Thank you dear subscribers, we are overwhelmed with your response.

Your Turn is a unique section from ThePrint featuring points of view from its subscribers. If you are a subscriber, have a point of view, please send it to us. If not, do subscribe here: https://theprint.in/

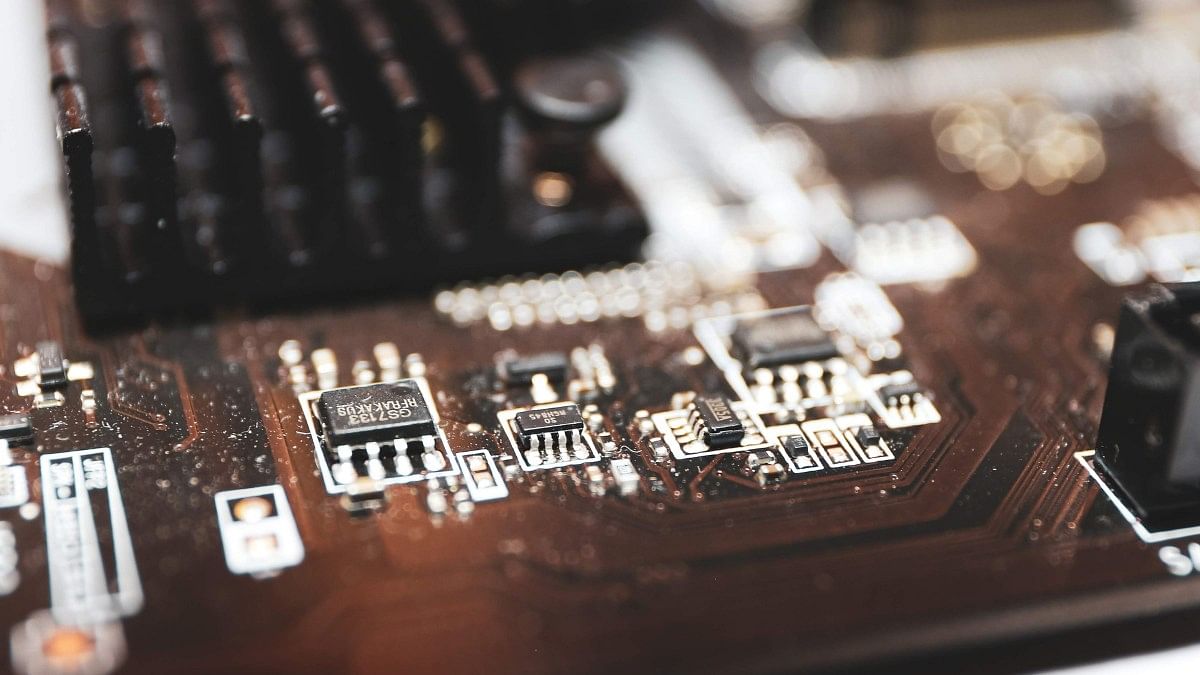

India’s National Policy on Electronics 2012 envisions the country to become a global hub for Electronics System Design and Manufacturing (ESDM). ESDM holds high strategic importance, especially in the current geopolitical scenario, where technology has become a crucial anchor of international trade and relations. Semiconductors are a significant part of ESDM with a diverse range of applications in almost every walk of life, from automobiles and mobile phones to the manufacture of toys and paints. Hence, it is no surprise that India, with its huge consumer market for electronics, aims at self-sufficiency in semiconductors through indigenous production.

The Ministry of Electronics and Information Technology made multiple efforts towards this direction through schemes like SPECS and Production-Linked Incentive Scheme for IT hardware to promote semiconductor manufacturing while acknowledging various challenges in India’s manufacturing capabilities. The Indian government also tried to attract foreign companies to set up semiconductor manufacturing units in India through customs duty waivers in 2017 and an Expression of Interest in 2020. However, these attempts did not receive much response from the semiconductor industry. One must understand the dynamics and geopolitics of the semiconductor value chain before analysing the potential of such policies.

The semiconductor value chain has three major components — Design, Fabrication, and Assembly and Testing. The chip design component involves software design through tools like Electronic Design Automation (EDA). It is highly dependent on Research and Development (R&D) and Intellectual Property (IP) protection, and hence extremely expensive. Though many foreign companies have their R&D divisions in India due to its skilled labour, inadequate IP protection and contract enforcement limit the extent to which such companies can collaborate with Indian companies. Fabrication plants are highly capital-intensive due to ever-changing innovations in manufacturing abilities and reliance on specific equipment and chemicals. Lack of uninterrupted power and water supply, and lack of long-term stable policies are significant impediments for the private industries to set up fabrication plants in India.

The semiconductor production chain is a unique case of free market economy with natural monopolies and consolidated markets, not because of state interventions, but because the companies focus on their niche and add specific value to different stages of production. For example, a few companies from the United States and South Korea dominate the design stage, while Taiwan holds a significant share of fabrication and assembly markets. However, despite concentrated markets and Integrated Device Manufacturers who have end-to-end manufacturing abilities, the semiconductor value chain is characterised by an incredible amount of interdependence. Hence, this is an exceptional industry where monopolies exist, but none of them is self-sufficient.

Not surprisingly, countries with dominant players realise that they can leverage their position and get impacted by this interdependence. Hence, many aim to strengthen their abilities and reduce their dependence on other players in semiconductor production. For instance, the US CHIPS Act and Intel’s $20 billion investment plan aims to boost domestic chip production and design and ensure the US continues its leadership in this area. China emphasised in its 14th Five Year Plan its ambition to reduce dependency on the US and boost its domestic innovation ecosystem.

India’s ambitions towards self-sufficiency might be along similar lines, but there is a stark difference between the positions of those countries and India. While countries like the US, Japan, Taiwan, and South Korea already hold a major share of the production market at various stages of semiconductor manufacturing and have an advantage over the others, India’s current manufacturing capacity is not big enough to compete with the existing players. Though this limitation is not a barrier for India to play a role in this market, the current government strategy to excel in all stages of the semiconductor ecosystem is not the efficient way forward.

India has a better chance at adding value in the Assembly, Testing, Marking, and Packaging (ATMP) component of the semiconductor value chain because of its various strengths. This phase of production is more labour intensive and relatively less capital intensive. India has a good share of engineers and skilled technicians who can be employed by Outsourced Semiconductor Assembly and Test (OSAT) companies. In the current geopolitical scenario, many OSAT companies are looking for an alternative as part of their China Plus One strategy, and India can take advantage of the changing global trade preferences. India’s friendly relations and strategic partnerships with Japan and US can facilitate strong ties with equipment and wafer production companies, which are crucial to becoming a preferred destination for ATMP. Thus India should aim to mark its place on the map and become a major player in the backend and gradually climb its way up to build frontend capabilities over the long term.

The recent pandemic’s impact on the shortage of semiconductors brought out the need to address the over reliance on specific choke points in the supply chain. Though most countries, including India, might think that strategic autonomy in semiconductors is the solution, the attempts towards diversification should help them realise the importance of comparative advantage and specialisation, leading to better trade relations. Hence, India’s strategy to lead the race in the semiconductor ecosystem should begin with gaining an irreplaceable position in ATMP rather than chasing unrealistic dreams of ‘Make everything in India.’

Also read: SubscriberWrites: ‘Democracy 2.0’ — A new definition of democracy is needed in changing times

These pieces are being published as they have been received – they have not been edited/fact-checked by ThePrint.

COMMENTS