New Delhi: The Indian government is sitting on a hidden revenue of lakhs of crores—from the waste recycling sector, the Centre for Science and Environment (CSE) has said in a new report released Tuesday, arguing that reducing 18% Goods and Services Tax (GST) on several crucial waste categories could bring in Rs 1.8 lakh crore in additional revenue by 2035.

Under the GST framework in India, scrap materials are treated as goods, and they are subject to GST when sold or traded. Further, the waste management sector in India is divided into the formal and informal sector. The formal sector consists of registered businesses that follow tax regulations, including GST, while the informal sector operates outside this framework.

“Most small dealers who collect scrap cannot afford an 18% GST, so they keep their transactions cash-based and untaxed,” CSE said in a release on the report. “These unrecorded transactions lead to estimated Rs 65,000 crore annual GST losses for the government.”

The report, titled ‘Relax the Tax: Facilitating Waste Circularity Ecosystem through GST Rationalization’, states how heavy GST rates on different products obstruct the circular economy around waste recycling in India.

From the same tax rates for virgin and recycled products, to a high 18% GST on metal scrap, plastic waste and e-waste, the report explains how the existing GST regime doesn’t incentivise and actively hinders waste recycling.

Waste recycling and circular economy are seen as pillars of India’s sustainable development policies, with Union Minister for Environment Bhupender Yadav announcing this March that India’s circular economy could create $2 trillion in market value by 2050. Initiatives like the NITI Aayog’s Circular Economy Cell and Circular Economy Action Plans for different waste categories like plastic, e-waste, industrial waste, hazardous waste and metal waste indicate the government’s efforts towards this end.

However, GST rates remain a financial barrier to the mainstreaming of circularity in most waste categories. “The (GST) regime does not differentiate between virgin and recycled materials, taxing them equally, which places recycled products at a severe cost disadvantage despite their lower environmental impact,” said Nivit K. Yadav, programme director, industrial pollution unit, CSE, in the release.

According to the CSE report, 90% of India’s e-waste and metal scrap waste is handled by informal operators. Paying high GST rate on selling this scrap is unviable for many of them. This leads to the problem of GST evasion, leading to loss of crores of revenue from waste recycling transactions for the government.

“The 18% GST on ferrous scrap makes it economically unviable for small dealers to operate formally. A reduced rate would align the fiscal policy with our circular economy objectives,” said Subhrajit Goswami, programme officer, industrial pollution unit, CSE.

Also Read: How GST changed import duty revenue for states—no blame, more profit

CSE analysis

The CSE in its analysis used data from market bodies, interaction with industries in the waste recycling sector, tax bodies like Director General of Taxpayer Services and Central Board of Indirect Taxes and Customs, and industry associations like Material Recycling Association of India (MRAI).

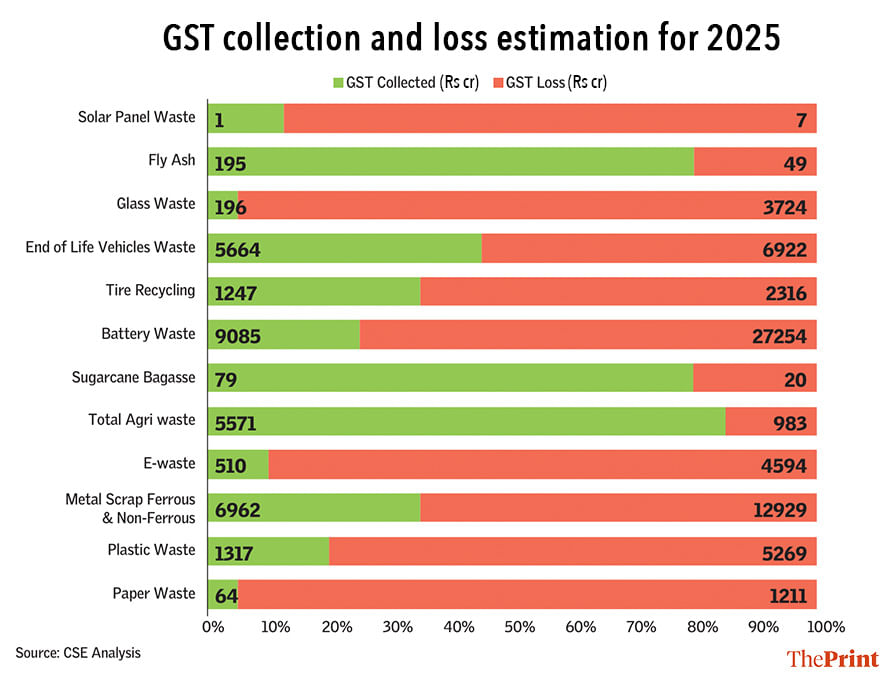

The market value of the waste generated and recycled in India was first estimated, and then figures for GST collection and losses were estimated in a year across all waste sectors.

In terms of categories, CSE found that most GST losses were in solar panel waste, e-waste, glass waste, paper waste and plastic waste. That is because more than 80% of the waste in these categories is utilised by the informal sector, making it very difficult to regulate the waste streams and therefore collect GST.

For example, 95% of paper waste in India is handled by the informal sector. Paper waste operates in a Rs 25,000 crore market and despite having a lower GST rate of 5%, it makes only Rs 64 crore in GST revenue, with loss of up to Rs 1,200 crore in potential revenue, according to the CSE.

The CSE reckons that if GST rates on plastic, metal and other waste forms are reduced from 18% to 12%, and informal sector participation is reduced by 50%, India could collect Rs 1,22,297 crore in GST revenue by 2035. And if informal sector participation is reduced by 100% and all waste transactions are taxed, India could collect a revenue of Rs 1.8 lakh crore by 2035.

“Our research shows that the current GST structure is inadvertently penalising the very sectors that could drive India’s transition to a circular economy,” said Yadav in the release. “By rationalising these rates, we’re not just talking about tax reform; we’re talking about unlocking India’s potential as a global leader in sustainable manufacturing.”

(Edited by Nida Fatima Siddiqui)

Also Read: Trash piles up across Chennai areas as sanitation workers protest privatisation move