India’s appetite for fuel has expanded up to 7 per cent, but performances in the banking and power sectors have declined.

India’s economic activity is picking up, boosted by a long-awaited recovery in consumption that’s helped cut down slack in the economy and underpinned sales of everything from cars to housing.

Almost 60 per cent of gross domestic product comes from private spending, according to estimates from New York-based CEIC Data Co., with the pick-up helping to fuel growth of more than 7 per cent this year, making India the world’s fastest-growing major economy. Yet the performance isn’t uniform across all industries, with the banking and power sectors facing distress and global trade tensions clouding the outlook for exports.

Here’s a detailed look at which sectors are ticking and those that are ailing:

The Leaders

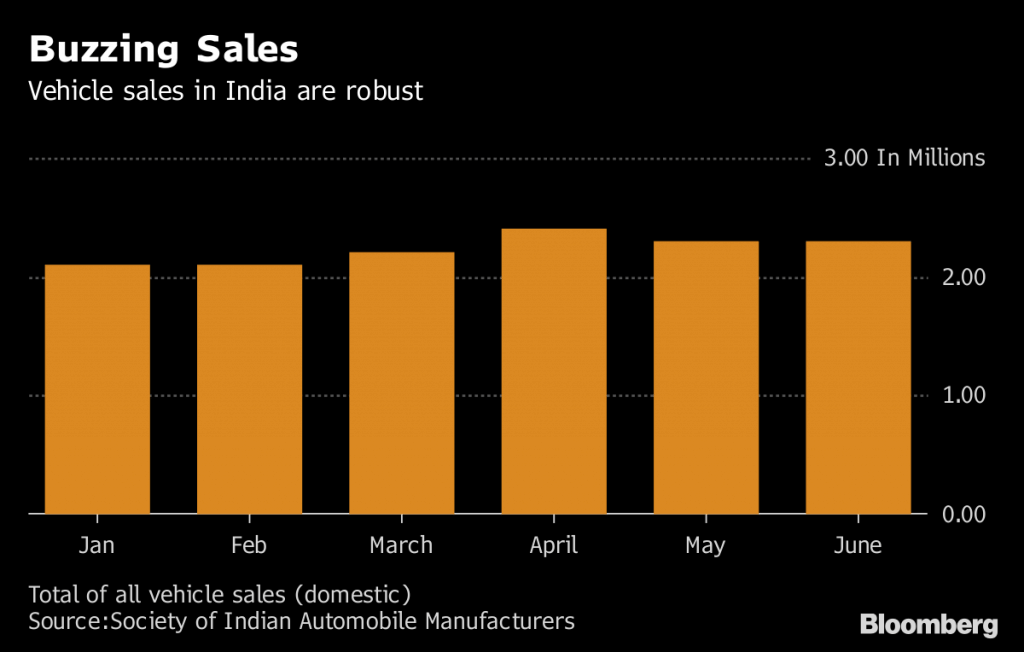

AutomobilesThe auto industry is on a strong footing. While demand is broad-based across markets, rural India appears to be doing particularly well, which is reflected in sales of two-wheelers and tractors. Companies such as Maruti Suzuki and Ashok Leyland are taking advantage of stronger demand by passing on higher prices to consumers.

“Rural India appears to be doing particularly well, which is reflected in strong growth in the two-wheeler and tractor industry,” analysts led by Hitesh Goel at Kotak Institutional Equities said.

