The world’s most important gold market isn’t what it used to be.

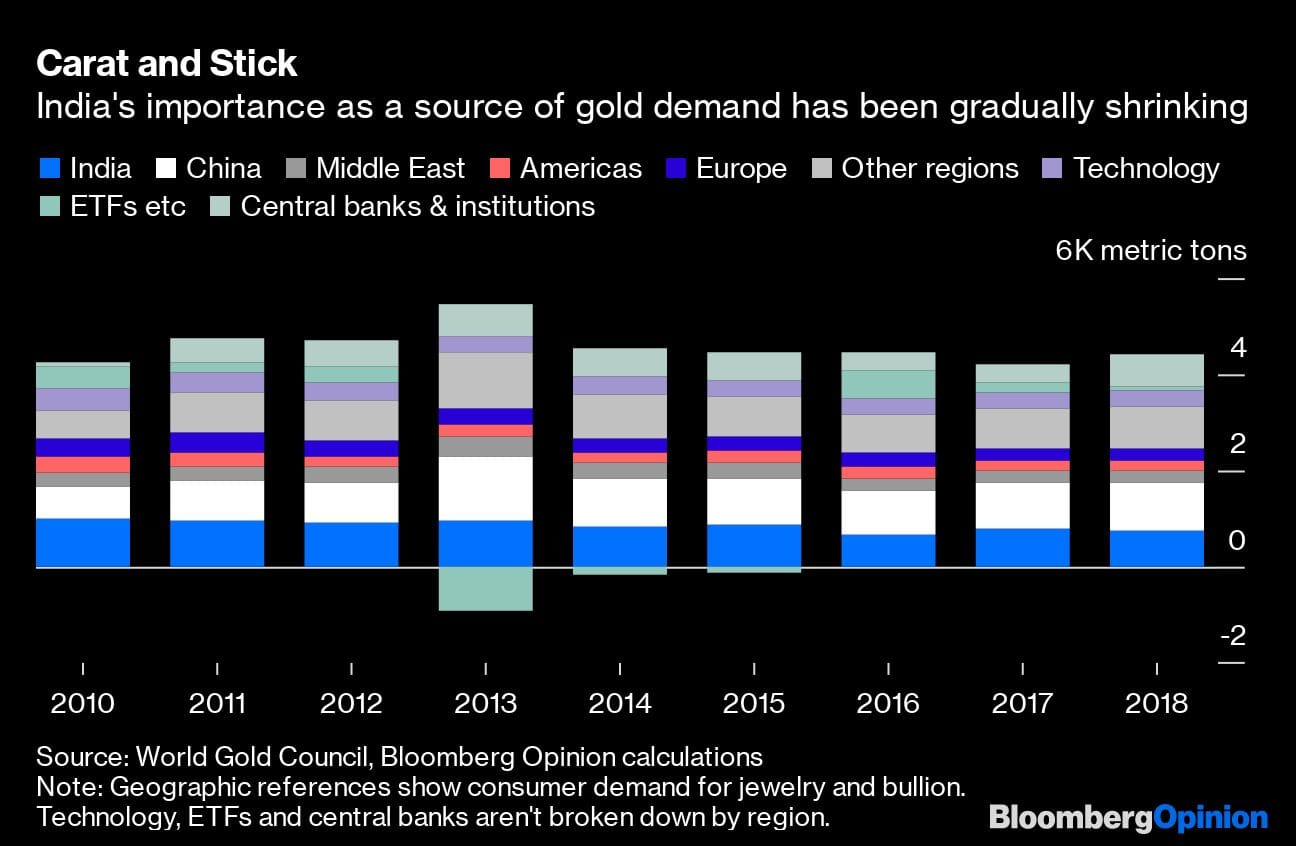

Just a decade ago, India’s hunger for gold jewellery and bullion meant it accounted for about a quarter of global demand. Consumption has since fallen by about 24%. Ahead of Sunday’s Diwali festival, when purchases traditionally peak, imports in September fell to their lowest level in three years.

Part of this is a reaction to short-term pricing factors. Buyers tend to stay away when the bullion price in Mumbai rises above about 30,000 rupees ($422.97) for 10 grams. Thanks to the rupee’s slump and the metal breaking through its long-standing $1,350-a-troy-ounce ceiling, it’s been in that territory now for the best part of two years, and is currently trading at 38,200 rupees.

There are longer-term issues to worry about, though. About two-thirds of the country’s gold is bought in rural areas, where its traditional roles as investment and adornment are oddly intertwined. Rural Indians are far more inclined to buy gold jewellery than their urban counterparts, and tend to favor plain pieces that can easily be valued and traded in if money gets tight.

That makes demographic changes a risk to the entire market. Rural population growth is grinding to a halt as people migrate to the cities and birth rates fall, shifting the focus of consumption spending. “Millennials in urban India are increasingly tempted by goods other than gold, particularly luxury fashion and smartphones,” according to a report by the World Gold Council, an industry group.

