New Delhi: State-owned telecommunications firm Mahanagar Telephone Nigam Limited (MTNL) informed the stock exchanges Thursday that Mumbai-based Bank of India has classified all of the loans taken by the company from the bank as non-performing assets (NPAs). The NPA amount stands at Rs 1,021.3 crore as on 4 September.

Concerning as this is, this isn’t the first time this year the public sector enterprise’s (PSU’s) loans have been classified as NPAs, and likely not the last. MTNL, which has been facing increasing losses year after year, has recorded four separate instances of loan defaults in just the last two-and-a-half months.

Independent auditors and credit rating agencies have noted that the company’s value is completely eroded, and it is being classified as a “going concern” (company that has enough resources to stay afloat for the foreseeable future without threat of liquidation) only because it is a PSU and has government-backed guarantees for portions of its debt.

Over the last few months, several rating agencies have downgraded MTNL’s bonds, placing them on watch with a negative outlook.

This comes at a time when the central government has already ploughed a whopping Rs 3.22 lakh crore—across three packages since 2019—into the revival of MTNL and Bharat Sanchar Nigam Limited (BSNL), another public sector telecom firm which, incidentally, also remains in loss.

Notably, the Centre had in 2014 classified MTNL as an “incipient sick” PSU, and had reaffirmed this status in 2017.

MTNL’s problems stem from a mounting debt burden, an inability to increase revenues to keep up with a rising interest burden, and a limited and falling market share. The government has been trying to merge the company with BSNL—approval for which had been granted by the Union Cabinet in 2019—but has not been able to manage it so far.

The fact MTNL has not yet launched 4G services, let alone 5G, is not helping matters.

Also Read: Indian investors don’t need a coddling nanny. Let them make mistakes and learn

Failing financials & failed recovery attempts

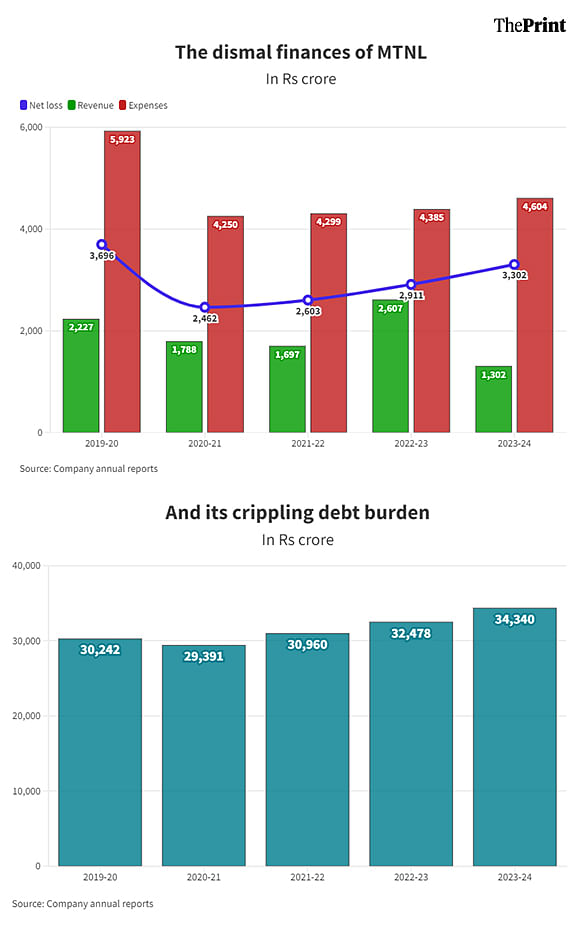

Five years ago, in FY 2019-20, MTNL earned a total revenue of Rs 2,227 crore. This would have been a reasonable amount had the company’s total expenses not been more than two-and-a-half times that amount. But they were, and this resulted in a post-tax loss of Rs 3,696 crore.

The ailing financial health of MTNL and BSNL prompted the government to come up with a rescue plan—the first of three attempts so far—which the Union Cabinet approved in October 2019. Under the plan, the government would infuse a total of Rs 69,000 crore into the two companies through various means.

The first part of this was Rs 23,814 crore towards 4G spectrum, which the government said the two companies would use to “deliver 4G services, compete in the market and provide high speed data using their vast network including in rural areas”.