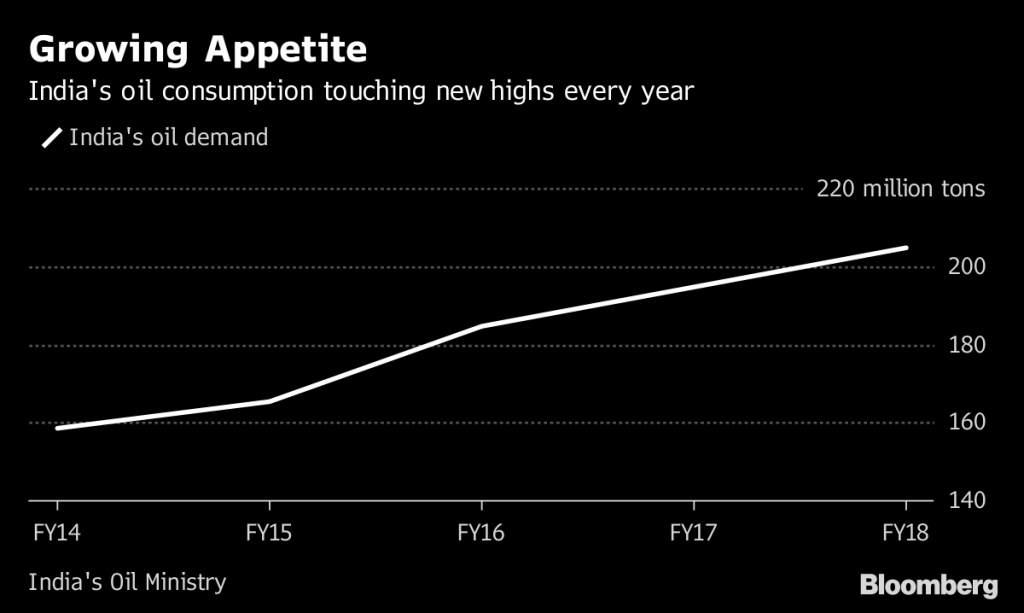

Oil and GasIf the automotive sector is doing well, can oil be far behind? India’s energy appetite is surging, courtesy of its expanding middle-class and unrelenting demand to power a growing fleet of trucks, cars and motorbikes. The government’s push for cleaner air by encouraging the use of cooking gas is driving refiners and attracting global majors such as Saudi Arabian Oil Co. to Rosneft PJSC.

However, an over-dependence on imports makes the nation vulnerable to a sustained spike in oil prices that can chip away at demand.

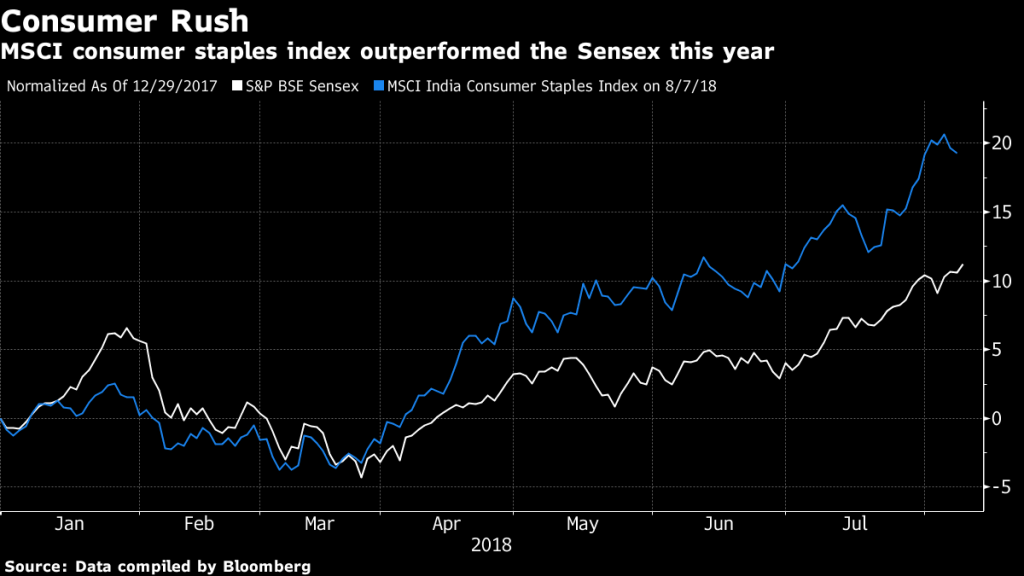

Consumer GoodsAnother bright spot is the sector for fast-moving consumer goods, which is ranked as the fourth-largest in the economy by think-tank India Brand Equity Foundation. It’s recovered well from the demand-disruptive and chaotic introduction of a consumption tax last year. Analysts see additional support for the sector coming from higher wages for millions of government workers as well as expectations of a recovery in farming due to higher guaranteed prices for some crops and a pick-up in public spending ahead of elections.

Steel and Cement

The steel industry, which contributes almost 2 per cent to GDP, has been reaping the benefits of increasing local demand and higher prices. Tata Steel Ltd.’s sales during April through June climbed 8 per cent year-on-year driven by automotive and special products’ demand, while JSW Steel Ltd. clocked a 11 per cent growth in group sales. That’s on top of steel consumption already rising to the highest in at least five years in the year ended March, according to data from the Steel Ministry.

