New Delhi: Oil traders are watching for any escalation of civil unrest in Iran that could disrupt crude production or prompt the government to block a critical shipping route used by several major Middle Eastern energy exporters.

The mass protests, triggered by a currency crisis and economic collapse, pose the biggest threat to the rulers of the Islamic Republic in decades and have been met with a deadly crackdown.

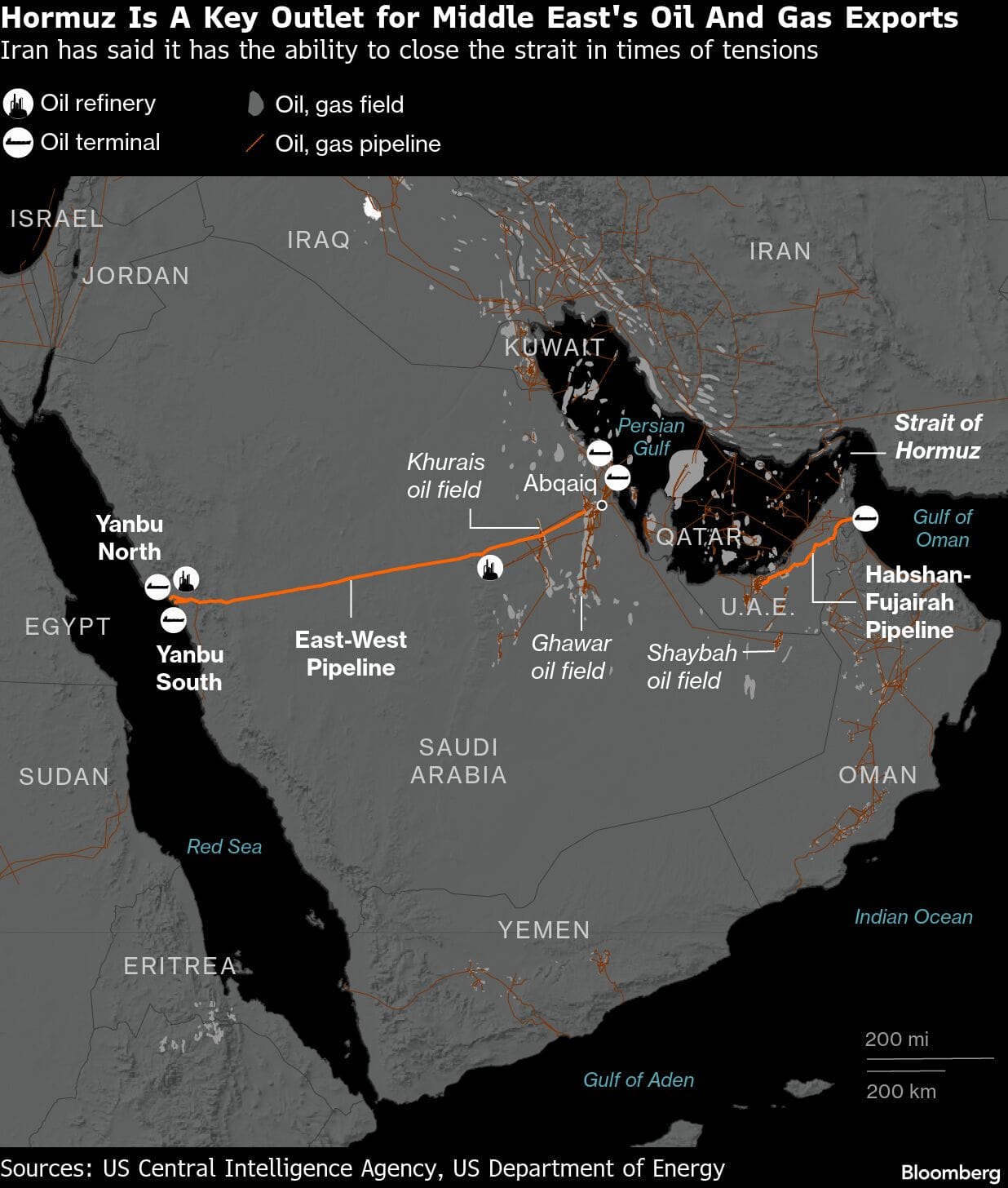

Tensions have been compounded by the US, with President Donald Trump saying Washington was weighing “very strong options,” including potential military action. Any intervention — or a move by Iran to restrict access to the Strait of Hormuz, which carries about a quarter of the world’s seaborne oil — could have consequences for global oil markets, while newly announced US tariffs on countries “doing business” with Iran add another layer of risk.

