Mumbai: For stocks worldwide, it may be time to worry about the upcoming earnings season. But there’s one place where profit estimates are surging: India.

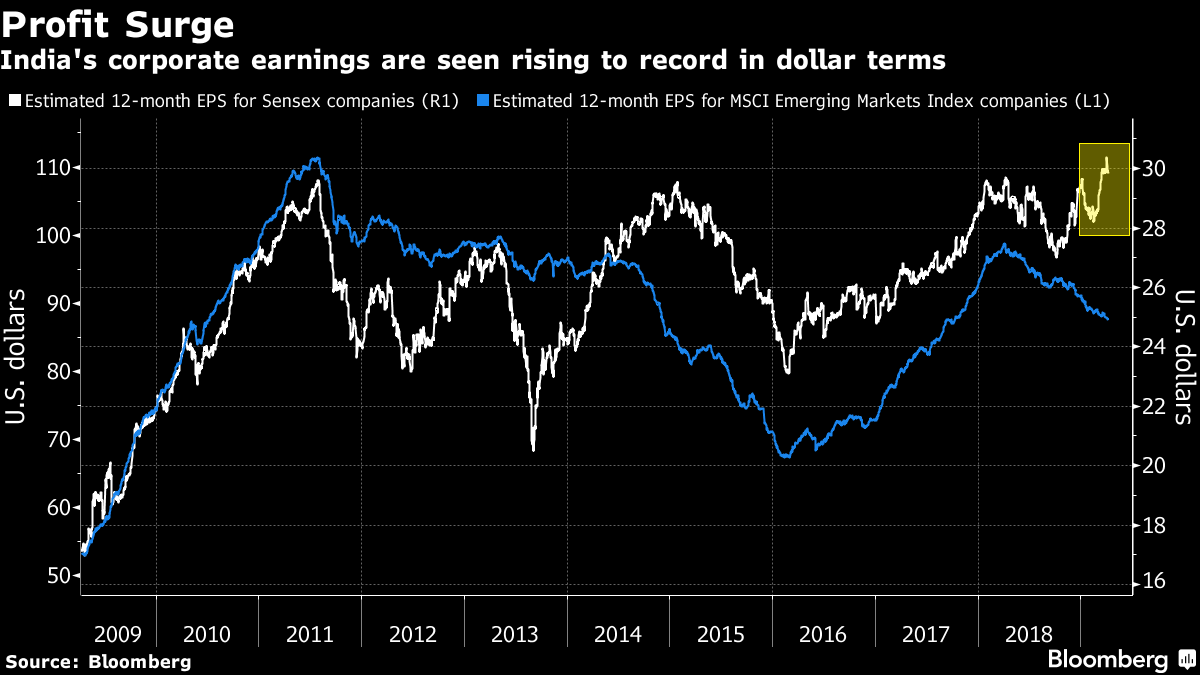

The fundamentals of corporate India are improving, and the average analyst projection for next year’s earnings at S&P BSE Sensex Index companies has jumped to a record high — not just in rupee terms, but also in U.S. dollars. That’s a stark contrast with members of the MSCI All-Country World Index and MSCI Emerging Markets Index, which have seen steady declines in estimates.

“We expect the earnings recovery momentum to continue this quarter as well with aggregate earnings growth expected in mid-double digits,” said Jyoti Vaswani, the Mumbai-based chief investment officer at Future Generali India Life Insurance Co. overseeing 40 billion rupees ($570 million) in assets. She expects corporate banks to report a significant recovery in earnings, while retail banks are expected to continue with their steady performance.

The beginning of the earnings recovery may be apparent in results for the final quarter of the last financial year, ended March 31, particularly when it comes to banks. With financials accounting for more than a third of the Sensex, good results for the sector could help boost the nation’s stock market. A pickup in credit demand and a recovery in loans is helping the firms now, after a mountain of bad debt — especially at state-run banks — dented profitability last year and took the market down 14 per cent from a peak.

“We expect earnings to grow at 15 per cent to 20 per cent and that should drive markets higher, bringing in foreign investors,” Vaswani said. “With this, domestic investors, too, should start coming back.”

For the three months ended March 31, profit at NSE Nifty 50 Index members increased 15 per cent, almost double the 8 per cent pace a year earlier, Motilal Oswal Securities Ltd. estimates. JM Financial Ltd. sees earnings-per-share up 17 per cent, buoyed by financials and health-care companies, even as telecoms and autos remained a drag.

Asia’s second-largest software exporter, Infosys Ltd., kicks off the quarterly earnings season in India on Friday. Here’s what some analysts expect:

FUTURE GENERALI INDIA LIFE INSURANCE CO.

- Profits for corporate banks to benefit from a weak base due to higher recognition of bad debts in the year-earlier quarter

- Cement companies, especially those in the south, to show improved profitability after raising prices during the quarter, while some input costs fell

- Oil and gas companies seen benefiting from wider inventory and stable marketing margins, although gross refining margins narrowed

- IT and pharma seen reporting in line with consensus

- Household goods and automakers seen delivering weaker results due to lower volumes, narrower margins

- Fast moving consumer goods makers to deliver slower pace of growth as rural demand has tapered off, while lower sales realization and rupee appreciation kept the performance of metals producers subdued.

CLSA

- Bank earnings to rebound, while state-run oil companies results will drive overall profits

- Cement and power companies may report double-digit growth; IT firms to benefit from demand in US market

- Telecom losses likely to have widened from a year earlier but be improved from the prior quarter due to higher tariffs

- Improved asset quality to help State Bank of India and Axis Bank to return to profitability

- Maruti, Hero and Mahindra & Mahindra could see lower profit on weak demand, margin trends

- Oil PSUs to see 50%-100% profit increase on wider marketing margins, inventory gains

- Quarterly results will test concern about slowing consumption

MOTILAL OSWAL SECURITIES

- January-March earnings will be a repeat of those seen in the previous quarter, with financials driving performance

- State-run banks will benefit from benign year-on-year comparisons, while non-bank finance companies may face “significant” deceleration in profit growth

- Tech firms will probably post a fifth straight quarter of double-digit profit gains

- Global cyclicals, which led earnings growth over the last few quarters, have decelerated

- Top large-cap picks: ICICI Bank, State Bank of India, Maruti Suzuki, Titan, Coal India, Bharti Airtel, L&T, Infosys, ACC

- Top mid-cap ideas: Federal Bank, Shriram Transport, Godrej Agrovet, Indian Hotels, Marico, IGL, Exide, Jindal Steel, Alkem Lab

RELIANCE SECURITIES

- Sees average 16 percent earnings growth for Nifty 50 members

- Banking, which is coming off a low base, saw operating metrics improve in the past three quarters and will continue to be critical to the market’s overall earnings growth; top picks are ICICI Bank and HDFC Bank

- Apart from lenders, tech and capital-goods companies are expected to post strong results; consumer firms will report double-digit earnings growth, with strong profits for companies such as Titan and Jubilant

- Sees significant decline in earnings for automotive-related companies

JM FINANCIAL

- Financials will drive strong earnings growth; telecom, industrials, realty and cement companies are expected to deliver the highest profit gains

- Utilities and metals firms are likely to post the steepest post-tax income declines

- Info Edge, IndiGo, Godrej Properties, Shriram Transport Finance, ICICI Bank, Axis Bank, Strides Pharma, Federal Bank and ABB India are among those expected to show the fastest earnings growth

- Sees Bharti Airtel, Jindal Steel & Power, Tata Motors, IndusInd Bank, Greenply Industries posting the slowest profit gains

Also read: What’s next for Indian stocks after posting world’s biggest rally in March