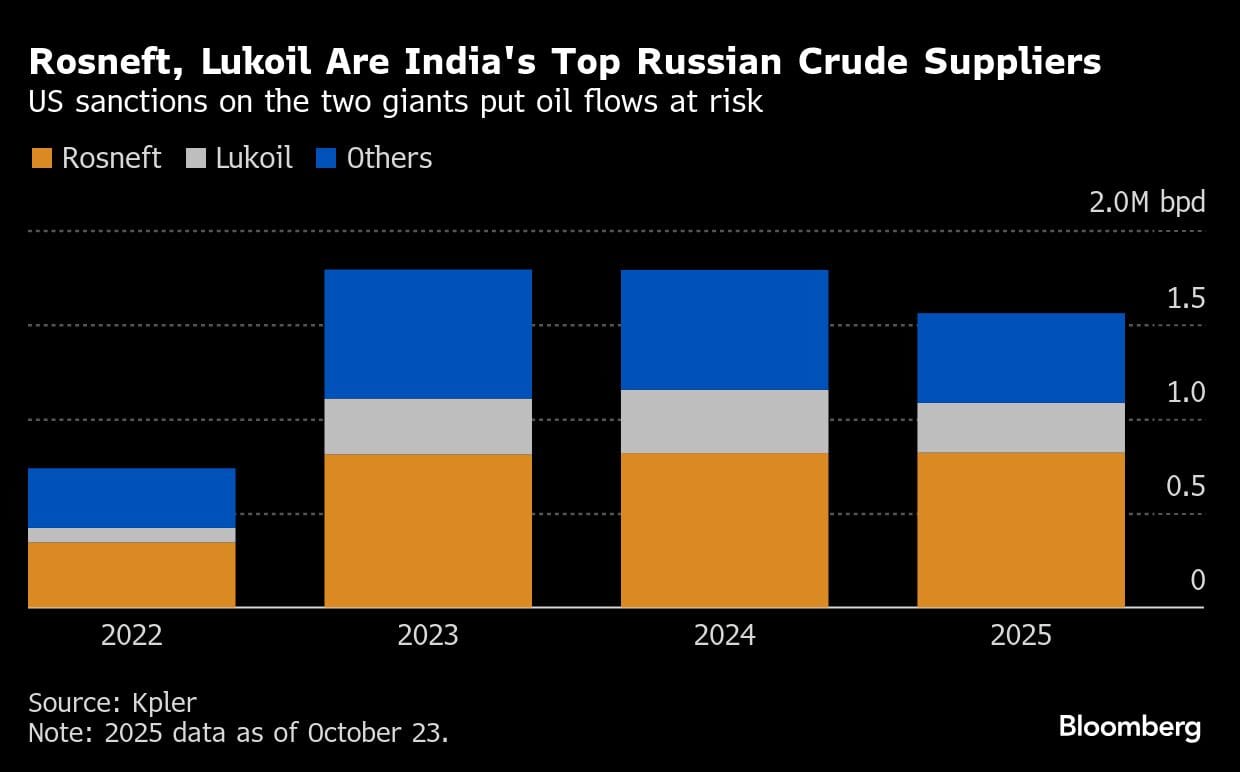

Flows of Russian oil to major Indian refiners — a boon for both countries’ economies over the past three years — are expected to fall to near zero after the US imposed sanctions on crude giants Rosneft PJSC and Lukoil PJSC.

Senior executives at the processors said the blacklisting of Russia’s largest producers would make it all but impossible for that supply to continue. They asked not to be named due to the sensitivity of the issue. Transactions involving the two firms need to be wound down by Nov. 21.

The latest restrictions, announced by Washington overnight, mark a significant step up by the Trump administration and a major change in Western policy around oil, which had previously sought to limit revenue to the Kremlin without impacting the flow of oil — especially to some of the world’s largest consuming economies.

China has long shown itself to be more tolerant of sanctioned cargoes than India, but the surprise move has sent shockwaves through its oil industry and left state and private refiners fretting over how to balance supply imperatives with the need to avoid crippling secondary penalties. Those could leave companies cut off from the Western financial system, and from the vast logistics networks that underpin global commodities markets.