Exports have, however, been declining this year because of protectionist measures taken by key consuming countries to protect local manufacturing.

Cement manufacturers are facing a more uneven recovery as rising input prices eats into profit margins. Nevertheless, higher government spending to build infrastructure and affordable housing in the run-up to next year’s elections should underpin demand.

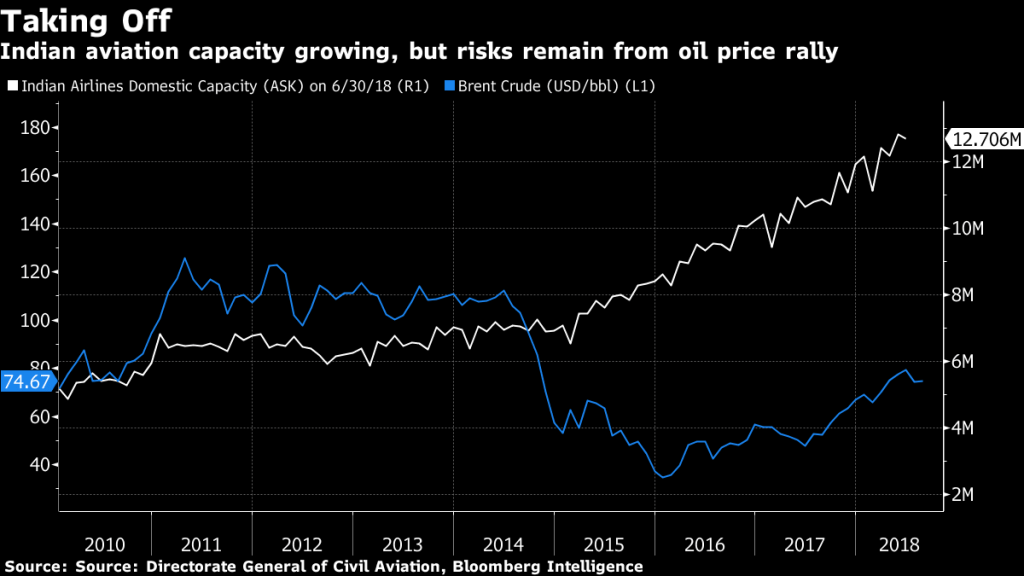

AviationThis is one sector that’s continued to see double-digit traffic and capacity growth, as more people take to flying and carriers expand their fleet. But India is also the most price-sensitive of the world’s large airline markets, and an oil price rally is a risk to growth.

“Low oil prices which helped stimulate air-travel demand will now act as a drag on industry profitability and will slow capacity additions,” Bloomberg Intelligence’s Rahul Kapoor wrote in a note. “We remain long-term positive but see near-term headwinds,” he said.

