New Delhi [India], June 26 (ANI): Covered bonds backed by security pool of gold loans and vehicle loans are findling favour with investors, rating agency ICRA has said.

A covered bond is a package of loans issued by banks and then sold to a financial institution for resale.

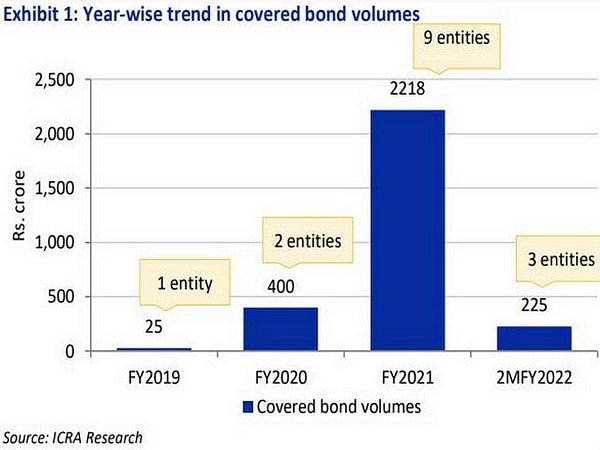

In FY21, domestic covered bond issuances witnessed a sharp increase to about Rs 2,220 crore from Rs 400 crore seen in the preceding fiscal.

These bonds were issued by non-banking financial corporations (NBFCs) — nine in FY21 compared to two in FY20. High net-worth individuals (HNIs) and family wealth offices have invested in many of the issuances.

“Through covered bond structures, the entities are able to reduce risks for investors by providing an exclusive cover pool of assets assigned to a trust, thereby helping them improve credit rating to double A or triple A rating categories,” said Abhishek Dafria, Vice President and Group Head of structured finance ratings at ICRA.

Issuers have benefitted from lower coupon rates on the covered bond issuances due to the higher rating with coupon reduction seen in the range of 0.5 to 1.25 per cent.

However, coupon rates still remain higher than benchmark yield for enhanced rating category due to new nature of the product and limited market size.

“We expect premiums to gradually decline with increase in the size of covered bond market through better stakeholder awareness and wider investor participation,” said Dafria.

Covered bonds saw improved acceptance in Indian market mainly in H2 FY21 as they provide a dual recourse benefit to an investor. Repayment obligation has to be met by the entity. In case of failure to do so, by a pool of assets assigned to a trust.

Given the uncertainty on collections due to the pandemic, the protection available to an investor of a covered bond improves when compared with the conventional securitisation of the pool of assets.

ICRA said a majority of covered bond issuances (almost two-thirds) have been in the form of market-linked debentures so far.

Rachit Mehta, Assistant Vice President and Sector Head of structured finance ratings, said for the covered bond market to witness any material increase, participation of other categories of investors remains critical, like mutual funds and insurance companies, who have the capacity to participate in large-size issuances. (ANI)

This story is auto-generated from a syndicated feed. ThePrint holds no responsibility for its content.