Are you a person who always thinks about your future? Who doesn’t? Everyone does! The ultimate aim to earn is financial freedom and a better tomorrow. With increasing prices in every sector, we have realised saving and making evaluated decisions on investment plans can help us to be stable if any instability happens in the future. Be it a retirement plan, education, business, or basic needs. You never know what tomorrow brings, so it is important to work for a secure future by making suitable investments. One of these is the SIP systematic investment plan. Now, many different financial institutions offer different SIPs with varying interest rates. It becomes challenging to manually calculate and decide which plan will give higher returns and keep your investment safe. Therefore, to make this process more streamlined and hassle-free, SIP calculators are magic. You can compare multiple companies’ offers to land on your ideal SIP just by using this SIP calculator tool.

What Is SIP Calculator?

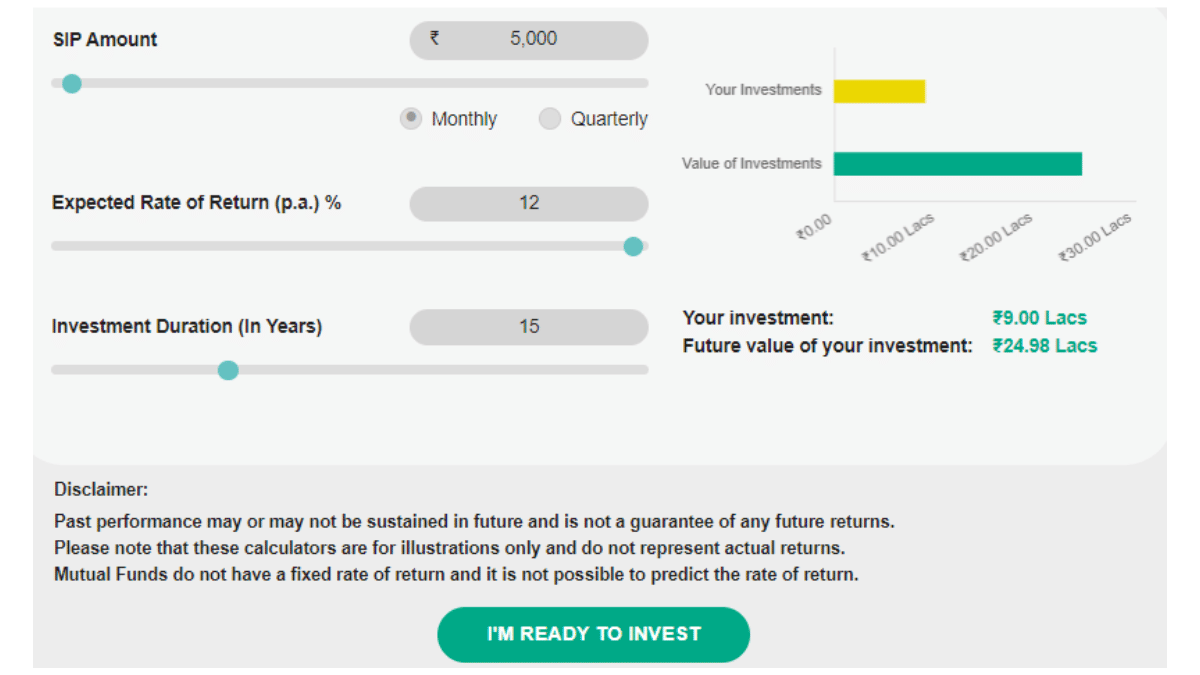

An SIP calculator serves as a valuable tool for investors to build a solid investment strategy. It is a simple tool that gives individuals a rough idea of the amount they will receive on their mutual fund investments made through systematic investment plans. These mutual fund sip calculators give potential investors an estimate of their mutual fund investments. However, the returns offered by a mutual fund scheme depend on various factors. This calculator helps calculate the gain and expected returns for your monthly SIP investment, giving you a rough estimate of the maturity amount for monthly SIP based on an annual return rate and its four parameters.

Four parameters of an SIP calculator

- Investment amount: A fixed amount invested in mutual funds through a Systematic Investment Plan every month.

- Investment frequency: This is the frequency at which SIP instalments are directed from your account into a mutual fund. It can be set to monthly, quarterly, or manually.

- Investment tenure: It is the number of years or years you continue investing in a mutual fund.

- Expected return: It is the estimated rate or percentage return from the mutual fund.

Benefits Of the SIP Calculator

-

Ease of use

The SIP calculator is a simple online tool that gives you an idea of your return amount on a particular mutual fund by just entering various values.

-

Find the right SIP parameters

SIP calculator helps you find the right SIP suitable for your mutual fund investment. With an SIP calculator, you can change and check the parameters as often as you want without manually checking them.

-

Devise an investment strategy

SIP provides flexibility to the Investors to change the installment amount and frequency of the SIP according to their financial situation. A SIP calculator helps you find out how these changes in investment strategies affect the future value of your investment. Using a SIP calculator, you can quickly determine the future amount to strategies finances.

Uses of a SIP Calculator

-

Tailor Investments to Goals

The SIP calculator can help you evaluate and choose investments based on your financial goals. Whether you’re purchasing a car, home, child’s education, or retirement, the online SIP calculator can help you establish the monthly SIP amount needed to reach your goals within your expected timeframe.

-

Risk Assessment

Different SIPs have different interest rates. Tools like SIP calculators can provide insights into potential investment returns that help assess risk levels and make decisions accordingly.

-

Flexibility Comparing Investment Plans

Different financial institutions offer various plans with different interest rates. With the help of SIP calculators, you can easily calculate and compare different mutual fund schemes. By adjusting the information, you can evaluate which SIPs give higher and can impact your finances.

-

Inflation Adjustment

One way to guard against the impact of inflation is by using a step-up SIP calculator. This will help you factor in inflation and ensure your savings grow fast enough to keep up with increasing costs. By gradually increasing your SIP amount each year, you can ensure that your returns surpass inflation and continue to grow effectively.

-

Maximising Returns:

A lump-sum SIP calculator demonstrates the potential of compounding, highlighting how a one-time investment can grow over time and give higher returns. This is particularly advantageous when you have a sizable sum of money to invest all at once, such as a windfall or a bonus.

Conclusion

Smart investing is a key element of financial planning, and that’s why it’s crucial to consider your SIP options carefully. Before making any decisions, do your homework and use online tools like SIP calculators to compare options and find the best one for you. By making informed choices, you can set yourself up for stability and peace of mind in the long run.

ThePrint BrandStand content is a paid-for, sponsored article. Journalists of ThePrint are not involved in reporting or writing it.