Mumbai: Arguing for a larger share of funds for developed states, the Maharashtra government has asked the 16th Finance Commission to make a key tweak to the population metric and introduce two new criteria while assessing states to decide devolution of funds.

Unlike most other states that have been lamenting the importance given to population while deciding devolution, the Devendra Fadnavis-led Maharashtra government has recommended that the weightage given to the population metric be increased to 20 percent from the previous commission’s 15 percent.

However, it also suggested basing half of this 20 percent on rural population and half on urban population. This will benefit Maharashtra as more than 50 percent of its population live in urban areas.

Similarly, the state government has also suggested introducing a criteria to assess states on the incremental contribution to the Union Gross Domestic Product, a demand made by some other states too such as Tamil Nadu, Gujarat, Haryana and Telangana, and on sustainable development and green energy.

These two criteria were not there while deciding how much states should get in devolution under the 15th Finance Commission.

Maharashtra has also asked for grants worth Rs 1.28 lakh crore for specific projects.

“Maharashtra being more urbanised than other states, basing a part of the share on urban population favours Maharashtra. It is a very unique suggestion and so far we have got it only from Maharashtra,” Arvind Panagariya, the chairperson of the finance commission, told reporters in Mumbai Thursday.

“We recognise that there is some legitimacy to demands that performance should also be given some consideration. Whether that consideration will be given will be decided by all members of the commission collectively,” he said.

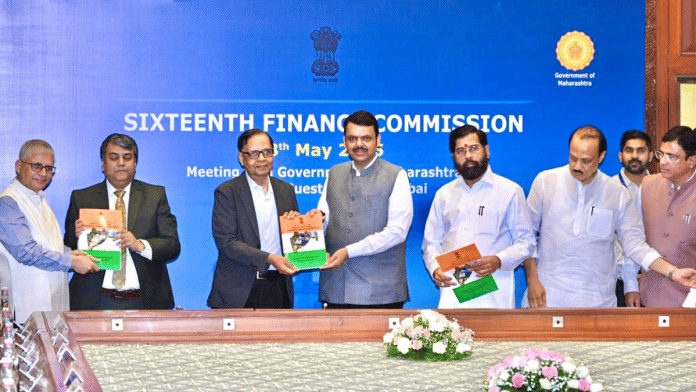

Maharashtra is the 25th state that the 16th Finance Commission is touring. Chief Minister Devendra Fadnavis and his deputies Eknath Shinde and Ajit Pawar met with the 16th Finance Commission Thursday morning and presented a memorandum.

‘GDP contribution, urbanisation‘

The 15th Finance Commission gave 15 percent weightage to population as a criteria while deciding on devolution to states. Maharashtra has asked this to be raised to 20 percent, but consider urban population as a separate metric within this 20 percent.

“The pace of urbanisation has been much faster in some states of India as compared to other states. Maharashtra is one of the rapidly urbanising states both due to migration within the state and also from other states…Local bodies are unable to meet the capital and maintenance and repair costs of various urban infrastructural projects necessitating the state government to step in with full or partial financial assistance,” the state memorandum said.

The state’s urban population was 45.23 percent of the total population as per the 2011 census, and is projected to have grown to above 50 percent now, the memorandum added.

Apart from this, the Maharashtra government has asked for two new criteria, one of which has been a demand made by some other richer states too. Maharashtra wants 2.5 percent weightage to be given to the states’ incremental contribution to the GDP. Some of the other states, Panagariya said, have suggested similar weightage keeping in mind absolute contribution to the country’s GDP.

Maharashtra has also asked for the 16th Finance Commission to “appreciate the efforts of states for environmental conservation” by giving a 2.5 percent consideration to this criterion.

“For instance, the states which have shown impressive performance in the use of renewable energy sources may be incentivised by giving weightage in horizontal devolution,” the state’s memorandum said.

Other criteria involved in making assessments for devolution include the area of the state, forest cover and ecology, demographic performance in terms of the total fertility rate and income distance (disparity between the per capita income of a state with the income of the state that has the highest per capita income.) Maharashtra asked to remove districts with a disproportionately high per capita income while arriving at the per capita income of the state.

Maharashtra has recommended reducing the importance given to income distance to 37.5 percent from the 45 percent under the 15th Finance Commission and take a re-look at how to calculate the criteria.

For this, Maharashtra cited how Mumbai’s per capita income substantially distorts the average per capita income of the state while 12 districts languish below the average national per capita income.

The Maharashtra government has also asked for Rs 1.28 lakh-crore in grants, a bulk of which is for two purposes.

The state has asked for Rs 67,051 crore for river-linking projects in Maharashtra and another Rs 50,000 crore to implement a master plan created with the help of the NITI Aayog to help double the Gross Domestic Product of the Mumbai Metropolitan Region to USD300 billion by 2030.

Other special grants that the state government has asked for is including projects such as a new Bombay High Court complex, strengthening prison infrastructure, promoting eco-tourism in Vidarbha and creating hostels for post-graduate medical students in Maharashtra.

Also read: Advisory council to 16th Finance Commission breaks with past, focusses on private sector members

‘Increase vertical devolution to 50-50’

Overall, Maharashtra has argued for the vertical devolution to states, which deals with the distribution of taxes collected by the Union government, to be 50 percent of the total divisible pool. In short, it has argued for the taxes collected by the Union government to be shared equally between the Centre and the states.

Under the 15th finance commission, the vertical devolution to states was 41 percent of the total divisible pool.

In the memorandum submitted to the 16th Finance Commission, Maharashtra said the state has consistently upheld fiscal prudence by keeping fiscal deficit under 3 percent of the Gross State Domestic Product and debt under 20 percent of GSDP, as prescribed by the Fiscal Responsibility and Budgetary Management Act. The state’s own tax revenue, comprising 69 percent of revenue receipts, has also grown, it said.

“However, the decline in grants-in-aid due to discontinued schemes and cost sharing revisions in centrally sponsored schemes has created fiscal stress. Committed expenditure, constituting over 55 percent of revenue receipts, constrains the fiscal space needed for new initiatives, despite Maharashtra’s rising capital investments in infrastructure,” the memorandum said, adding that tax devolution should be the primary route of transfer of financial resources to the state.

Under the 15th Finance Commission, states got 41 percent of the total divisible pool of taxes as vertical devolution.

(Edited by Ajeet Tiwari)

Also read: India approves new finance commission to suggest how federal taxes will be shared with states