Mittal-controlled Bharti Airtel and Mukesh Ambani’s Reliance Jio Infocomm bond sale may finally end India’s steep telecom price pain.

Companies owned by billionaires Mukesh Ambani and Sunil Bharti Mittal may raise as much as 365 billion rupees ($5.6 billion) selling bonds as the telecom titans build a war chest in what investors hope will be the home stretch in India’s bruising tariff war.

Mittal-controlled Bharti Airtel Ltd., which sold its first-ever rupee bond of 30 billion rupees last month, has approval to raise 165 billion rupees, according to a March 12 filing. Reliance Jio Infocomm Ltd. announced days later that it plans to sell as much as 200 billion rupees of notes, marking the disruptive upstart’s return to the onshore bond market after 20 months.

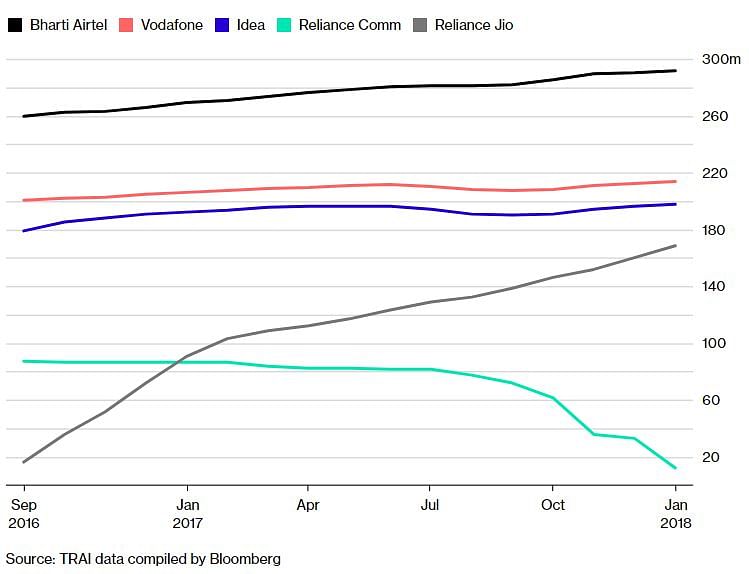

The fundraising amount — about 78 percent of the total outstanding bonds of India’s top four telecom firms — signal that the largest carrier and its rival Jio are gearing to roll out next-generation services and manage about 320 billion rupees of debt due in the next five years. Jio stormed into the mobile-phone market in 2016 with free services that set off a tariff war and forced smaller players to merge or exit.

“After four years of intense price pain, the India telecom battle could be in its last stretch,” said Raj Kothari, head of trading at Jay Capital Ltd. in London. “It’s down to the big boys and they are piling up funds for that.”

Narrowing The Gap

While Jio has added users every month since 2016 launch, bridging the gap with the big three, Bharti has held its top spot Emails sent to Bharti and Jio spokesmen seeking details on use of funds went unanswered.

Emails sent to Bharti and Jio spokesmen seeking details on use of funds went unanswered.

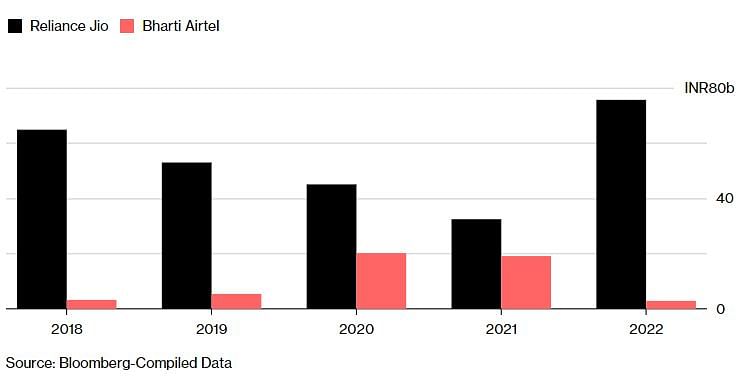

Bharti said in the filing that the money would be be used for treasury activities, including refinancing, and for paying off spectrum dues. Jio hasn’t specified end use, though it has significant repayments due in the next few years, data compiled by Bloomberg show.

Upcoming Repayments

Jio, Airtel to face ~320 billion rupees debt maturity wall over the next five years

The total debt at four publicly traded wireless operators — Bharti, Idea Cellular, Reliance Communications Ltd. and Tata Teleservices Maharashtra Ltd. — has jumped 55 percent since the end of March 2016 to $34.81 billion, data compiled by Bloomberg show.

Jio, being a new player, needs to spend aggressively to grab market share, while Bharti is investing more to retain its lead, said Mehul Sukkawala, senior director for corporate ratings at S&P Global Ratings. “This competition could move to the fiber-to-home business in the future and the related bundling of services with fiber.”

Jio secured AAA rating for 150 billion rupees of debentures last week from Crisil Ltd., a unit of S&P Global, which cited the “irrevocable and unconditional” support from parent Reliance Industries Ltd. India’s most valuable company has invested at least $31 billion in the telecom venture. Crisil rates Bharti’s rupee notes at AA+.

Bharti and Jio won’t have a problem finding buyers, Jay Capital’s Kothari said. “Both have a good pedigree. Their debt will easily get consumed.”