Mumbai: The shipyard controlled by embattled Indian tycoon Anil Ambani is facing the prospect of bankruptcy after failing to get creditors’ approval for restructuring 70 billion rupees ($970 million) of debt, people familiar with the matter said.

India’s bankruptcy tribunal will consider putting Reliance Naval & Engineering Ltd. in bankruptcy on Wednesday as no new repayment plan was submitted after lenders led by IDBI Bank Ltd. rejected an earlier offer in July, the people said, asking not to be named as the information is not public. The court can also defer the decision on bankruptcy.

Any court ruling favoring the banks would deal another blow to the tycoon’s stressed empire after his wireless carrier slipped into insolvency earlier this year. The revival of the shipyard is crucial for the tycoon, who’s betting on potential cash flows from government defense contracts as Prime Minister Narendra Modi plans billions of dollars in spending on national security.

While IDBI had sought to move Reliance Naval into insolvency in September 2018, a decision was delayed after industry bodies representing power-generating companies, shipyards and sugar mills successfully challenged the RBI directive that required delinquent borrowers to be pushed into bankruptcy. However, the risk of bankruptcy reemerged for the submarine maker after it failed to come up with a repayment plan even under RBI’s relaxed norms.

Also read: Anil Ambani looks to sell everything between roads and radio units to cut crushing debt

Representatives for Reliance Naval and IDBI Bank didn’t respond to emails and phone calls seeking comments.

The warship maker’s loan-recast plan that was rejected in July proposed banks converting part of the debt into equity after the RBI eased rules to provide lenders more discretion in dealing with soured debt, the people said. The plan didn’t involve any upfront payments and proposed a transfer of banks’ non-fund exposures such as guarantees and letter of credits from Reliance Naval to another Ambani company Reliance Infrastructure Ltd., the people said.

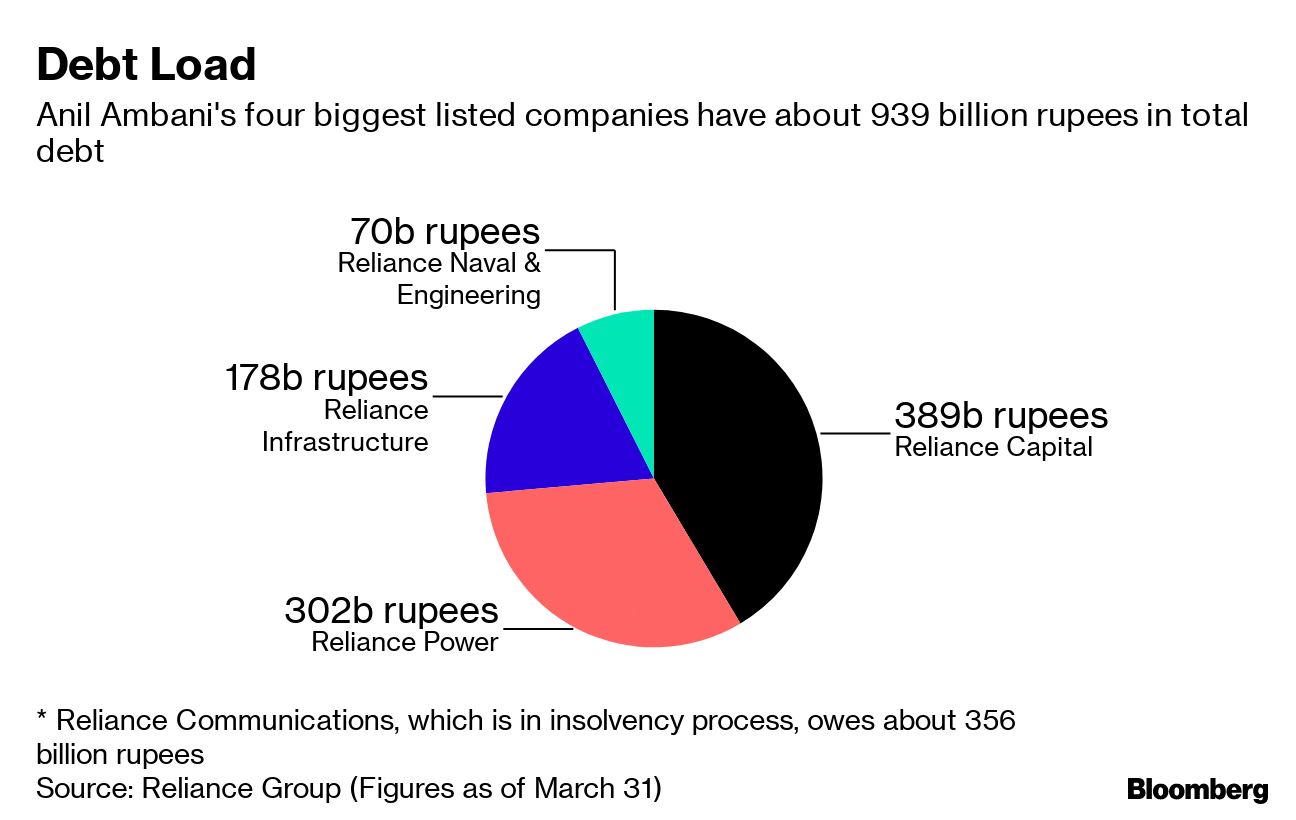

Meanwhile, Anil Ambani’s wider conglomerate is planning to dispose of assets spanning roads to radio stations, aiming to raise about 217 billion rupees ($3 billion) to help pare debt that has ballooned to about 939 billion rupees at four of its biggest units — excluding the telecom business Reliance Communications Ltd. – Bloomberg

Also read: Anil Ambani has to now return $2.1 billion to Chinese banks

Brings to mind the saga of Eike Batista, Brazil’s richest man, who lost 97% of his fortune in less than two years.