New Delhi: Indian banks finally got moving Tuesday to give relief to borrowers by allowing a three-month deferment of loan EMI repayments, four days after the announcement by the Reserve Bank of India to help ease the financial impact of the coronavirus outbreak.

The implementation of the package had apparently been delayed due to confusion about the modalities, forcing the finance ministry and the central bank to intervene Tuesday.

The Department of Financial Services under the Ministry of Finance directed banks to pass on the benefits to the customers at the earliest and ensure the message is communicated to all branches, said a finance ministry official, who did not wish to be identified.

The central bank will answer some frequently asked questions (FAQs) to address the confusion, an RBI spokesperson said.

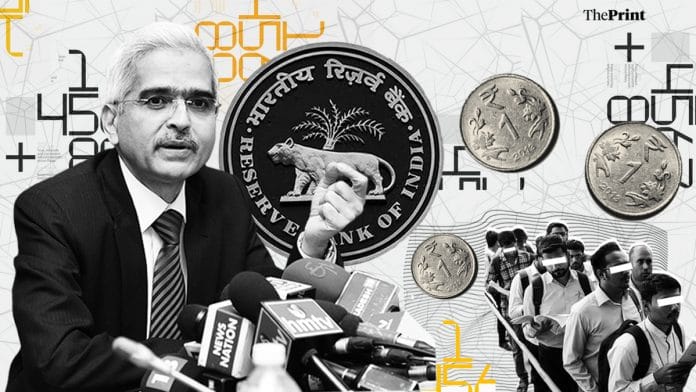

On Friday, RBI Governor Shaktikanta Das had announced a three-month loan moratorium for all term loans, providing a massive reprieve to borrowers. The loan moratorium meant that borrowers would not have to pay equated monthly instalments (EMIs) either for the loan or on the interest for three months.

It was part of the central bank’s attempts to insulate borrowers from the economic fallout of Covid-19 that has forced many small businesses to shut shop, leading to job losses.

The RBI notification had clarified that interest will continue to accrue on the outstanding portion of the loans during the moratorium period, clearly encouraging those who can afford it to continue paying their EMIs.

Also read: These are the steps India has taken to contain economic fallout of Covid-19

Some banks offer clarity

Most state-run banks, including Canara Bank, Punjab National Bank (PNB), Bank of India (BoI), Bank of Baroda and the State Bank of India, took to social media Tuesday afternoon to announce that borrowers were eligible for the loan moratorium as they detailed the process of availing the scheme.

A State Bank of India spokesperson told ThePrint the moratorium will be applicable to all term loans and the bank will shortly put out details on its website.

Bank that cares…..#WeAreInThisTogether @DFS_India @DFSFightsCorona @FinMinIndia pic.twitter.com/BwVFGENpDE

— Bank of India (@BankofIndia_IN) March 31, 2020

PNB presents relief scheme for our customers. In view of COVID-19, it has been decided to defer payment of all installments on term loan and recovery of interest on cash credit facilities falling due between March 01,2020 and May 31 2020.@DFS_India @dfsfightscorona pic.twitter.com/dHRvu5luXb

— Punjab National Bank (@pnbindia) March 31, 2020

#BankofBaroda is providing a moratorium of 3 months on payment of all instalments falling due between 01.03.20 & 31.05.20 for all term loans including Corporate, MSME, Agriculture, Retail, Housing, Auto, Personal loans, etc. in pursuance of the RBI COVID-19 Regulatory Package.

— Bank of Baroda (@bankofbaroda) March 31, 2020

Important announcement for all SBI customers.@guptapk @DFS_India @DFSFightsCorona#Announcement #SBI #StateBankOfIndia pic.twitter.com/hEWSXVxVIp

— State Bank of India (@TheOfficialSBI) March 31, 2020

An HDFC official said the housing finance company will communicate with its customers in a day or two on the options of the moratorium.

Borrowers can defer the repayment of both the principal and interest components of the loan. However, interest will continue to accrue on the outstanding amount. The residual tenor of the loan will also be shifted accordingly.

Also read: India must get last mile right, direct cash payment is better than freezing loan repayment

Pain points

The confusion lies in the fine print of the deferment. For customers, it remains unclear whether they need to approach banks for seeking a temporary halt in EMI repayment or whether it will be done automatically.

