New Delhi: Corporate insolvency proceedings under the Insolvency and Bankruptcy Code (IBC), 2016, have been taking longer to complete and are yielding lower recovery rates for creditors who have lent money to these insolvent companies, an analysis of data by ThePrint has found.

This trend holds for cases that have been sent for resolution and those sent for liquidation.

However, experts on the matter say that the reason for this is less to do with the functioning of the IBC process, and more to do with the quality of the cases and the state of the economy.

Many cases that have been pending for a long time are legacy cases from the previous Board for Industrial and Financial Reconstruction (BIFR), which the IBC replaced in December 2016.

The expert view is that the success and speed of the resolution and liquidation processes also depend on the economy. Insolvency professionals find it harder to find buyers for assets that come up for restructuring when the economy is doing well than when it is doing badly.

As of 31 December, 2023 — the latest period for which data is available — claims worth Rs 10.07 lakh crore have been admitted for insolvency proceedings.

There are broadly four ways that a case admitted for insolvency proceedings can be dealt with — the borrowers and creditors reach a settlement under the IBC, the case is withdrawn, a resolution plan is agreed upon and the case is sent for liquidation.

A resolution plan — where the insolvent company goes through a restructuring process to turn it around — has to be arrived at within 270 days of the case being admitted, according to the rules under the IBC.

Also Read: Low IBC recoveries are a worry. But solutions lie in cutting court delays, not blaming CoC

Search for resolution plan taking longer, yielding less

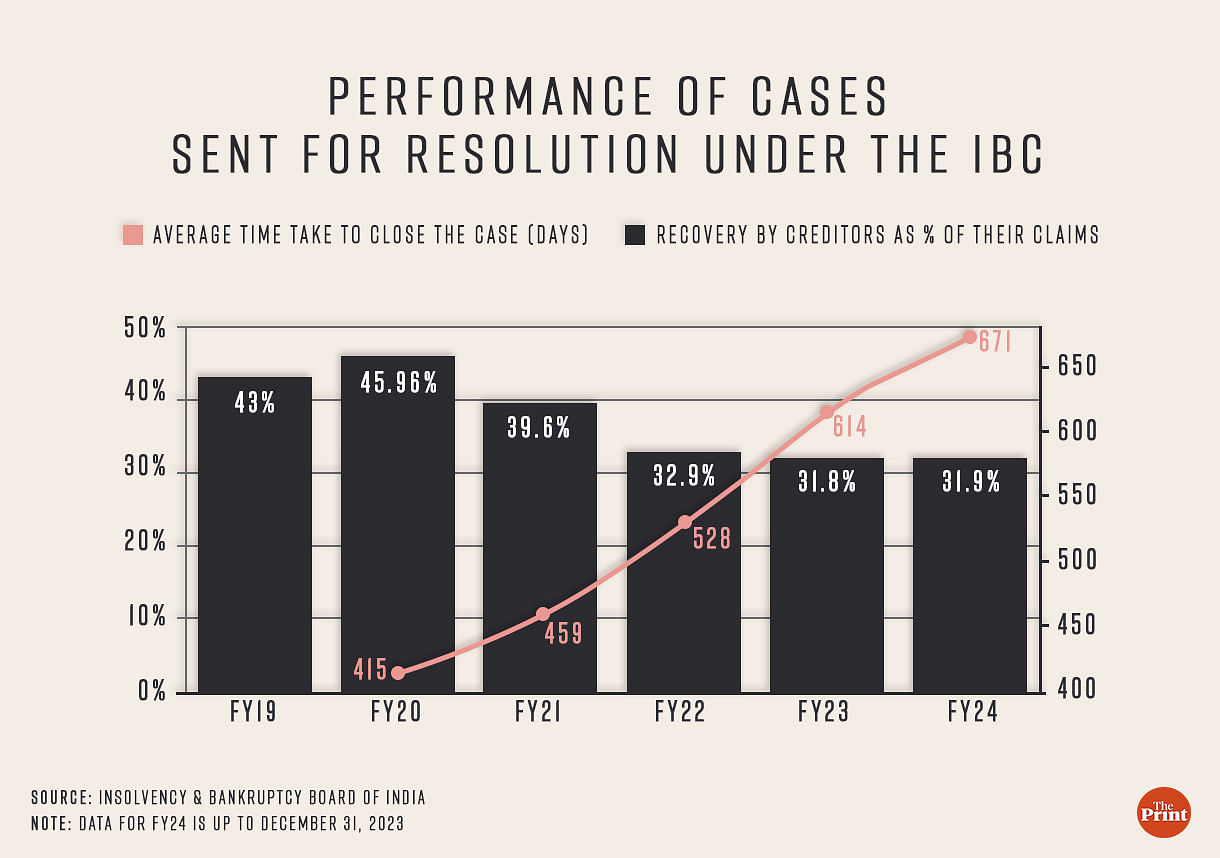

Data from the Insolvency and Bankruptcy Board of India ((IBBI), however, shows that not only is this timeline routinely overshot, but the length of the delay has been growing larger each year.

