Mumbai: India’s years of corporate scandals have honed the stock-picking skills of the nation’s fund managers to a point where they can now consistently beat the choices of foreign peers and retail investors.

An equal-weighted basket of Indian stocks with high domestic mutual-fund ownership and low foreign ownership has been outperforming a basket with the reverse profile over the past two years, according to data compiled by Bloomberg. Local fund managers have become more adept at using knowledge of the companies, the government and economic climate to avoiding pitfalls.

“Experience with past governance issues shows that domestic mutual funds have skirted investing in blowups better than offshore peers,” said Nitin Chanduka, an analyst with Bloomberg Intelligence. Local funds also have more exposure than foreigners to mid- and small-caps, which have driven gains in India since 2019, he added.

India’s years of corporate scandals have honed the stock-picking skills of the nation’s fund managers to a point where they can now consistently beat the choices of foreign peers and retail investors.

An equal-weighted basket of Indian stocks with high domestic mutual-fund ownership and low foreign ownership has been outperforming a basket with the reverse profile over the past two years, according to data compiled by Bloomberg. Local fund managers have become more adept at using knowledge of the companies, the government and economic climate to avoiding pitfalls.

“Experience with past governance issues shows that domestic mutual funds have skirted investing in blowups better than offshore peers,” said Nitin Chanduka, an analyst with Bloomberg Intelligence. Local funds also have more exposure than foreigners to mid- and small-caps, which have driven gains in India since 2019, he added.

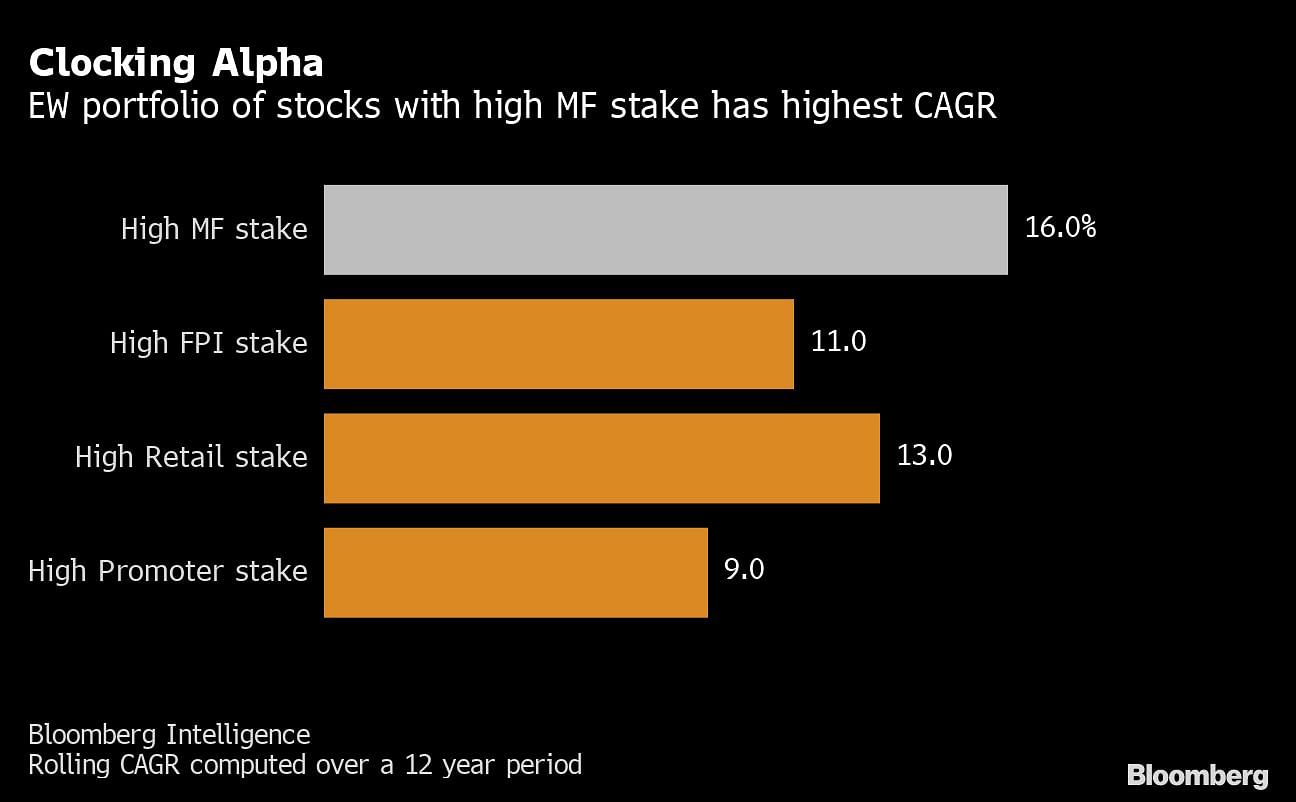

Domestic fund managers’ picks have also been better bets than those of India’s retail investors, whose ranks have swelled during the pandemic. Stocks with high Indian mutual-fund ownership have risen at a compound annual growth rate of 16% over the past 12 years, compared with 11% for stocks with high foreign ownership and 13% for those with high retail investor stakes.

Historical analysis by Chanduka and Gaurav Patankar at Bloomberg Intelligence shows local pros have had smaller holdings in companies that reported governance issues than overseas and individual investors.

| Company | Date of disclosure

of corporate

governance issue |

Pre-event

onshore

mutual-fund

holding (%) |

Pre-event

foreign

investor

holding (%) |

Pre-event

individual investor

holding (%) |

|---|---|---|---|---|

| Cox & Kings | Aug. 2019 | 0 | 77 | 10 |

| Indiabulls Housing Finance | July 2019 | 4 | 70 | 6 |

| Dewan Housing Finance* | Jan. 2019 | 5 | 30 | 23 |

| Zee Learn | Jan. 2019 | 0 | 57 | 26 |

| Yes Bank | Nov. 2018 | 14 | 53 | 11 |

| Manpasand Beverages* | May 2018 | 21 | 39 | 5 |

| PC Jeweller | April 2018 | 2 | 77 | 8 |

| Vakrangee | Feb. 2018 | 0 | 35 | 15 |

| Gitanjali Gems* | Feb. 2018 | 0 | 8 | 43 |

| Tree House Education | Dec. 2016 | 0 | 15 | 35 |

| Note: Holdings given as % of free float, 6-12 months pre-event; *trading suspended | ||||

| Source: Bloomberg Intelligence | ||||

Part of this discrepancy in holdings of troubled companies is due to the fact that domestic funds are still a smaller presence than foreign funds overall. Local institutions hold a combined stake of more than 25% in just 45 of the Nifty 200 Index stocks, compared with 145 stocks with that level of holding by foreign funds.

Still, the better performance of the Indian managers’ picks demonstrates local knowledge can be lucrative.

“Companies whose shares have a high stake among domestic funds lead those with low stakes, so accounting for this factor can generate better risk-adjusted returns,” said Chanduka of Bloomberg Intelligence.-Bloomberg

Also read: India’s strict emissions rules will hit car sales, hurt economic recovery, Maruti says