So far this year, India has taken 36% of its oil imports from Russia, according to analytics firm Kpler, a major irritant for President Donald Trump and a hurdle to trade talks after punitive tariffs came into effect in August. Those negotiations are at a crunch point, although Indian Prime Minister Narendra Modi is set to skip a regional summit in Kuala Lumpur next week, where he had been expected to meet his US counterpart.

Historically, India hasn’t been a significant importer of Russian crude, depending more heavily on the Middle East. That changed in 2022, after Russia’s invasion of Ukraine and a $60-per-barrel price cap imposed by the Group of Seven nations that aimed to cap the Kremlin’s oil revenues while keeping supplies flowing globally. India eschews US-sanctioned crude from Iran and Venezuela, but Russian cargoes were both permitted and comparatively inexpensive, so purchases jumped.

The Trump administration had previously held off on major sanctions, even as officials publicly criticized Modi for the purchases. It has now directly targeted oil flows from Moscow’s heavyweights and effectively ends that trade, sowing chaos just as Indian refining executives returned to work after the Diwali holiday.

A sole exception could be refiner Nayara Energy Ltd., which is backed by Rosneft and has already been sanctioned by the UK and the European Union. The refiner has been operating exclusively on Russian crude since EU sanctions came into effect in July and doesn’t have other supply options.

The company, which accounted for 16% of India’s oil imports from Russia this year, didn’t immediately respond to an email seeking comment.

The latest sanctions mean that near-term orders for crude, bought for loading in November and delivery in December, will now be overwhelmingly from other destinations. Spot negotiations for Urals cargoes from Russia have been muted since mid-October, when Trump said Modi had vowed to halt purchases of Russian crude, leaving buyers reluctant to take major positions.

“With this sanctions move, the Indian refiners may have to pull back way faster,” said Vandana Hari, founder of Singapore-based market analysis firm Vanda Insights. “It’ll probably be relatively easier for India, which was not buying any Russian crude until three years ago, compared to China.”

India is the largest buyer of seaborne Russian crude, but the buyer of last resort will be China. The world’s biggest oil importer will have to contend both with US blacklist and a package of measures adopted by the EU on Thursday, which targets 45 entities that have helped Russia evade sanctions, including 12 companies in China and Hong Kong.

In response to a question about the US measures at a briefing on Thursday, China’s Foreign Ministry spokesperson Guo Jiakun said the country opposes “unilateral sanctions that lack a basis in international law.” Beijing has also expressed “strong dissatisfaction and firm opposition” to the EU over its actions, he said.

Mammoth Trade

Central to the mammoth trade between Russia and China is the long-term contract between Rosneft and state-owned China National Petroleum Corp., which involves purchases of ESPO crude via pipelines to landlocked refineries in the northern Daqing region. The plants there rely predominantly on Russian feedstock, making them particularly vulnerable to any disruptions.

It’s unclear, however, if these pipeline flows — about 800,000 barrels a day — will be affected by the sanctions due to the government-to-government nature of the project. CNPC didn’t immediately reply to an email seeking comment and phone calls to the company also went unanswered.

Another big question is whether Washington has the will and means to enforce the sanctions it’s just put in place, given the broader trade tensions playing out with Beijing. Cracking down on Chinese intermediaries could come at a heavy geopolitical cost, and in any case would be tough to enforce.

“This is definitely one of the more meaningful measures the US has taken, but I think it will be blunted by the widespread use of illicit financial networks,” said Rachel Ziemba, analyst at the Center for a New American Security in Washington. “So it really comes down to whether China and India are afraid of further escalation in secondary sanctions.”

State refiners Indian Oil Corp., Bharat Petroleum Corp., Hindustan Petroleum Corp. Ltd. and Mangalore Refinery & Petrochemicals Ltd. didn’t immediately respond to Bloomberg queries. They typically buy crude on the spot market. Reliance Industries Ltd., which has a long-term contract with Rosneft, also didn’t immediately respond to a request for comment.

The Indian government has yet to comment on the US measures. Its oil ministry didn’t reply to an email seeking comment.

(Reporting by Rakesh Sharma. With assistance from Sarah Chen, Weilun Soon and Rong Wei Neo.)

Disclaimer: This report is auto generated from the Bloomberg news service. ThePrint holds no responsibility for its content.

Also Read: PM Modi raises terrorism in call with Trump, American President reiterates Russian oil claim