For instance, banks like PNB and BoI require customers to contact their respective branches to opt for the deferment. But the IDBI Bank has specifically clarified that the EMI moratorium will be uniformly applicable to all customers unless a customer specifically writes to the bank saying they wish to continue paying EMIs.

However, most banks are yet to provide this kind of clarity even though four days have passed since the RBI’s announcement.

There is also confusion on the due EMI payments of March.

Though the RBI notification issued on 27 March permitted lending institutions to grant a moratorium on payment of all instalments due between 1 March and 31 May 2020, banks continued to debit EMIs.

Also read: Lesson from Black Death: Coronavirus will transform economic life for longer than we expect

I had also opted the moratorium but I didn’t get it for three months as the emi for March was already paid. As per my knowledge the emi cycle for all kinds of loans are paid till 15th of every month. Then how can banks can count March month also.

The Lockdown was announced on March 22, and the moratorium was announced on March 27 then how can they count March in that period as the emi cycle had already passed. In that cases people considered that they will be getting three months after the announcement that is April, May and June. Bank has charged me and many others for not keeping the account funded for deduction of emi in month of June.

Till date i never understood what calculation this was committing relaxation for three months and giving only two months and top of that deducting money for not having sufficient funds in bank account.

This is RBI’s and government’ hypocrisy in name of helping people. Its nothing but backstabbing.

The most foolish announcement in this era from RBI to all banks & finance companies. No 3 EMI monotorium. Eveything is false in India nobody cares. The government fools you & as a foolish we vote them. India is not, never ever be a super power till good government is formed with good administration. don’t believe anybody. India leaves on EMI only so be ready to face worst time forever.

Dear sir according to your orders emi relaxed upto June 30. Our business was closed so no

Money how we pay in June 2020. Please relax three months more relaxation to pay emi otherwise account will be NPA

The announcement not help to the custome.the bankers are doing clever action specially rural bank .the bank manager said no written order from the RBI.so you have to pay EMI.the announcement foolish the customer.the bank not help to the UN educated people.pls clarify the bankers.txs.

Kotak cc collection officers and India bulls officers are harassing they call again and again in a day even at around 12:00 am also they are harassing by there calls…kindly help us government how we can pay this emis salaries are also on hold

Kotak cc collection officers and India bulls officers are harassing they call again and again in a day even at around 12:00 am also they are harassing by there calls…

Bajaj finance company force to submit emi

In April 2020 according to lockdown I am late

To submit the emi they give me cheak bounce

Charge and other overdue. When I called him to know what charge they put on me they give the reason of lockdown and tell me office is closed. But for emi they call me.

Please do something about it

MY no.8909279009

Inspire of sending mail to idfc for loan morototium in march bank had deduct the emo for April and may .how their do this .j

Sks finance ka bhi call aa raha hai emi ke leye

Dear sir/Madam aap ne kaha the ke March se lekar may tak koi EMI nahi kateyee lekin sir aap ke rule ko bilkul bhe nahi maan rahe hai Bajaj Finserv ek to AAP ne hum Ko Ghar par beetha diya aur uppar se Bajaj Finserv wale ko peeche laaga diya aap Ko aisa nahi karna chahiye aap Bajaj Finserv wale ko ke zaaheel inshan Ko kuch to sharam karo har jagah paise kaam nahi aate Madam boliye Bajaj Finserv wale ko

Bajaj finserv to is baat ko maan hi nahi raha hai or emi ke liye baar baar coll kar raha hai bank me chek bhi laga raha hai bausing charge bhi laga raha hai

I had paid my HDFC Jumbo loan EMI for the month of April,and I can’t pay,for the month of May and June, because of covid19, so will have to pay fine amount with Installments after May 30

I get personal loan at faizabad awedunivesity branch but my emi continu deducted

My emi cut today, from Sbi, govt say no emi, but how sbi cut the emi

I have Personal loan from Axis bank. My Emi is 4210 Rs . This month Emi deducted from my account ,my account balance is 2000 Rs before deduction emi, my account balance -2210 after deduction. Bank said you must paid this month Emi with bouncing charges. But three months exemption in Emi announced by RBI governor. What should I do..

This is only eyewash. Banks are not willing to provide moratorium.

मेरे बजाज परसनल लोन 5/4 2020 को EMI कटा फेकु सरकार

Hero Finecrop Two wheeler loan EMI postponed or not?