This plan benefited BSNL more than MTNL, since the latter only operates in Delhi and Mumbai, and in 2019 had a market share of just 0.29 percent in wireless services. Since then, this share has only fallen, to 0.16 percent as of June this year. This is probably due to the fact that the company is yet to launch its 4G services.

In fact, the company had a respectable market share of 15.2 percent in wireline services in 2019, but even this has steadily fallen to 6.1 percent as of June this year.

The second element of the revival plan was to raise capital through bonds. This has come to pass, with MTNL raising Rs 6,500 crore from the market in the form of bonds. However, this too comes with its own concerns, since these bonds are fully government-guaranteed, which means that as MTNL fails to repay them—which it already has—taxpayer money will be used to repay its debt.

The third part of the plan was to implement a Voluntary Retirement Scheme (VRS) to their employees aged 50 years and above, the cost of which was to be borne by the Centre through budgetary support. This worked out to Rs 17,169 crore, not counting the cost towards pension, gratuity and commutation.

This step, however, did have a positive impact on the company’s financials. The company’s employee-related costs fell from Rs 2,124.4 crore in 2019-20 to Rs 570.1 crore in 2023-24.

However, finance costs associated with the company’s mounting debt burden continued to grow, jumping from Rs 1,941.5 crore in 2019-20 to Rs 2,689.8 crore in 2023-24.

What all of this—the falling market share and rising debt burden—meant was that the company’s revenues fell by more than 40 percent over the five-year period to Rs 1,301.5 crore in 2023-24. Losses, meanwhile, remained high at Rs 3,302.2 crore.

It is important to note that the government had, during this period, approved two more recovery packages—one worth Rs 1.64 lakh crore in 2022 and the other worth Rs 89,047 crore in 2023—to revive MTNL and BSNL. Both companies remain in losses and are yet to launch 4G or 5G services.

Possibly the first large PSU to become NPA

On Wednesday, a day before MTNL informed the stock exchanges, the Bank of India wrote a short letter to MTNL.

“We advise that all the credit facilities availed by Mahanagar Telecom Nigam Limited (MTNL), from our Bank i.e Bank of India has [been] classified to NPA, on 04.09.2024 as per RBI Guidelines,” Bank of India wrote. “The outstanding liabilities of the borrower as on 04.09.2024 is Rs 1021.26 crore.”

This came less than a month after the Union Bank of India, a Mumbai-based public sector bank, designated the telecom company’s debt as NPA and froze its accounts.

“We wish to inform that your account has slipped to NPA with effect from 12.08.2024 due to which all accounts of MTNL have been freezed automatically,” Union Bank of India wrote to MTNL on 21 August.

It added that the freezing of the accounts was a “system driven process” and does not amount to coercive action. However, the bank did urge MTNL to pay its dues so as to upgrade the account, pending which they would remain frozen.

There is no central database of accounts that have been declared NPA, but two former deputy governors of the Reserve Bank of India and three senior bankers in public and private sectors, each with more than 25 years of experience, have told ThePrint that they can’t remember any previous incident where a PSU’s loans have been designated as NPAs.

“I certainly can’t remember any other incident where a PSU’s loans have been listed as NPA,” one of the former RBI deputy governors told ThePrint. “It didn’t happen with BSNL or even with Air India.”

One of the bankers confirmed to ThePrint that this was the first time since the implementation of the Insolvency and Bankruptcy Code in 2016 that a PSU has been categorised as NPA. He, however, conceded that it is possible that smaller PSUs might have become NPA in the past.

Five defaults in 2.5 months

MTNL’s falling revenues and mounting expenses meant that it has had to borrow large amounts to remain afloat. The company’s total liabilities increased from Rs 30,241.7 crore in 2019-20 to Rs 34,340 in 2023-24, more than 26 times the revenue it earned that year. In fact, the company’s total debt stood at 2.8 times its total assets.

