per passenger.

As per ICRA, the industry is expected to report net losses of Rs 2,000-3,000 crore in FY25 and FY26 each on account of the expected pressure on yields due to airlines trying to maintain adequate passenger load factors (PLFs), which is the percentage of available seating capacity filled with passengers.

In other words, the attempts to ensure that enough seats are bought will likely impact the profitability of the airline industry over this year and the next, according to ICRA.

Nonetheless, Shah stressed that the expected losses are significantly lower than losses reported in FY22 (Rs 23,500 crore) and FY23 (Rs 17,400 crore).

According to Shah, there are four major factors affecting the performance of the Indian airlines—elevated ATF prices, depreciation of the rupee against the US dollar, intense competition, and supply chain disruptions.

“Despite the strong demand for air travel, the domestic aviation industry continues to face challenges from elevated aviation turbine fuel or the ATF prices and the depreciation of the INR vis-a-vis the US dollar, both of which have a major bearing on the airline’s cost structure,” Shah said.

ATF accounts for about 30-40 percent of the total costs of an airline. As per the ratings agency, average ATF prices eased year-on-year by 6.8 percent to Rs 96,192/KL in the first eight months of FY25, though exceeding the levels seen in the pre-Covid period (the first eight months of FY20) when ATF prices fell to Rs 65,261/KL.

In addition, about 35-50 percent of an airline’s operating expenses, including fuel expenses, and a significant portion of aircraft and engine maintenance expenses are denominated in dollar terms. A depreciation of the rupee, therefore, makes these costs more expensive.

Furthermore, some airlines also have foreign currency debt. While the domestic airlines also have a partial natural hedge to the extent of earnings from their international operations, they overall have more payments in foreign currencies than incomes.

Combined impact of competition & grounded aircraft

Shah added that, despite the shutdown of several airlines over the last decade, the competitive intensity of the industry continues to be high and it faces stiff competition from other modes of transportation, especially trains. She said that, for shorter distances, the introduction of new trains like the Vande Bharat trains pose a threat to the aviation sector.

“The competitive intensity in turn impacts the pricing power of the airlines as they strive to maintain their PLFs,” she explained.

The Indian aviation industry has also been facing supply-chain challenges and engine failure issues. ICRA estimates that almost 144 aircraft—about 16-18 percent of the total industry fleet as on 30 September, 2024—has been grounded, thus affecting the overall industry capacity (as measured by available seat kilometres, or ASKMs).

The percentage of aircraft grounded has, however, reduced from 20-22 percent in September 2023.

“In addition, global supply chain issues have affected the availability of aircraft, engine and parts, thus preventing airlines from ramping up capacity,” Shah said. “The industry ASKM for the current fiscal has also been impacted due to challenges related to availability of pilot and cabin crew for select airlines, leading to several flight cancellations and delays.”

These have, therefore, resulted in increased operating expenses towards the cost of grounding, increased rentals due to additional aircraft being taken on lease to offset the grounded capacity, rising lease rates and lower fuel efficiency due to the use of older aircraft leased at short notice.

Some tailwinds exist, too

“In terms of tailwinds, the air travel penetration in India is definitely very low, which provides a lot of opportunity for the passenger traffic growth,” Shah said. “The demand from both leisure travel and business travel has picked up significantly.”

ICRA estimates an increase in domestic air passenger traffic to 164-170 million in FY25, reflecting a year-on-year growth of 7-10 percent.

During the first half of the current financial year, however, the domestic air passenger traffic stood at 79.3 million, only 5.3 percent higher than in the same period of last year, partly impacted by the severe heat waves and other weather-related disruptions.

The international passenger traffic growth for Indian carriers expanded and was healthier at 16.2 percent in the first half of FY25. This momentum is expected to continue for the balance part of FY25 as well, reaching an estimated level of 34-36 million for the full year, representing a YoY growth of 15-20 percent.

“ICRA has maintained its ‘stable’ outlook on the Indian aviation industry, amid the continued growth in domestic and international air passenger traffic,” the ratings agency said.

Replying to a query on the impact of the slowdown in GDP growth on air passenger traffic, Shah said leisure travel may get impacted to some extent. However, she said this will not happen immediately.

“The impact of GDP slowdown takes time to factor in, in cases such as air travel, it happens with a lag,” she said. “Business travel is likely to continue seeing the momentum we have seen in the past, while there can be some hit at leisure travel. Overall, factoring all this, our expectation is growth of 7-10 percent in domestic air traffic.”

(Edited by Zinnia Ray Chaudhuri)