Gold edged higher as investors weighed the outlook for tighter monetary policy against the threat that the omicron virus variant poses to the global economic recovery.

Billionaire investor Bill Ackman said the Federal Reserve is losing its battle against inflation and should raise its key interest rate by a bigger-than-expected 50 basis points in March to “restore its credibility.”

Facing pressure from Congress and the public to tackle the hottest inflation since the 1980s, a chorus of officials this month floated raising rates in March and the potential need to hike as many as five times this year, marking a clear shift in projections from just a few weeks ago.

While more central banks globally are seeking to normalize monetary policy to contain price pressures, China on Monday lowered a key interest rate for the first time since the peak of the pandemic in 2020 as a property-market slump and repeated virus outbreaks damped the nation’s growth outlook.

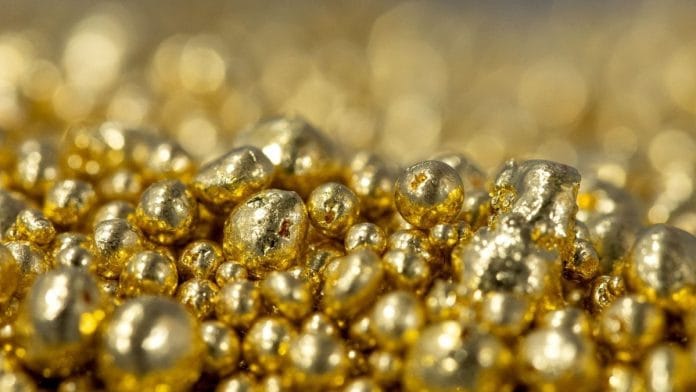

Gold is steadying above $1,800 an ounce after dropping for the first time in three years in 2021 as investors started to price in tighter monetary policy. Still, demand for the haven asset has been supported amid concerns over the impact of omicron, with U.S. Surgeon General Vivek Murthy saying the outbreak is likely to worsen and that “a tough few weeks” are ahead.

“Expectations increasingly priced for a tighter policy outlook, rising Treasury yields and a recovery in the U.S. dollar from its recent sell-off” are headwinds for gold, said Yeap Jun Rong, a strategist at IG Asia Pte. Still, this is pitted against some risk-off sentiment in markets, which underpins the metal, although there is resistance at the $1,830 level, he said.

Spot gold rose 0.2% to $1,822.25 an ounce at 7:38 a.m. in London, after dropping 0.3% Friday. The Bloomberg Dollar Spot Index was steady after gaining 0.2% in the previous session. Silver, platinum and palladium all advanced.

Also read: India’s forex reserves drop by USD 878 million to USD 632.73 billion