New Delhi: Reintroduce the wealth tax, infuse capital in the unorganised sector, and dispel the “climate of fear among industrialists” to revive the flailing economy — these are three of seven solution offered by a group of economic experts, including from the Congress and the Left, to improve India’s economic health.

As government data Friday showed India’s GDP growth rate fall to a six-year low of 4.5 per cent in the second quarter of 2019-20, the experts brainstormed on ways out of the distressing situation.

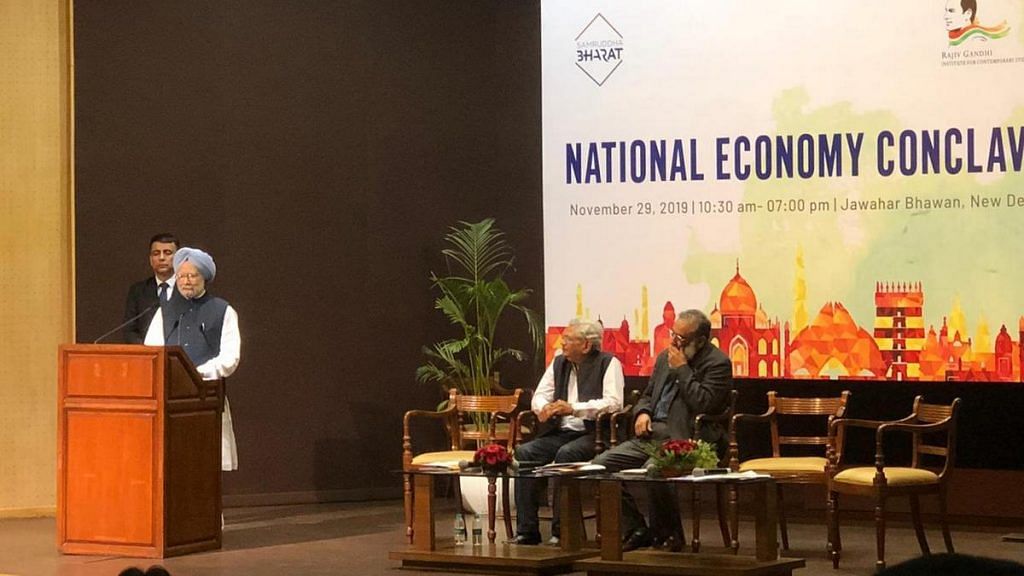

Participants at the National Economy Conclave, organised by the Rajiv Gandhi Institute for Contemporary Studies and the Samruddha Bharat Foundation, included former PM Manmohan Singh, Left leaders Sitaram Yechury and D. Raja, and JNU professors Arun Kumar and Jayati Ghosh.

ThePrint takes you through the solutions provided at the conclave, where discussions were split into five different sessions.

Also Read: Why there are no magic bullets to stop GDP growth slide

Bring back the wealth tax

Leading the conclave, which sought to discuss the state of India’s economy, were professors Kumar and Ghosh. According to Kumar, a wealth tax could help generate extra revenue to bridge the fiscal deficit. The wealth tax was abolished by the Modi government in 2015.

“Wealth tax, estate duty and gift tax, we need to raise direct taxes and not cut indirect spending on health, education and drinking water,” Kumar said.

“Not only is there a decline in growth rate there is a recession in economy,” he added. “FMCG growth rate is down, tax collection is down, the credit off-take is low, the investment rate [is] down because capacity utilisation is down.”

“The problem is policy shocks. It is not cyclical but structural. This is not a legacy issue,” he added.

According to him, a wealth tax can prove an additional resource for the government.

The panelists also asserted that the Modi government’s concessions for industry, such as the corporate tax cut announced earlier this year, cannot mend the economic paralysis as they are “agenda-driven”.

Decentralisation

Speaking about fiscal federalism, CPI(M) general secretary Sitaram Yechury said the Modi government was moving towards an authoritarian centralisation of power by dictating terms to states.

“The Modi government wants to make a Hindu rashtra. That will entail complete centralisation of power.. The Niti Aayog is its mechanical tiger,” Yechury said, referring to the government thinktank. “Inter-state councils need to be revived to check this.”

Academic Yamini Aiyar said there was a need to balance the tug-of-war between the state and the central governments.