As of 2019-20, it took an average of 415 days for a resolution plan to be arrived at. This number, as of December 2023, is 671 days or nearly two-and-a-half times the permissible amount of time.

Significantly, it isn’t as if this longer time is yielding better results for the creditors.

The data on recoveries through resolution plans shows that creditors have been receiving a smaller share of their claim amounts — from 46 percent by 31 March, 2020, to 32 percent by 31 December, 2023 — the latest period for which data is available.

This, however, needs to be seen in the context of how the economy is doing, according to Soumyajit Niyogi, director of the core analytical group at India Ratings & Research.

“This has to be seen with respect to the economic cycle that we are in,” Niyogi told ThePrint. “Usually, if there is an economic downturn, then you are more likely to find a good asset brought for insolvency proceedings because the company owning it has defaulted due to the downturn, but has good assets.”

However, because it is a good asset, it finds takers and the case can be resolved relatively quickly.

When the economy is doing well — as it is doing now — then the assets that come for restructuring are more likely to be poor ones because it is more likely that the company that owns it has defaulted due to a real issue with it, mostly because that particular business is not viable, he explained.

“It is difficult to find buyers for such assets, so the resolution process gets delayed,” Niyogi added.

Legacy cases bringing the recovery rate down

The other reason why insolvency proceedings are taking so long is that many cases are legacy cases from the previous BIFR — the body in charge of resolution processes before the IBC was implemented — and several are now defunct.

That is, there’s no scope to turn these companies around, and all that can be done with them is to liquidate them.

According to data from CareEdge Ratings, based on the IBBI data, a little less than a third of the cases admitted under the IBC have been sent for liquidation. Of these, more than three-fourths (77 percent) are either legacy cases from the BIFR era or are defunct.

“In many long-pending cases, the underlying assets, such as the machines, have stopped working,” Saurabh Bhalerao, associate director of BFSI research at CareEdge Ratings, told ThePrint.

“Basically, there is no business to run, recover, or operate. These entities usually end in liquidation, where even the land is sold off. So, while there is a recovery from this sale, it falls short of the entire due amount, taking the principal, interest and penalties into account,” he explained.

Bhalerao added that the bunching up of large cases can also skew the recovery numbers. “Earlier, the recovery rate was higher because large cases were decided then, but since then it has fallen,” he explained.

Also Read: Insolvency code is one of India’s success stories. But it now needs a new life

Avoiding the IBC process altogether

Speaking to ThePrint, an official in the IBBI said that another trend that was increasingly emerging was that creditors and defaulting corporate borrowers were avoiding the insolvency process altogether, instead choosing to settle their case out of court.

“The perception is that a large number of cases in the IBC are going for liquidation because a resolution plan cannot be formulated,” the official explained. “Creditors definitely do not prefer liquidation, so they try to work out an out-of-court deal with the borrowers.”