How significant is Iran’s oil industry?

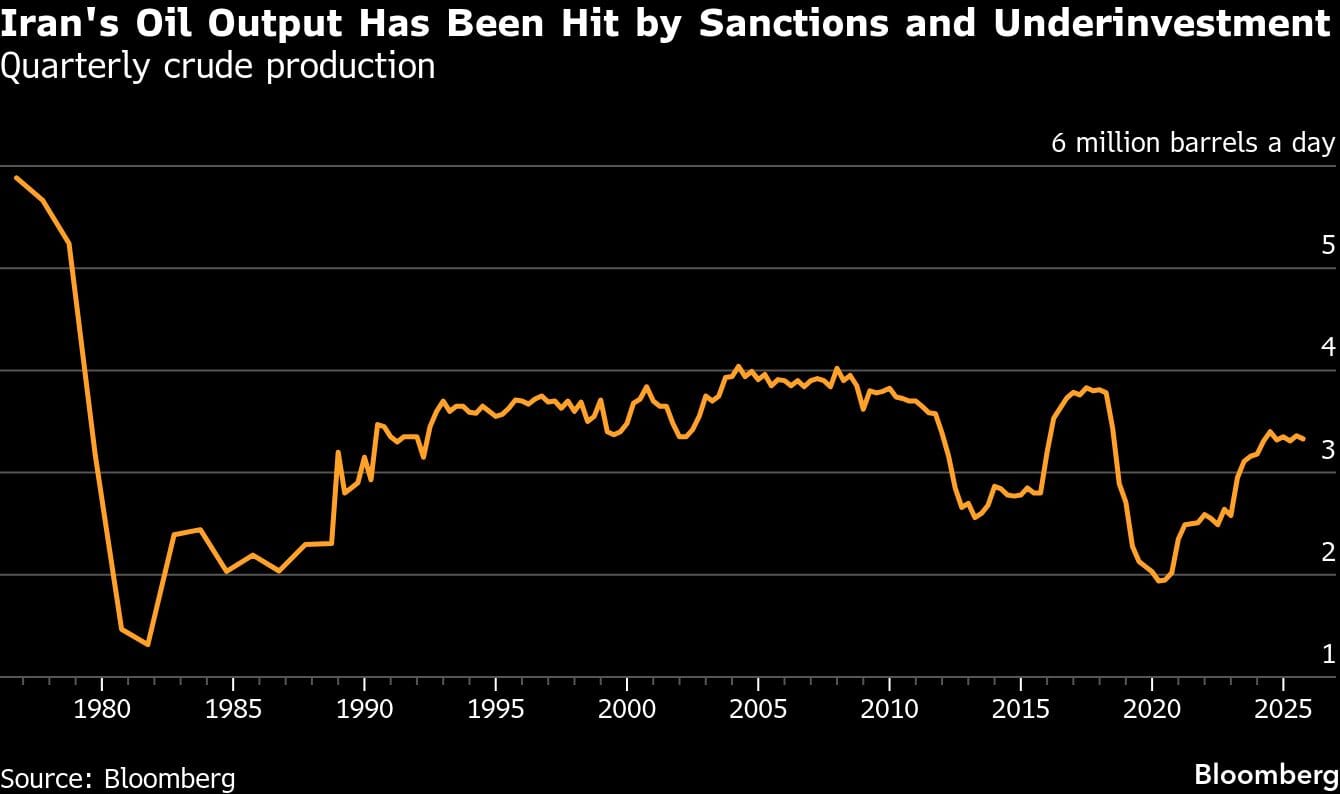

Iran’s influence has diminished in recent years due to prolonged sanctions and limited foreign investment. Overall, the country accounts for about 3% of global supply, producing roughly 3.3 million barrels per day.