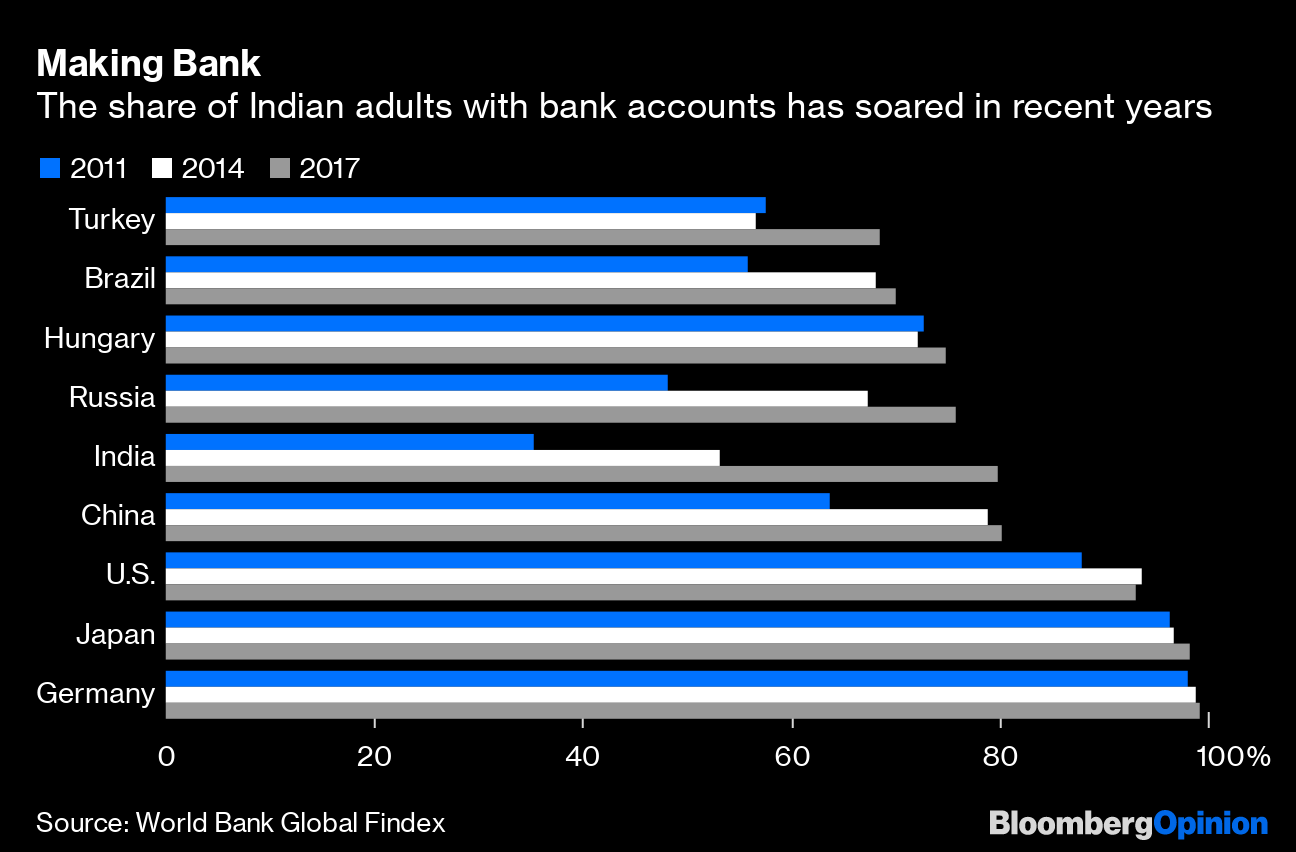

There are also a growing number of alternatives to gold jewellery for those who want to save up for a rainy day. (In the case of rural India, the better term might be “a dry day,” as weak monsoons tend to tighten farmers’ cash flows and force them to pawn or sell.) Gold was originally popular as a store of value because banks weren’t available, but the share of rural adults with an account has soared to 79% in 2017 from 33% in 2011, according to the World Bank. A larger proportion of the adult population now has a bank account than in Hungary or Turkey.

Considering the State Bank of India’s current 6.4% benchmark one-year deposit rate and inflation at 3.99%, a savings account is a far better way to protect your wealth against rising prices than a bangle.

Even in deprived urban areas, alternative stores and sources of capital are opening up. About four million people in Delhi’s shantytowns will be granted ownership rights, the government said this week, a move that would help them take out loans to build houses.

To be sure, the allure of gold can’t be wiped out by banking. Another reason that buying tends to be so vigorous in late October is that it’s peak wedding season. About half of India’s gold-jewellery demand is for the heavy pieces worn as part of a bridal outfit, according to the World Gold Council. Consumer spending, the other main leg of gold demand alongside investment (industrial uses are a distant third) will tend to rise with income, benefiting from the same urbanization that’s depressing purchases in rural areas.

