Thank you dear subscribers, we are overwhelmed with your response.

Your Turn is a unique section from ThePrint featuring points of view from its subscribers. If you are a subscriber, have a point of view, please send it to us. If not, do subscribe here: https://englishdev.theprint.in/subscribe/

Around August 2023, with the usual fanfare, the Ministry of Housing and Urban affairs (MoHUA) launched National Common Mobility Card (NCMC debit card) for use across all Metro systems of India. While MoHUA hopes that it can also be used across other modes of public transport, it will be difficult to implement it on these other modes, because unlike Metros, they have unrestricted entry-exit systems for their platforms. If they try to implement it at the entry and exit doors of buses and trains, the process will slow down these already slow-moving services. Leaving aside larger ambitions, having one card for all metros is itself a good development.

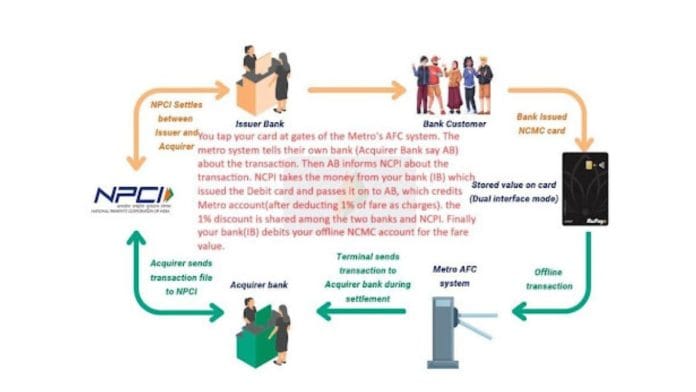

The NCMC card creates and uses an offline wallet on its own chip to store money in electronic form which can be used at Metro entry and exit gates without the need for any internet connection. This top up money could have come from your own bank account (when top up is done through bank app or internet banking) or by you handing over currency at the Metro ticket counter. In either mode of top up, the account for the offline money is maintained by your bank which gets the information about the transactions through the Automatic Fare Collection (AFC) system (entry and exit) of the Metro used by you.

For each NCMC debit card one Metro system (AFC), two banks and one government agency called National Payments Corporation of India (NCPI) co-ordinate to make the system work for you. So, it is only natural that they should also make some money for providing this service. The beauty is that you, as a passenger, are not charged for this service but the Metro gives a small portion of the fare charged by it to the two banks and NCPI.

At this point you may ask the question: What is the benefit for the Metro with NCMC cards compared to their own Metro cards and tokens/paper tickets. It is hoped that with the increased use of NCMC cards Metros’ burden for creating and selling cards, tokens and tickets will be taken over by banks and customers (top up through internet banking) themselves and limited Metro staff can deal with ever-increasing number of passengers with need for tickets or tokens.

Additionally, the implementation of the NCMC debit card is part of a broader initiative known as One Nation One Card, which aims to streamline payment systems across various modes of transport.

Before you start using your NCMC debit card on Metros, two things need to be done.

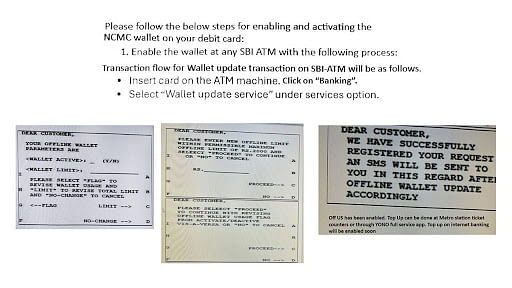

- You need to create the offline wallet service at the Metro station or at your Bank’s ATM. This is an RBI rule. Below is the process for the State Bank of India ATM based service. Your own bank will have a similar process, which you need to ask them about.

- You might have observed that the maximum money which can be kept in the offline wallet is Rs 2000. This is because if your card is stolen, the thief can use the amount without any restriction whatsoever.

This NCMC facility is available only on NCMC enabled RuPay debit cards. There is no such facility on Visa and Master Card. This NCMC facility gives the RuPay cards a competitive advantage over other card issuers. It might force most banks to switchover to RuPay for their debit cards.

Now, let me explain why I call the implementation of this scheme tardy. While most public sector banks are NCMC enabled to issue Rupay NCMC debit card none have really started issuing these debit cards except State Bank of India. Many of them have tied up with individual Metros to issue pre-paid NCMC cards which are less efficient and less user friendly compared to NCMC debit cards. Let us hope MoHUA pulls up these banks and speeds up the issuance of NCMC debit cards.

These pieces are being published as they have been received – they have not been edited/fact-checked by ThePrint.