Thank you dear subscribers, we are overwhelmed with your response.

Your Turn is a unique section from ThePrint featuring points of view from its subscribers. If you are a subscriber, have a point of view, please send it to us. If not, do subscribe here: https://theprint.in/subscribe/

The National Statistical Organisation (NSO) under the Ministry of Statistical and Programme Implementation (MOSPI) of India has shared Q4FY23 and fiscal year 2023 estimates of GDP on 31stMay’23.

| Economic Growth (% Change over Last Year) | FY22 | FY23 |

| Real GVA | 8.8 | 7.0 |

| Real GDP | 9.1 | 7.2 |

| Nominal GVA | 17.9 | 15.4 |

| Nominal GDP | 18.4 | 16.1 |

India’s real GDP stands at 7.2% in FY23 vs 9.1% in FY22 with normalised base effect. In FY22, the real GDP had climbed to 9.1% because of low base effect in FY21 owing to the pandemic. However, despite the global uncertainties’, high inflationary pressures and high interest rate environment prevailing now, India’s FY23 GDP figures at 7.2% has astonished the economists as their projections were lower this time. Nominal GDP of India stands at 16.1% in FY23 vs 18.4% in FY22.

The real GVA (gross added value) stands at 7% in FY23 compared to 8.8% in FY22. Nominal GVA stands at 15.4% in FY23 compared to 17.9% in FY22.

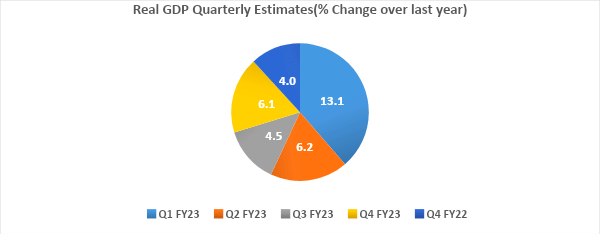

Similarly, Q4FY23 real GDP stands at 6.1% vs 4% in Q4FY22 and also exhibits sturdy performance compared to Q3FY23 at 4.5%.

Projections

RBI had projected real GDP for FY23 at 7% and for Q4FY23 at 5.1%. India’s economic growth is progressing at 3.4% every year since FY19.

World Bank had projected India’s GDP for FY23 at 6.3%.

ICRA has forecasted growth of GDP at 6% for FY24 due to El Nino effects.

HDFC Bank expects GDP growth at 5.8-6% for FY24 as they apprehend monsoon risks and global recession risks.

CareEdge expects growth to be moderate at 6.1% in FY24 from 7.2% in FY24.

CII forecasts growth to remain around 6.5% in FY24 apprehending risks emerging from the global world.

GDP estimates

| Expenditure Components | FY22 Revised Estimates (Cr) |

FY23 Provisional Estimates (Cr) |

Share in GDP % FY22 | Share in GDP % FY23 |

| Private Final Consumption Expenditure (PFCE)

(Major economic driver) |

87,03,541 | 93,58,694 | 58.3 | 58.5 |

| Government Final Consumption Expenditure (GFCE) | 15,75,281 | 15,77,306 | 10.6 | 9.9 |

| Gross Fixed Capital Formation (GFCF) | 48,78,773 | 54,34,691 | 32.7 | 34.0 |

| Exports | 33,05,833 | 37,54,521 | 22.1 | 23.5 |

| Imports | 34,93,326 | 40,91,375 | 23.4 | 25.6 |

There is an uptick observed in the private individual consumption (PFCE) and investments (GFCF) in FY23 that shows some momentum as the raw material prices, crude oil prices and interest rates have softened but Government consumption (GFCE) remains stagnant in FY23.

Higher core inflation has kept the demand restrained such that urban demand remains intact but rural demand needs to grow. As the inflation cools off, we must see some demand picking up from rural sector giving support to rural consumption with higher wages. However, the El Nino heat effects could flatten the demand, out of reduced agricultural output and rural income.

Global slowdown and volatility in financial markets pose downside risk to exports and growth in coming quarters, hence economists refrain from showing excitement towards the GDP positive outcome visible in Q4FY23. The economy needs to be watched with caution. India’s exports and imports have risen comparatively in FY23 against FY22. Imports of crude oil from Russia has been 60 million barrels in May’23 from Russia, more than 50 million barrels that China imports from Russia. Buying cheaper crude oil from Russia has undoubtedly reduced our import bill giving a boost to India’s GDP growth for FY23.

Sector contribution

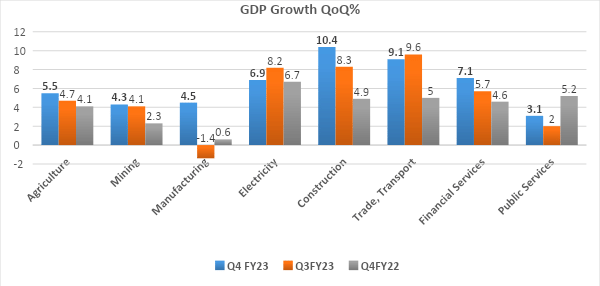

Manufacturing, mining, agriculture, construction, and services sector, have fairly done good in Q4FY23 compared to their previous quarters. But, electricity did not pose good number in Q4FY23 against its previous quarter as the unseasonal rains kept the heat aside for a short time and less industrial activity kept the demand for electricity muted. There is indeed a robust growth seen in manufacturing up at 4.5% while the services sector up at 7.1% in Q4FY23 as against the last quarter.

Good industry credit growth, steel and cement production, 31-month high GST collections that increased by 12% in May’23 and stood at Rs.1.57 lakh crore, an uptick in automobile sales and narrower trade deficit has played out well in fostering economic growth across the sectors for FY23. But, IT companies have scaled back their revenue and constrained hiring, FMCG companies see input cost inflation pressures and passenger vehicle sales for small cars and commercial vehicles are still a cause of concern.

Conclusion

RBI may not like to hike the interest rates, seeing the robust GDP numbers of Q4FY23 as a consequence of last rate hikes but may take actions as the situation unfolds in the coming quarters. There are downside risks that prevail and could weigh heavy on sectors due to global geopolitical tensions, US latest hike in jobless claims, OPEC production cuts and the quantity of liquidity in the stock markets.

These pieces are being published as they have been received – they have not been edited/fact-checked by ThePrint.

COMMENTS