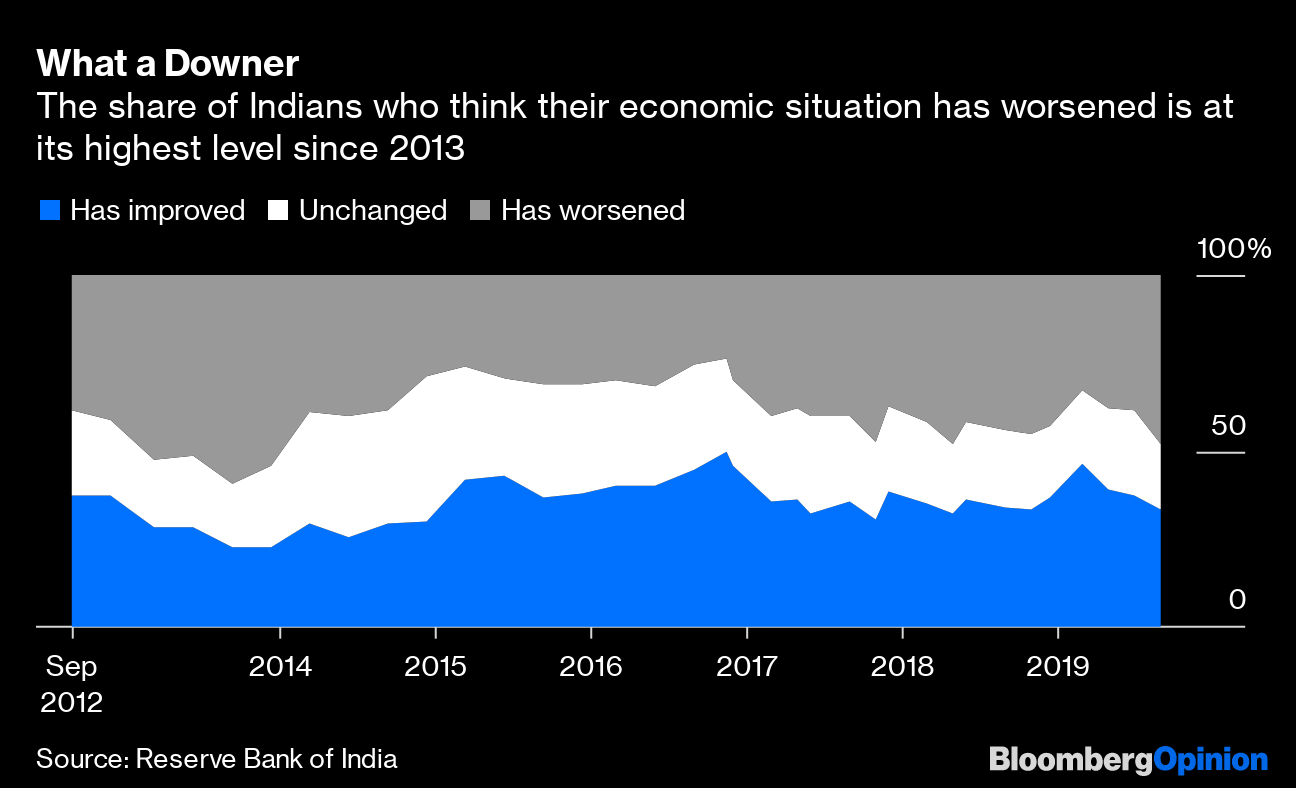

This year, however, consumers are a tough market to bet on. Motor-vehicle purchases, usually a good proxy for the public’s appetite for big-ticket items, are collapsing. Sales of cars, trucks and buses fell by more than a third in September from a year earlier, and two-wheelers were down 22.1%.

The same pattern is borne out in broader data. The share of consumers who think their current economic situation has worsened and is set to deteriorate over the coming year was its highest since 2013 in September, according to the Reserve Bank of India. Perceptions of the job market are the worst in seven years of records. For the first time in four years of data, consumers think they’re spending less on discretionary purchases.

India’s outsize role in the world gold market isn’t going to disappear overnight. Its consumers still account for more than one in six ounces bought globally.

Still, this change in gold demand should be a warning to investors. For many years its role as a rural investment made India a downside buffer for the yellow metal, with farmers rushing in to make physical purchases whenever the price fell to levels that tempted investors to liquidate their positions.

As the country changes, that dynamic is disappearing. While high gold prices still appear to put off purchases, consumption-focused urban jewellery buyers aren’t necessarily going to be around to prop up the market when it’s weak.

Gold’s attraction for investors has long been its counter-cyclical tendencies. As this crucial part of the market grows more pro-cyclical, they’d do well to pay attention. – Bloomberg

Also read: Silver glitters in India as record prices dull gold’s luster

Prejudice makes people stupid. An unchanged economy looks like improving one for some and deteriorating for others. Keep teaching vedas for kids. They will be less prejudiced.