Iran began developing its oil industry at the start of the 20th century, under the watch of a British government eager to secure reliable supplies. Decades later, the nation became a founding member of the Organization of the Petroleum Exporting Countries and rose to become the group’s second-largest producer. At its peak in the mid 1970s, Iran ranked among the world’s most important oil suppliers, responsible for more than 10% of global crude production.

That dominance unraveled after the 1979 Iranian Revolution, when the new regime expelled foreign companies from the oil industry, curbing investment and outside expertise. The country’s crude output slumped and never reached peak levels again.

The Islamic Republic did ramp up exports after the Iran-Iraq War ended in the late 1980s, to support economic growth. European and US majors eventually sought to reenter the sector. But those efforts collapsed in 2018, when the first Trump administration pulled out of the Iran nuclear deal — an international agreement to limit and monitor the nation’s nuclear program in exchange for sanctions relief — and reimposed sanctions.

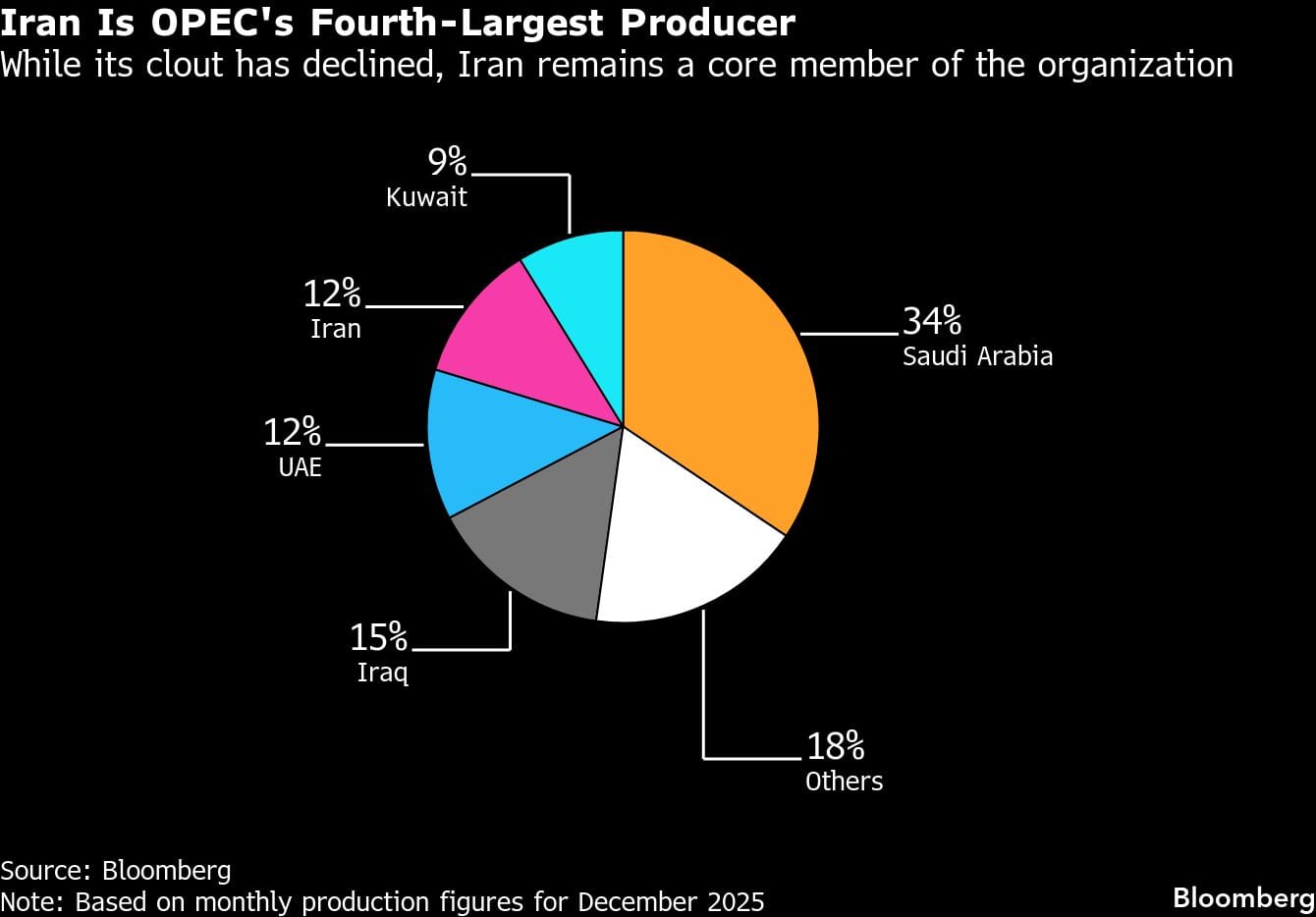

Today, Iran’s slice of the global oil market has been sharply reduced, constrained by its own size and rising output from other producers. The country now ranks fourth within OPEC, behind Saudi Arabia, Iraq and the United Arab Emirates, according to December production data.

Who buys Iran’s oil?

In the face of international sanctions, Iran now relies on China to take about 90% of its crude exports, which are sold to independent refiners at a steep discount.

While official customs data suggests China hasn’t imported Iranian crude since mid-2022, these barrels are shipped via opaque trading networks and a “dark fleet” of mostly aging tankers. As of late December, those volumes were at a two-and-a-half year high of more than 50 million barrels, according to data from analytics and ship-tracking firm Kpler Ltd.

Other countries that have continued to buy Iranian cargoes include Syria.

How could unrest in Iran affect oil prices?

A large share of Iran’s production — up to 2 million barrels a day — goes to Chinese refineries, which would be forced to seek alternative supplies in the event of major disruption.

But the bigger risk lies beyond Iran itself. Any escalation that spills over into the wider region could threaten the Strait of Hormuz, the backbone of global oil supply, through which Saudi Arabia, Iraq, the UAE and Qatar ship much of their crude.

US policy adds another layer of uncertainty. Trump said on Jan. 12 that Washington would impose a new 25% tariff on goods from countries “doing business” with Iran. While details remain unclear, the move would most likely affect major economies such as China, India and Turkey, all of which trade with both Tehran and Washington.