Mera emi kata gaya hai Bajaj finance ne or 1000 rupis ,bola upar se ordar nahi mila,boliye sir abhi

Kya Bajaj finance ko nihe kaha Gaya hai ke 3 mahena Tak EMi rok na hai ya castamber ko SMS aur call Kar ke parashan Kar rahain hai please bhaiyon,,,

it is useless….. BANKs don’t care about RBI instructions or the people….banks does not inform customers & continued the EMI deduction, and not replying any calls or emails of customers….total bullshits …….& where should we take this matter… Nothing is mentioned….

As per my bank Home First Finance company they did not have any circular for private bank circulars for moratorium from RBI,

Kindly do something for this trouble,

Hope you people can help us.

Waiting for your reply.

Thanks

Home credit help 6a 3 month mata

State Bank of India ke staff bol rahe hain ki loan EMI deduction nahi hone ke liye koi order nahi ahya hain.

KYA HDFC BANK NE BHI PERSONAL LOAN AND CREDIT CARD KI EMI KO MORATORIUM KAR DIYA H FOR 3 MONTHS

What about manna puran finance ltd for two vehicle loan emi’s

How can I get three months loan deferment

As per my bank Abhyudaya co oprative bank Ltd., they did not have any circular for private bank circulars for moratorium from RBI,

Kindly do something for this trouble,

Hope you people can help us.

Waiting for your reply.

Thanks

Monitoriun is trap for the customers they r charging u don’t its maximum interest they will charge to u .RBI cheated on they havenot clarify the interest will charged by the bank .it’s helping hand to home customer or any loan so be careful.iasked my bank they told they r going to charge 15 percent

Plzz no Emi 3 mant

Bank RBI Ka aadesh ko nahi manati

Bank is not providing this fasality and cutting interest beware

Citibank charged my emi as usual.

Next 3 manth emi Hero fincorp stopped

Hdfc bank sending messages emi dates…

What aboutHDFC BANK stand

I have a personnal loan shall I get the

Prevelage of 3 months moratorium

Tata capital worst services no update on moratorium till now my due date on April 3rd

My due date is 2 april.please reply fast

Hi sir what happened the private bank circulars for deducting of emi please updates karur vysa bank reg of RBI rules is eligible Already the March month emi deducted but confessions. But some others banks are published.

Hi sir what happened the private bank circulars for deducting of emi please updates karur vysa bank reg of RBI rules is eligible Already the March month emi deducted but confessions

Didn’t get any useful info in this article..

Kya capital first and home credit Jaisi finance company relaxation provide kar rhi hai

Is car loan extend in hdfc bank

Which bank to be contacted in below said situation:-

PL lending bank is Icici , emi getting debited from salary account with HDFC bank ?

This is headache for both Banks and the customers,since one month is already gone.

The govt.has not notified their expectation that the pandemic will cease my May.

The whole situation is uncertain. The customers will have to grapple with the problem of EMI

as well as the Corona virus situation.

My suggestion is for a safer alternative ie, to reschedule the loan for an extended period of six months. and announce new EMIs.

Present moratorium of three months can then be extended if necessary

as per the prevailing pandemic situation,

All those who think they can pay without any moratorium can be encouraged to pay.

If feasible .RBI can directly communicate through the Media.print or otherwise to the borrowers

and Banks may be directed to for implementation.

Hero fincorp personal loan emi postponed or not?

R B I guideline 3 month EMI deferments 1 march 2020 to 31 march 2020 ki order copy send kare

HDFC TWO WHEELER LOAN EMI IS POSTPONED FOR 3 MONTHS, GIVE UPDATES

msg send emi from bank

Kya ye sahi hai private Finance co. ICICI Megma fincorp. ltd. Ki bhi EMI 1 mach 2020 to 31 may 2020 tak ki EMI bhi aage bada di gayi hai.

HDFC TWO WHEELER LOAN EMI IS POSTPONED FOR 3 MONTHS, GIVE UPDATES.

ICICI BANK TWO WHEELER LOAN EMI IS POSTPONED FOR 3 MONTHS, GIVE UPDATES.

I was purchase electronics goods so can I pay EMI

Its not a useful article unfortunately. Definately not what i expect from theprint. Where is the research? Did you read indianexpress’ article for the same topic? That’s quality. I expected theprint to be equivalent but this article disappointed me. Its not adding any value to information we already know from twitter.

Msg are send banks emi dates