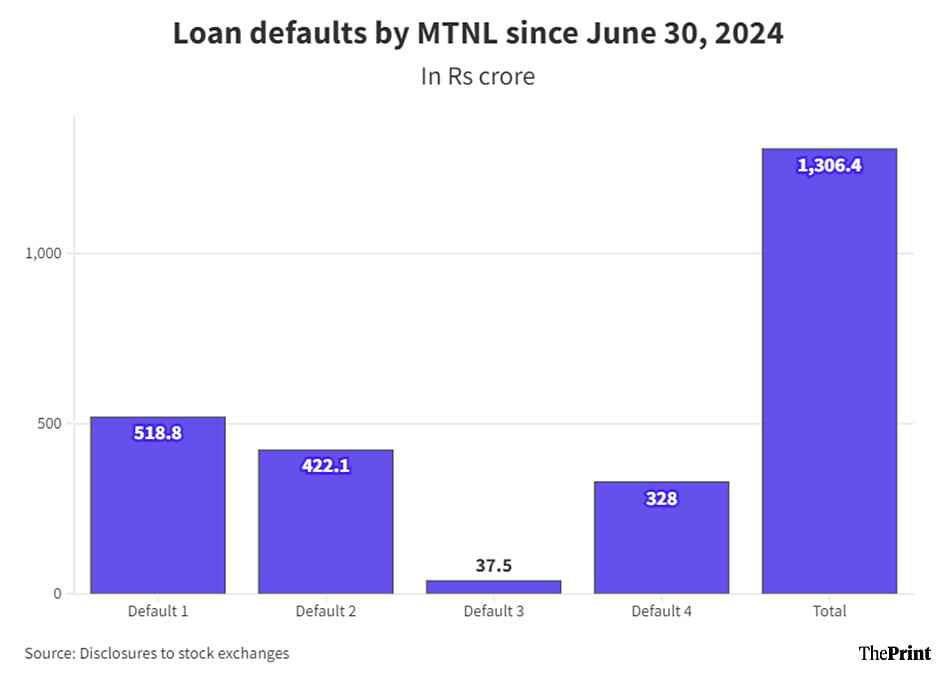

Due to this poor financial state, the company has begun defaulting on its loans to banks. Since 30 June, it has informed the stock exchanges of four such defaults, totalling a loan amount of Rs 1,306.36 crore across six public sector lenders—Bank of India, Punjab & Sind Bank, Punjab National Bank, State Bank of India, UCO Bank, and Union Bank of India.

The defaults aren’t limited to bank loans, either. Brickwork Ratings (BWR) informed MTNL Thursday that it had placed its Rs 6,500 crore worth of bonds—issued by the government as part of the PSU’s recovery plan—on “Rating Watch with Negative Implications”.

“The rating action factors in the continued non-adherence of the company to the structured payment mechanism as stipulated for the Government of India (GoI) guaranteed bonds,” the ratings agency said. “The company was unable to fund the escrow account for the scheduled coupon payments…in past few months as per the terms of issue of those bonds.”

As a result, the government’s “unconditional, irrevocable, and legally enforceable” guarantee associated with these bonds had to be invoked so that the payments could be made. That is, the government stepped in to make up for the shortfall.

“These non-fundings (by MTNL) were considered payment default events per the terms of the issues,” BWR added.

A little earlier, on 5 September, CareEdge Ratings too said it had downgraded the bonds issued by MTNL. On 28 August, India Ratings and Research placed MTNL’s bonds on “ratings watch with negative implications”, highlighting the company’s difficulty in making payments.

From ‘going concern’ to ‘growing concern’

Despite all of this trouble, the company is comfortable with overwhelmingly relying on the government for its continued operations as a “going concern”. According to MTNL’s annual report, the company acknowledges that the net worth of the company has been “fully eroded”, it has incurred net losses for years, and that the current liabilities exceed the current assets by a substantial amount.

“However, the standalone Ind AS financial statements of the company have been prepared on a going concern basis keeping in view the majority stake of the Government of India,” the annual report said.

An independent auditor of the company’s financials didn’t have such a sanguine view of the situation, however. In fact, it said that the company’s financial troubles were such that the company was unlikely to remain a going concern unless the government’s revival plans came to fruition soon.

“Net worth of MTNL is negative as on 31/03/2024 to the tune of Rs -23,662.80 crore and debts service as well as interest service coverage ratio is also negative,” the auditor wrote in the report.

“Further due to high exposure of loans from banks and financial institutions and heavy repayment schedule of loans as well as interest payment to banks and financial institutions, MTNL is facing liquidity crunch which will be a great threat to MTNL to keep it as an ongoing concern in near future but for the revival plans fructifying in time,” it added.

(Edited by Radifah Kabir)

Also Read: How bike dealership’s Rs 12 cr IPO raised whopping Rs 4,800 cr & why this isn’t cause to celebrate