If major buyers curb or reroute Iranian crude to avoid broader trade penalties, Iran’s exports could fall further — tightening supply and pushing prices higher if other producers are unable to quickly fill the gap.

So far, markets have remained relatively calm. Supported by ample global supply, Brent crude has hovered around the low $60s a barrel, not far off 2021 lows. Still, futures prices have firmed in recent days, with both Brent and US benchmark West Texas Intermediate edging higher as traders price in rising geopolitical risk.

Why is the Strait of Hormuz so important?

The Strait of Hormuz is the narrow waterway that connects the Persian Gulf with the Arabian Sea. The Iranian government previously said it has the ability to impose a naval blockade during periods of heightened geopolitical tension, though it has yet to effectively block the waterway. If it were to disrupt this key trade chokepoint, shipments of oil, liquefied natural gas and liquefied petroleum gas from Iraq, Kuwait, Saudi Arabia and the UAE would be at risk.

Some 16.5 million barrels of oil a day flow through the strait, including the bulk of Iran’s exports. Saudi Arabia exports the most via the waterway, at roughly 5 million barrels per day, but it can divert shipments by using a 746-mile pipeline that runs across the kingdom from east to west to a port in the Red Sea, where the oil is loaded onto vessels for onward transport. The UAE can likewise bypass this chokepoint by moving its 1.5 million barrels a day through a pipeline that ends at the Gulf of Oman.

A shutdown of the Hormuz Strait would likely disrupt Asia-bound oil flows from the Middle East. In June, when tensions in the region escalated during a 12-day conflict between Israel and Iran, the benchmark rate for a supertanker carrying 2 million barrels of crude from the Middle East to China spiked.

How important is oil for Iran’s economy?

Oil exports remain a central pillar of the economy, despite years of efforts to reduce dependence on crude and diversify into heavy industry, textiles and mining.

While sanctions have forced Iran to export its oil at steep discounts to international benchmarks to attract buyers, the country still earned an estimated $2.7 billion in revenue in November alone, based on Bloomberg calculations using a discounted oil price of $45 a barrel, after accounting for shipping and other costs.

Disclaimer: This report is auto generated from the Bloomberg news service. ThePrint holds no responsibility for its content.

Also read: India’s growth story rests on stability, reforms & strategic self-reliance: Shaktikanta Das