New Delhi: The India-US trade deal announced on 2 February is unlikely to trigger an immediate shift away from Russian crude imports, with market analysts predicting that any changes in sourcing will be gradual and driven by commercial considerations rather than political commitments.

Despite US President Donald Trump’s statement on Truth Social this week that India would stop purchasing Russian oil and increase purchases from the US and Venezuela, energy analysts say Russian barrels remain economically critical for India’s refining system.

“Russian volumes remain largely locked in for the next 8–10 weeks and continue to be economically critical for India’s complex refining system, supported by deep discounts on Urals relative to ICE Brent,” Sumit Ritolia, lead analyst for refining and modelling at global trade intelligence firm Kpler, told ThePrint.

Ritolia expects Russian imports to India to remain broadly stable in the 1.1–1.3 million barrels per day (mbpd) range through the first quarter (January-March) and early second quarter (April-June) of 2026, meaning the trade deal may not immediately translate into lower Russian intake.

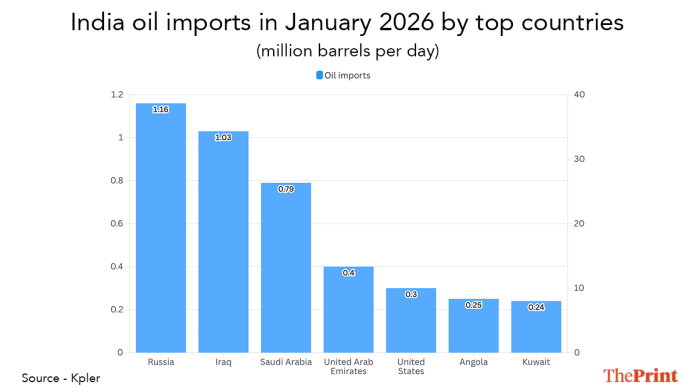

Kpler data showed that in January 2026, India imported around 1.16 mbpd from Russia, accounting for about 22 percent of total imports for the month—the highest for any country in the timeframe. Russia was followed by Iraq (20 percent), Saudi Arabia (15 percent), United Arab Emirates (8 percent) and the United States (6 percent).

The India-US trade deal was announced this month, but it is yet to be signed. The formal deal is expected to be signed this March, still weeks away.

US to gain at margins, not displace Russia

Instead of a sudden cut in Russian oil, Ritolia expects India’s diversification to continue gradually, with the US emerging as the “primary marginal winner”. According to him, US crude could rise to nearly 10 percent of India’s monthly intake, but would largely displace lighter West African barrels rather than Russian supply.

Prashant Vasisht, Senior Vice-President and Co-Group head (corporate ratings) at ICRA Limited, said India could buy more crude from the US, but commercial viability will dictate decisions. He emphasised that Indian refiners will weigh pricing and margins carefully before shifting sourcing patterns.

“It may not naturally follow that… just because somebody has announced Indian refiners will go and buy,” Vasisht said.

A key challenge, he said, is freight cost. Vasisht estimates that shipping crude from the US Gulf Coast or Venezuela to India costs “about $2.5 going up to $3.5 and sometimes $4” per barrel, compared to Middle Eastern crude where freight can be “about 40 cents per barrel, rising to 70 cents per barrel”.

Venezuela oil possible, but constrained

Alongside the US, Venezuela has also re-entered the conversation as a potential supplier, particularly for Indian refiners capable of processing heavy grades.

According to Vasisht, Venezuelan crude is very heavy and sour, meaning very few refiners globally can process it.

Indian refiners like Reliance Industries (RIL) are better positioned to refine Venezuelan oil than many global peers.

Venezuelan crude oil imports have not shown any uptick recently, with the last shipment dating to May 2025, largely by RIL. But RIL has made a deal to purchase 2 million barrels of oil from Venezuela, according to a Reuters report, though no timelines have been mentioned.

Over the long term, Vasisht pointed out that the economics of Venezuelan oil would remain challenging because of distance. He stressed that Venezuelan crude would need to be priced much lower to offset shipping costs. “Venezuelan crude has to be available at significantly lower prices to be able to justify the freight cost,” he said.

Another limitation is volume. Vasisht pointed out that Venezuela’s production capacity is only about 900,000 barrels per day, and scaling output would require substantial investment, which will take years. This effectively indicates that Venezuela cannot meaningfully replace Russia in the near term even if sanctions ease

Ritolia similarly argued that Venezuelan crude offers “optional, non-structural upside”, but it is constrained by “weaker economics, sanctions compliance, insurance, and blending requirements”.

Moderation in Russian imports, not retreat

India’s imports from Russia fell further in January, extending the moderation seen in December, driven partly by US sanctions on Rosneft and Lukoil that came into effect on 21 November last year.

Kpler data showed Russian crude imports to India in January 2026 fell 37 percent from November 2025, when the sanctions kicked in.

According to Ritolia, this marked India’s lowest Russian crude intake since late 2022. But he emphasised the decline was “a short-term procurement adjustment rather than a structural shift away from Russian barrels”.

The immediate driver, he noted, was that Reliance Industries avoided Russian cargoes, along with some other refiners, after European Union sanctions came into effect on 21 January. But Russian crude has not disappeared from the region—it has simply been held offshore.

Kpler data showed that more than 30 million barrels of Russian crude were floating in tankers in the Arabian Sea in January, with more than 20 million barrels remaining in floating storage in the region. For comparison, last year in January, floating storage was less than 10 million barrels.

Ritolia said that while some of these cargoes could move to China, “the majority are expected to find a home in India once commercial and compliance considerations are resolved”.

For India’s refiners, Russian barrels remain hard to replace at scale because of pricing. Ritolia said that Urals continues to trade at deep discount relative to Brent, making it “economically critical” for India’s refining system. He said any sharper reduction would require “a clear policy shift” by the Indian government, which appears unlikely given energy security concerns.

Urals is often used as a benchmark for Russian oil–a mix of heavy, sour oil from the Urals and Volga region, and a light Siberian oil. Brent is a light and sweet crude oil extracted from the North Sea.

(Edited by Prerna Madan)

Also Read: Don’t celebrate India-US deal yet. It’s a work in progress & Trump can back out any time