Singapore: India’s debt-burdened companies could get kicked out of MSCI Inc.’s benchmark index later this week.

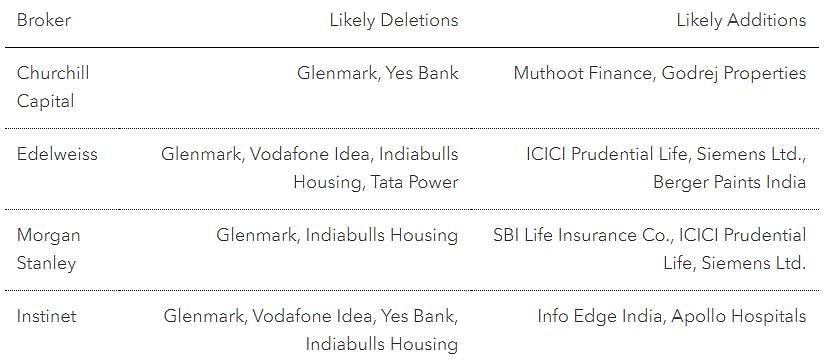

Highly indebted companies including Vodafone Idea Ltd., Indiabulls Housing Finance Ltd. and Glenmark Pharmaceuticals Ltd. are likely to be removed from the MSCI India Index, according to brokers.

Most of these companies have seen a sharp erosion in their market values in the wake of the yearlong crisis in India’s credit market. The troubled private lender Yes Bank Ltd. has slumped more than 60% this year, while Indiabulls was axed from the NSE Nifty 50 Index in September after the mortgage lender’s share value more than halved.

ICICI Prudential Life Insurance Co. and Siemens Ltd. are companies likely to be added to MSCI’s indexes, according to Morgan Stanley and Edelweiss. The insurer is up more than 50% this year. Siemens slid 0.4% at 10:11 a.m. in Mumbai after reaching a record on Monday.

MSCI will announce the results of its semi-annual review of gauges on Nov. 7 during U.S. hours. The changes will be effective at the close of Nov. 26, the index provider said last month. A company spokeswoman didn’t have any immediate comments to offer. – Bloomberg

Also read: How close the world is to its first recession since 2009