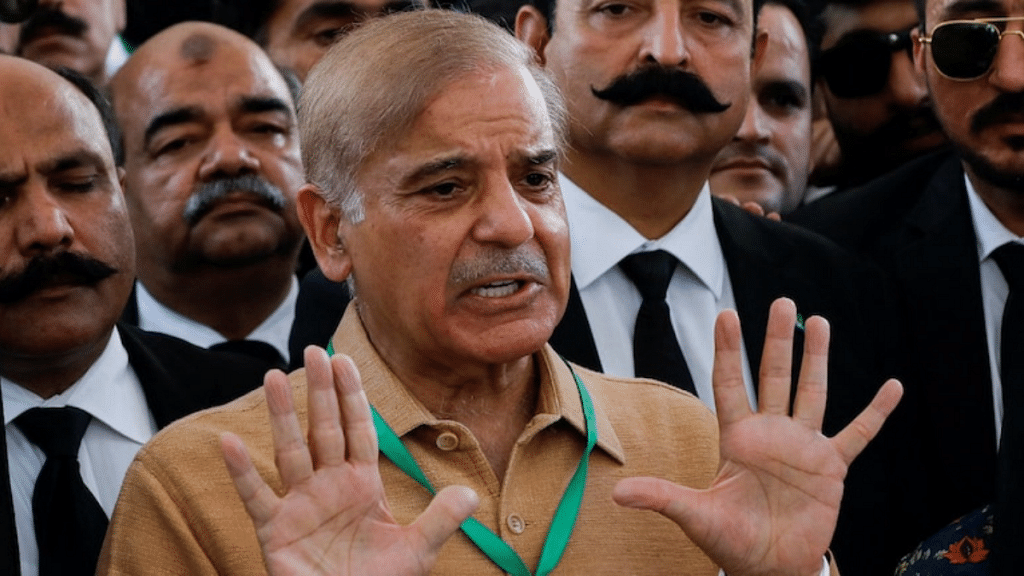

NEW DELHI: Shehbaz Sharif, Pakistan’s Prime Minister, has said that “all hell could break loose” if the country is not given debt relief in the wake of floods that have killed over 1,500 people, and caused damage estimated at over $30 billion. The warning, made in an interview to Bloomberg, led Pakistan’s sovereign bonds—instruments it uses to raise money from international investors—to plunge to record lows amidst fears that the country might default on its loans.

Flagging a “yawning gap” between the country’s needs and the aid on offer, the Prime Minister said Pakistan had appealed for help from the Paris Club—a group of 22 major lender-nations which meets ten times a year to consider relief to heavily indebted countries.

The Prime Minister said that, in addition to the Paris Club, Islamabad would seek help from China, to which Pakistan owes about $30 billion, one third of its total external debt.

Unless we get substantial relief”, Sharif argued, “how can the world expect from us to stand on our own feet? It is simply impossible.”

The comments sparked fears that Pakistan might be preparing to default on Eurobonds that become due in December. “I’m not sure that was the intended consequence of the PM’s comments but that’s how the market has interpreted it” said Abdul Kadir Hussain of Dubai-based Arqaam Capital, which holds the bond due in December.

Finance Minister Miftah Ismail responded by reiterating an earlier promise that the country would pay the $1 billion due in December “on time and in full.” Pakistan’s appeal for debt rescheduling was limited to the Paris Club, Ismail said, and adding that that the country was “neither seeking, nor do we need, any relief from commercial banks or Eurobond creditors”

Ismail said Pakistan’s Eurobond debt was only $8 billion until 2051, “which was not a large burden.”

Last month, Pakistan secured an $1.1 billion lifeline from the International Monetary Fund, to help it avert debt default in the midst of multiple economic crisis, complicated by long-running political instability. The funds were part of an $6 billion bailout negotiated in 2019, which had stalled after Pakistan failed to meet reform conditions.

Economists have warned the IMF aid could prove inadequate to avert a default crisis, unless Pakistan secures additional external financing it expects from West Asian partners. The country’s foreign exchange reserves now stand at $8.3 billion, which will cover less than two months of imports.

Also read: ‘Trade with India would be opened if need be’, says Pakistan Finance Minister Miftah Ismail