By Amanda Cooper

LONDON (Reuters) -Gold prices hit record highs on Wednesday, defying the dollar’s rise, which kept pressure on the yen and the euro, while global stocks edged lower on investors’ reluctance to place major bets ahead of the U.S. election in less than two weeks.

Investors are also rethinking how much the Federal Reserve might need to cut interest rates after the most recent U.S. economic data pointed to an economy that continues to expand and create jobs.

A month ago, traders were pricing in as much as a full percentage point in cuts by January, whereas now, that expectation is closer to a half point.

U.S. Treasuries have taken a battering, sending yields to three-month highs and pushing the dollar to multi-month peaks against the euro, sterling and the yen, which is now back at 150 per dollar levels, prompting verbal warnings from Japanese officials. [FRX/]

Stocks, meanwhile, are turning lower, but still near record highs, suggesting that equity investors are focusing more on the positives around the economy and earnings – for now, at least.

The MSCI All-World index was 0.1% lower on the day, echoing weakness in Europe, where the STOXX 600 was down 0.2%. U.S. stock index futures fell between 0.2-0.3%.

“This week’s stock market price action suggests that the 50th record high for the S&P 500 could be a tough ask with the U.S. election so close,” XTB research director Kathleen Brooks said.

Investors are preparing for more market volatility ahead of the U.S. election on Nov. 5.

The chances of Donald Trump beating Kamala Harris have recently edged higher on betting websites, though opinion polls show the race to the White House remains too tight to call.

The prospect of another Trump presidency has been in focus for investors, as his policies include tariffs and restrictions on undocumented immigration, among other measures, that are expected to push up inflation.

ROBUST DOLLAR

A growing expectation that U.S. rates may not fall as quickly as once thought has supported the dollar.

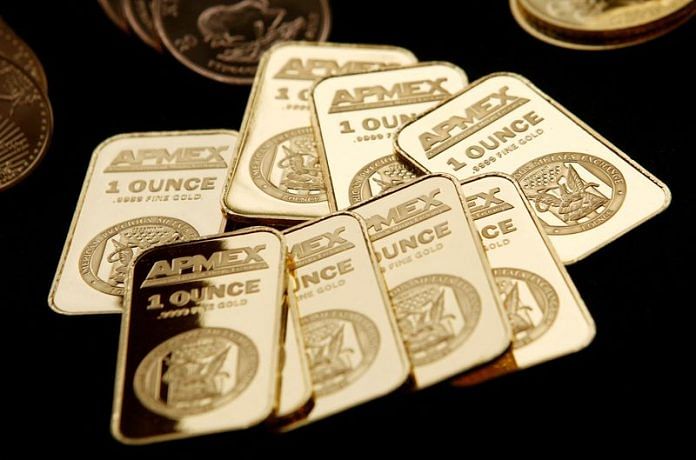

Gold has shrugged off the strength in the U.S. currency and rallied to a new record high of $2,757.99 an ounce.

Conflict in the Middle East has also given risk-averse investors an excuse to buy gold, analysts said.

The yield on the benchmark U.S. 10-year Treasury note rose 1.4 bps to 4.2197%. It has risen by nearly 50 bps since the Fed cut rates by half a point on Sept 18.

“The Treasury sell-off has deepened this week as markets acknowledge that the Fed risks reigniting inflation if it eases into a strong economy,” said Prashant Newnaha, a senior Asia-Pacific rates strategist at TD Securities.

“Trump’s improving election odds are also tempering market expectations for the Fed to continue easing into 2025 and the possibility of the Fed moving to the sidelines for six months next year cannot be ruled out.”

With the dollar and U.S. yields on the rise, other currencies came under pressure. The Japanese yen, the worst-performing major currency this year, weakened again, leaving the dollar up 1.1% at 152.79, its highest since late July.

Japanese markets in general were under pressure, with Tokyo’s Nikkei down 0.8%.

The euro fell 0.18% to $1.0779, its lowest since early August. Goldman Sachs said in a note on Tuesday the euro could fall by as much as 10% in a scenario under which a Trump presidency ushered in hefty tariffs and tax cuts.

Brent crude futures fell 1.84% to $74.65 a barrel. West Texas Intermediate crude dropped nearly 2.0% to $70.34 after data showed U.S. fuel inventories rose more than expected in the most recent week and investors watched diplomatic efforts in the Middle East amid Israel’s continued attacks in Gaza and Lebanon.

(Reporting by Ankur BanerjeeEditing by Shri Navaratnam, Sam Holmes, Jane Merriman and Christina FincherTo read Reuters Markets and Finance news, click on https://www.reuters.com/finance/markets For the state of play of Asian stock markets please click on: )

Disclaimer: This report is auto generated from the Reuters news service. ThePrint holds no responsibilty for its content.