The Stragglers

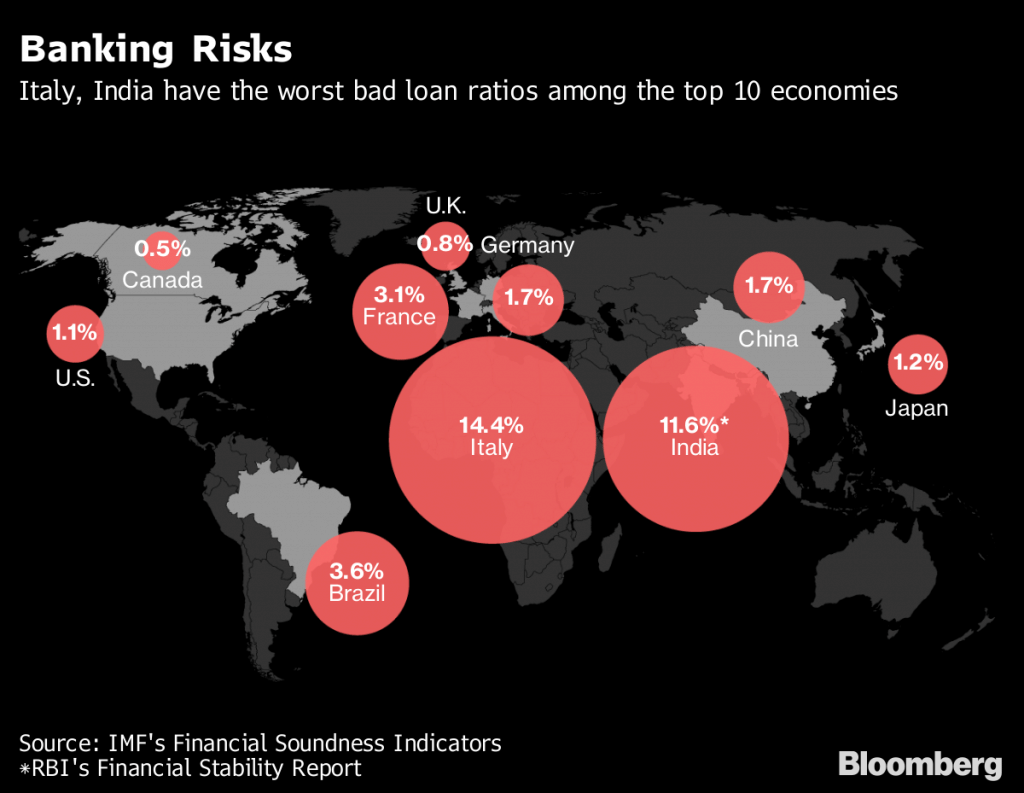

BankingWhile demand for bank loans is growing from a year ago, the industry’s gross bad-loan ratio may increase to 12.2 per cent in the fiscal year through March 2019 — the highest in almost two decades — from 11.6 per cent last year, according to data from the Reserve Bank of India. The deterioration in asset quality is eroding capital buffers at the lenders and curtailing their ability to take on financing for large projects.

What Our Economists Say… “Nearly one in every six rupees of credit advanced by public-sector banks has already turned sour. As interest rates rise, debt burdens may prove to be too much for firms on the edge — creating more bad debt in the year ahead.”–Abhishek Gupta, India economist, Bloomberg Economics.

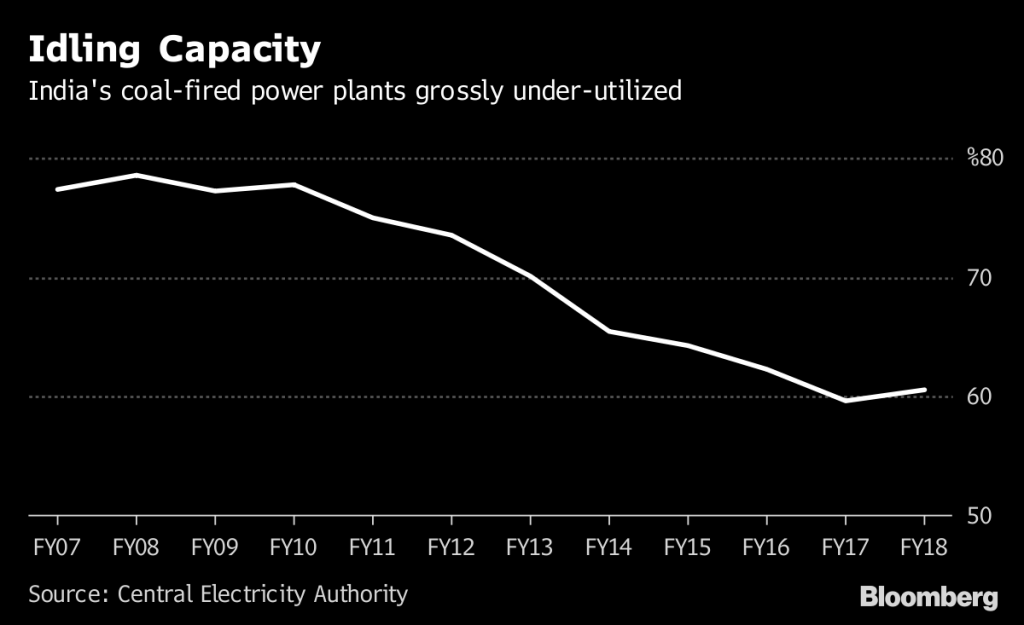

The industry is another big laggard and a cause of headaches for bankers and policy makers. It’s plagued by fuel shortages and companies face difficulties securing long-term supply contracts with the country’s money-losing electricity distributors. Nearly 40 per cent of coal-fired power generation capacity is lying unused.

Loans totaling at least $38 billion are at risk of being written-off in the power sector, Bank of America Merrill Lynch estimates. The sector is also reeling from the 2014 court-ordered loss of coal mining permits, as well as financing and cash-flow concerns that make revival difficult. – Bloomberg