New Delhi: The public sector banks that currently do not meet the minimum public shareholding norms of 25 percent will go to the market “over the next few months” to address this, Economic Affairs Secretary Ajay Seth told ThePrint.

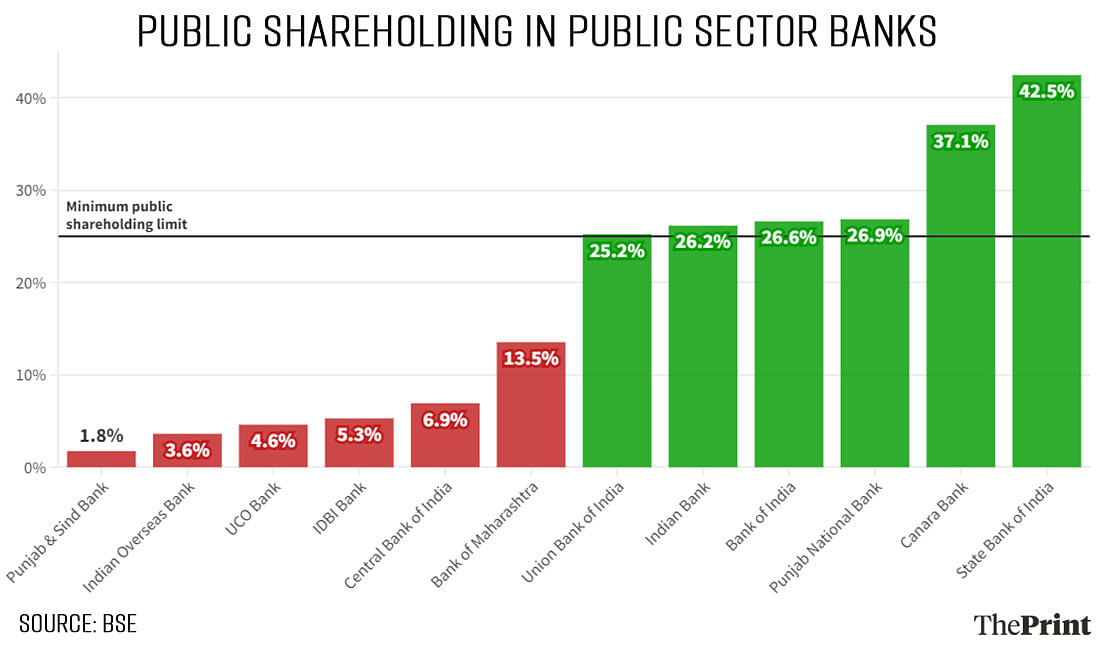

An analysis by ThePrint finds that half of the 12 public sector banks do not meet the minimum public shareholding norms set by markets regulator Securities and Exchange Board of India (SEBI).

While this is not in contravention of the rules, since the government gave itself the power in 2023 to exempt Public Sector Undertakings (PSUs) from these requirements, market experts point out that low public shareholding can increase the chances of stock price manipulation.

“Yes, some banks are not at 25 percent, and we do expect that over the next few months, those that are below 25 percent public shareholding, will be coming to the market,” Seth told ThePrint in an interview.

“It will not be possible for some of them to reach 25 percent in one go,” he added. “It will take a couple of years, but that is our attempt and conversation within the government as well as with the management of those banks.”

According to SEBI requirements, a promoter may hold a maximum of 75 percent share in a company, and 25 percent of the holding should be free float or, in other words, the shares should be held by the public.

Dr. V. K. Vijayakumar, chief investment strategist at Geojit Financial Services, a Kerala-based investment services company, told ThePrint that the requirement of minimum 25 percent public float is important as it helps prevent stock price manipulation.

“The rationale behind this is that if the promoter holding is high and public holding is very low, the stock prices can be manipulated. You cannot manipulate the stocks of a large company like Reliance, Bharti Airtel, Infosys or ICICI Bank because the public float is too large, and even if the large operators gang up together, they cannot manipulate the price,” Vijayakumar said.

He added that in the interest of transparency, it is desirable that the public float should be around 25 percent.

Vivek Iyer, partner at audit firm Grant Thornton Bharat, said that minimum shareholding rules are prescribed to ensure that the public shareholder interests are not diluted on account of a larger private holding by other investors. Also, free float shares ensure adequate price discovery, thereby reflecting the adequate value of the enterprise.

Financial & non-financial PSUs

In addition to banks, there are three other financial PSUs — LIC, New India Assurance Company and General Insurance Corporation of India — with low public shareholding. The government shareholding in all three is above 85 percent, which means the public shareholding is less than 15 percent.

There are also 62 non-financial PSUs, which are listed on the stock exchanges. Of these, nine companies, including SJVN, MMTC, Mazagon Dock Shipbuilders, Indian Railways Finance Corporation (IRFC) and India Tourism Development Corporation (ITDC), do not meet the SEBI guideline for at least 25 percent free float shares.

With Indian stock markets witnessing a strong rally, Ajay Bodke, an independent market analyst, opined that it is in times of such euphoria that there is need for vigilance among regulatory authorities and investigative agencies to protect millions of retail investors.

He added that one such manipulation currently being played out, which endangers retail investors, involves targeting companies with low floating stocks.

“Many government-owned PSUs and smaller government-owned banks (PSBs) have emerged as a favourite playground for such ramping-up schemes,” he told ThePrint.

He explained that this is happening as speculators are confident that no large-scale supply of shares, and a subsequent fall in stock prices, is likely from the government as the approval process for further sale of shares is long, tedious and involves multiple levels.

He also pointed out that many of the PSBs’ shares are now trading at valuations significantly higher than their larger, more efficient and profitable public sector financial peers, which, due to their large floating stocks, remain shielded from large-scale speculative trading.

Echoing similar views, Vijayakumar said, “In the case of stocks, where the government of India owns more than 75 percent, since the floating stock is very less, some operators can drive up the prices. And that is why, in the case of some of these, the stocks have seen an increase of 5-10 times. This would be a 500-1000 percent rise in the last couple of years. This is not desirable.”

Iyer added that PSUs, to a great extent, execute the priorities of the government, which are in national interest, have a long-term focus on building a sustainable ecosystem, and may not be necessarily focused on profitability in the short term.

“Having said this, they also don’t want public shareholders to lose out on participating in the long-term growth. Further, PSU stocks are largely undervalued, which tend to be good investments from a long-term standpoint and hence, offset the risks that otherwise stem from an exemption to the minimum shareholding rule,” he added.

Increase in demat accounts

In an indication that more people are investing in equities, the number of demat accounts, which are required to trade and hold shares in electronic format, crossed the 150-million mark in March this year, a nearly three times increase from 40.8 million demat accounts at the end of March 2020.

Asked if now may be the right time for the government to offload stake in companies where it holds more than 75 percent share given the strong performance, Iyer said that divestment in PSU holding is not just a function of the price at which the stocks are trading, but also a function of the maturity of the organisation to sustainably grow without much government direction.

“Based on this intersection, the government may or may not decide to go on the divestment journey for a PSU on a case to case basis,” he added.

(Edited by Radifah Kabir)

Also read: Hostels, creches, skilling programmes — budget bats for higher participation of women in workforce