New Delhi: India’s coal-fired power generation declined in 2025 even as the country continued to add new thermal capacity, marking a structural turning point in the power sector driven by record renewable energy deployment.

According to the India Power Sector Review 2025 by the Centre for Research on Energy and Clean Air (CREA) released Wednesday, coal-based electricity generation fell by 3 percent in calendar year 2025.

“This is only the second time in over 50 years that coal-fired power generation has fallen for a full year, based on a time series of coal-fired power generation starting from 1971 in the International Energy Agency,” the report states. “The first one (full-year decline) being associated with the Covid-19 pandemic.”

CREA’s analysis shows that the drop in coal and gas-fired power generation was caused by record growth in clean power generation, which contributed to 44 percent of the drop, compared to the coal power generation trend in 2019-24.

Less demand for air-conditioning due to milder weather accounted for another 36 percent of the drop, while a broader structural slowdown in power demand growth contributed the remaining 20 percent.

In 2025, thermal and nuclear power generation showed a decline by 4 percent and 2 percent, respectively, while large hydro and renewable energy grew by 15 percent and 22 percent, respectively.

While hydropower is considered a renewable source of energy, the report has categorised large hydropower separately, and small hydropower under the renewable bracket.

According to the report, renewables are not only adding capacity but are increasingly meeting actual electricity demand, particularly during daytime hours when solar output is high.

CREA’s findings suggest that India’s power system is now entering a phase where incremental demand growth can be met largely by non-fossil sources.

Even on the highest demand day of the year —12 June 2025, when peak demand touched 242 giga watt (GW)—215 GW of thermal capacity was required to meet the load, with the rest 27 GW was met by non-fossil energy.

“The peak occurred during solar hours, and only 215 GW of thermal capacity was online for generation. The rest was offline due to planned maintenance (5 GW) and forced outages (22 GW). This highlights the system’s ability to meet even peak loads without utilising the full thermal fleet,” says the report.

Also Read: Niti Aayog CEO has a message for power stakeholders. Buckle up for surge to feed EVs, data centres

Installed renewables closing in on coal

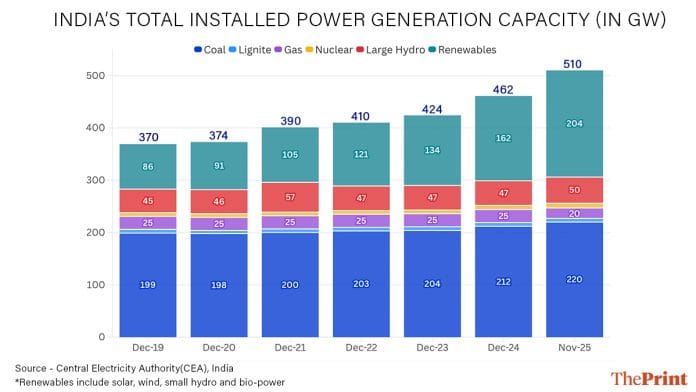

As of November 2025, India’s total installed power generation capacity stood at 510 GW, reflecting the rapid scale-up of renewable energy over the past decade. Coal still remains the single largest source, with about 220 GW, accounting for 43 percent of total installed capacity.

However, renewable energy sources — including solar, wind, biomass, and small hydro — have reached 204 GW, or 40 percent of the total capacity, while large hydro adds another 50 GW.

Other sources such as gas, nuclear, lignite and diesel contribute smaller portions.

Solar power dominates India’s renewable portfolio, with 133 GW installed, accounting for nearly two-thirds of renewable capacity. Wind power has crossed 54 GW, accounting for 26 percent of renewable capacity, while biomass and small hydro make smaller contributions, but are steadily growing shares.

The ownership pattern of power capacity highlights the private sector’s growing role in the energy transition.

Of the total installed capacity of 510 GW, the private sector accounts for 279 GW, far exceeding the central government’s 119 GW and the state governments’ 112 GW.

This dominance is even more pronounced in renewables, where private developers account for more than 90 percent of installed renewable capacity, compared to coal, which remains concentrated in central and state utilities.

Capacity additions risk coal overcapacity

Looking ahead, the report flags a growing mismatch between planned coal capacity additions and actual system requirements.

India currently has 36 GW of thermal capacity under construction, spread across central, state, and private sector projects. In addition, 22 GW of coal capacity is classified as stressed, with projects either delayed or unlikely to be commissioned.

If all under-construction and stressed projects come online, India’s coal capacity would rise to around 278 GW, well above the 252 GW projected as sufficient to meet demand by 2030-31.

The report states, “If all these plants come online, India risks significant overcapacity in coal, which would depress coal plant PLFs (Plant Load Factors) and, without greater system flexibility, could exacerbate curtailment of solar and wind generation.”

At the same time, the renewable pipeline continues to expand rapidly.

India is targeting 500 GW of non-fossil capacity by 2030, requiring annual additions of around 50 GW of clean energy. CREA’s analysis finds that sustaining this pace would be sufficient to meet projected electricity demand growth through the rest of the decade, leaving no headroom for coal-based power generation to rise further.

“Clean electricity sources are also increasingly covering demand peaks, making coal power capacity additions redundant,” says the report. “If under-construction coal power projects (36 GW) are completed, capacity utilisation could fall to unprecedented lows, causing financial distress for generators and excessive cost burden on power users.”

(Edited by Ajeet Tiwari)

Also Read: The problem with India’s discom privatisation is too little competition right now