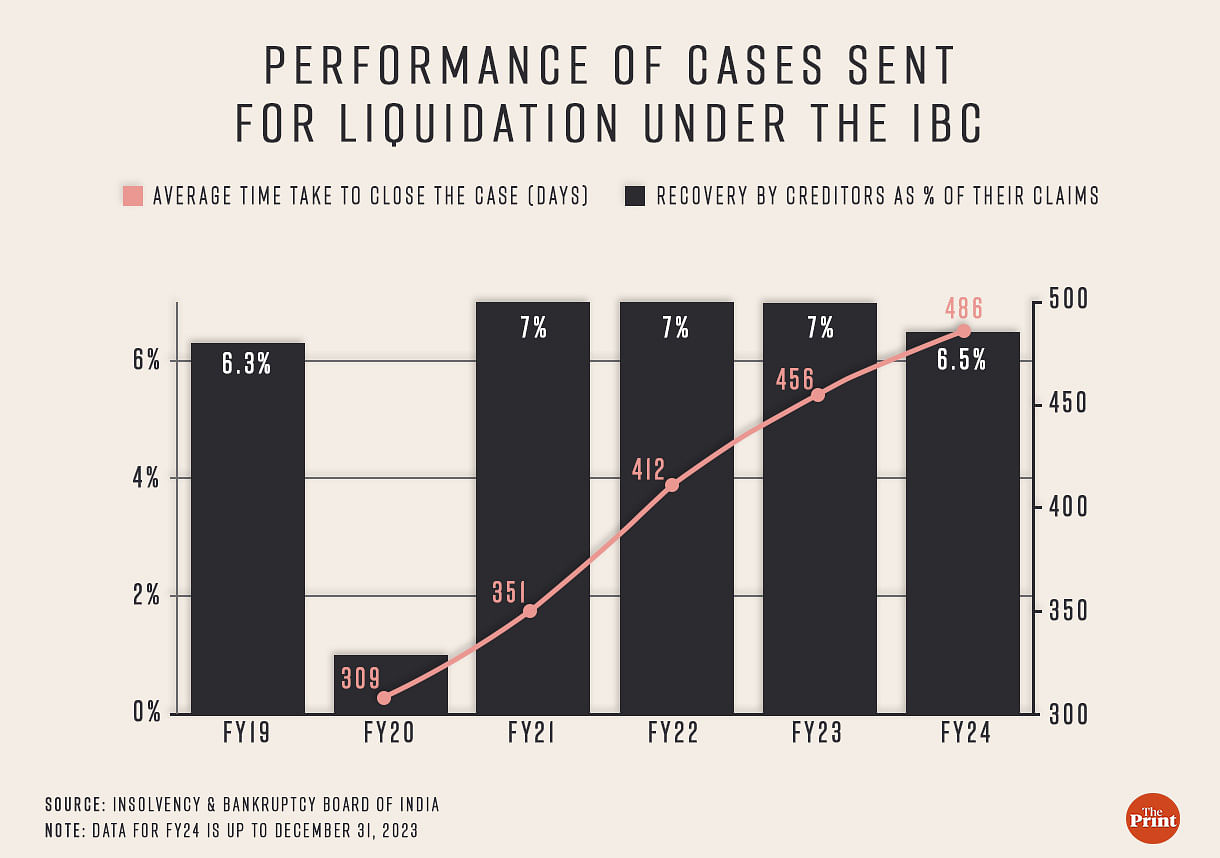

The data with the IBBI makes clear why this would be — abysmal recovery rates for the creditors and long processing times.

The data shows that the average number of days taken to liquidate a company under the IBC has grown from 309 days as of 31 March, 2020, to 486 days as of 31 December, 2023.

Further, the data also shows that the creditors recover only about 6.5-7 percent of their claim amount if the case is liquidated.

“The IBC seems to be incentivising debtors to settle their defaults even before the cases are admitted under the code, with over 27,500 applications for initiation of CIRPs (corporate insolvency resolution process) with an underlying default of Rs 9.74 lakh crore withdrawn before their admission,” the CareEdge report said.

The other reason for the rise in out-of-court settlements is that they provide creditors and borrowers greater flexibility to tweak the parameters of the deal.

For example, the creditors can decide to forgo the interest amount or agree to be paid back in instalments, among other possible customisations.

“The borrower and the lenders want a win-win outcome, not a liquidation,” Bhalerao said.

“A number of cases under the IBC go for liquidation, where there is less hope of restructuring the company and timely reviving it. So, in a lot of cases, they withdraw the cases from the IBC proceedings because they work out a deal among themselves. This also gives them flexibility over how to structure the deal, (and reach) an optimum outcome,” he added.

(Edited by Richa Mishra)

Also Read: Go First files for insolvency, blames ‘failing engines’ supplied by Pratt & Whitney

This column is quite shallow and avoids a few key areas where data should have been collected and presented. Increasingly IRP is becoming a rent-seeking profession and together with increased timelines, the columnist should have tracked “loading” of IRP fees in the process. Recently there have been many instances of leading creditors, including banks, challenging expenses incurred by IRP. This data should be easy to get.

Also grapevine talks about “collusion” between IRPs and insolvent parties where “qualifying criteria” for auctions are kept to ensure friendly bidding.

As a result, most creditors today are preferring to go for a bilateral settlement.

In a real estate company case I know of, a particular project’s creditors wanted to dissociate and complete the project in partnership with another builder, but were refused to do so by the IRP. Case is dragging on and asset quality declining, making it lose-lose for everyone but the IRP and the delinquent.

IBC can be reformed by making IBC remuneration fixed, timelines defined and maybe a variable based on recovery % to align with creditor interests. Unless this beast is tamed, creditors have little incentive in getting caught in what is currently a blackhole.