“At one point, the Planning Commission (scrapped by the Modi government early on in its first tenure) seemed emblematic of centralisation but, in retrospect, after the creation of Niti Aayog, it seems that the commission provided space for negotiation,” she added.

GST needs to change

All panelists argued that the goods and services tax (GST), introduced in 2017 to make tax collection uniform across the country, was an all-out disappointment.

Former Jammu & Kashmir finance minister Haseeb Drabu said he used to believe in the GST. “I was foolish. The legislation was done in good faith but implemented badly,” he added.

“It changes entire fiscal federal structure. GST isn’t a tax, it’s a regime. There was earlier a producer-based tax, but GST regime is consumption-oriented. The entire devolution mechanism changed. Its core design has to change, there is a need to look at the mechanics of it,” he said.

“GST needs major reform,” Kumar added. “It is structurally flawed. It needs to be a last-point tax, should be simplified.”

“GST rates are jerky,” said Anil Bhardwaj. “There was shoddy implementation, even the public sector came down after,” he added.

Also Read: India’s shock GDP growth rate is a crisis Modi govt should not waste

Industrialists living in fear

Former Prime Minister Manmohan Singh reiterated what he wrote in an editorial for The Hindu early November, saying a palpable climate of fear was stifling economic growth in the country.

“The root cause of this is the government’s policy doctrine that seems to suspect every industrialist, banker, policymaker, regulator, entrepreneur and citizen. This has halted economic development with bankers unable to lend, industrialists unable to invest and policymakers unable to act,” he said.

“For economic growth to revive, it is very important that the government enthuses trust and confidence. It is very important for businessmen, capital providers and workers to feel confident and exuberant rather than being fearful and nervous,” he added.

Congress IT and analytics cell in-charge Praveen Chakravarty backed the former PM, saying the economic situation is unlikely to improve unless the environment changes.

Intensive job-creation activities

The root cause of the economic slowdown, according to most panelists, was the decline in demand across different social classes, brought on by the jobs crisis. In this light, professor Ghosh called for a targeted focus on the revival of demand by undertaking employment-intensive activities.

“The government needs to increase social-sector spending such as on education and health, which will result in high employment and have a multiplier effect,” she said.

Rajya Sabha member and economist Bhalchandra Mungekar added that the government needs to focus on spending money on employment guarantee schemes. “This is a monumental failure on the part of the government. We have to create exterior measures to reduce poverty because mainstream policies are creating poverty,” he said.

Many of the panelists noted that poverty in the country is at an all-time high, with the absolute numbers growing each year — a phenomenon that hasn’t been seen since 2004 and 2005, they said.

“Rural consumption numbers are terrifying,” said Congress Rajya Sabha MP Rajeev Gowda. “There is a need to understand what they mean in real terms. For the first time, people are falling into poverty faster than they are coming out of it, they are also cutting down how much they spend on food.”

Also Read: 4.5% GDP rate alarming, Modi govt must ensure we don’t slip further to Hindu rate of growth

Pump capital into unorganised sector

Several panelists said the slowdown could also be attributed to the fact that the impact of demonetisation and sudden GST implementation was never clearly assessed. The two big-ticket moves came within months of each other and thrust the cash-dependent unorganised sector into deep disarray.

“Rather than tax cuts and concessions for the organised sector we need to increase investment in the unorganised sectors,” said Professor Kumar. “Farmers income needs to increase, as does credit to micro and small sector.”

“Low demand will lead to low prices in turn to low income and inevitably low demand,” said agriculture activist Himanshu, who just uses his first name. “What is needed is to inject money into agriculture sector… piecemeal solutions will only take us from one crisis to another.”

Separating micro from small and medium enterprises

Another key facet highlighted at the conclave was that micro industries are suffering due to the “blanket policies” being implemented by the government for the micro small and medium enterprises (MSME) sector.

“There is a need to disaggregate the micro from the small and medium enterprises,” said Kumar.

Jeemol Unni, a former RBI chair professor at the Gujarat-based Institute of Rural Management (IRMA), backed Kumar.

“There is a dualistic structure of industry in India, what we call the organised and unorganised sector,” she said. “There is a need to separate the micro from the small and medium enterprises. Different levels have different needs. At times, the medium and small enterprises can access the policy while the micro ones can’t.”

She also emphasised the need to fix the mismatch between skills and employment.

Also Read: Slowdown not recession says Nirmala Sitharaman: Is Modi govt still in denial on economy?