As German firms wrestle with new Chinese controls on rare earths, they are handing Beijing sensitive supply chain information it could potentially use to squeeze manufacturers or shut down production lines in Europe’s biggest economy.

Yet even as German companies divulge commercial secrets to China, their own government is flying blind, according to people familiar with the matter. While Chinese officials demand detailed information before they approve exports of the rare earth elements used in a vast array of modern products, Berlin has no such leverage over its own companies, and no immediate strategy to tackle the problem, the people said, asking not to be named discussing confidential conversations.

The German economy ministry “views the continuous expansion of Chinese export controls with great concern,” spokeswoman Luisa-Maria Spoo said in a statement. The government, she added, is “using all available channels” to address the matter.

Berlin’s brewing crisis is yet another ramification of the spiraling trade war between the US and China. Washington has for years weaponized China’s dependence on American products, and Beijing is now following suit – destabilizing major economies around the world that, like Germany, tethered their economies to Chinese supplies.

German Foreign Minister Johann Wadephul had planned to raise the issue with Chinese officials in Beijing next week. But his trip was abruptly postponed on Friday, raising questions about when Chancellor Friedrich Merz will actually make a long-promised visit.

For increasingly desperate German firms, the ramifications of inaction are daunting — especially as crucial semiconductor suppliers like Dutch-based but China-owned Nexperia get snarled in the trade drama.

“The information gathered could lock in dominance for Chinese companies and allow them to extract better conditions for their presence and investments in Europe,” said Rebecca Arcesati, lead analyst at MERICS, a China-focused think tank. “From Beijing’s perspective, having a say on how these industrial supply chains are built is an enormous advantage.”

The Problem

Under new rules China introduced in April and dramatically tightened in October, foreign companies must submit granular, confidential data to obtain a six-month import license for rare earth minerals.

The forms are extraordinarily detailed, according to people who have seen them, requesting product photos showing mineral placement, manufacturing diagrams and customer details. In some cases, the application requests annual production data for the last three years and projected data for the next three years.

The information could help Beijing map out Germany’s vulnerabilities – showing which firms have only one Chinese supplier, for instance, or which have low supply stockpiles.

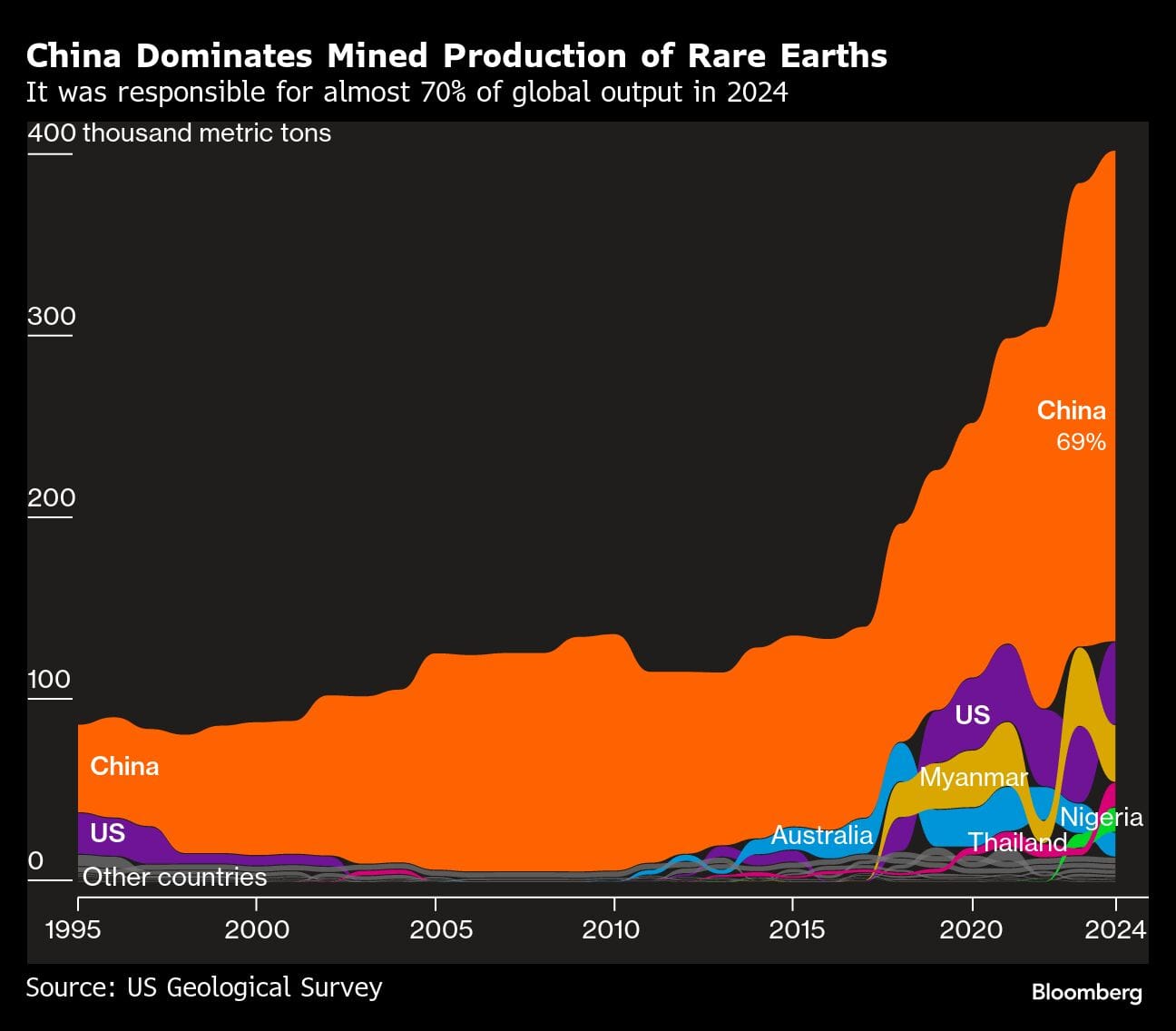

Companies are typically loath to reveal such private information. But German firms don’t have much choice – 95% of their rare earth minerals come from China, far surpassing any other EU country, according to MERICS. China’s Ministry of Commerce has argued the rules help “better defend world peace,” citing the minerals’ use in “the military field.”

Hoping to speed license approvals, the German embassy in Beijing gave China a priority list. This “white list” did help bigger firms get sign offs, but it left behind smaller companies without lobbying operations.

It also inadvertently gave China more visibility into Berlin’s economic chokepoints.

Ultimately, there are fears Beijing will not just disrupt Germany’s economy, but the entire European supply chain – a troubling prospect for the continent’s massive rearmament plans as Russia saber rattles.

“With all the information they are in the process of collecting, the Chinese authorities are likely also getting a picture of defense industrial bases in NATO countries and how intertwined they are with each other,” said MERICS’ Arcesati.

Already, licensing delays are starving European companies of essential inputs, causing production stoppages. The European Chamber of Commerce in China said a September survey of 22 companies showed only 19 of 141 export applications had been approved. That was expected to cause 46 production shutdowns that month, and 10 more by December.

Thus far in Germany, the shutdowns have affected mostly small- and medium-sized firms, flying under Berlin’s radar, according to people familiar with the matter.

Conversely, bigger firms, including Germany’s automakers and other manufacturing heavyweights, are getting their licenses fast enough to keep production running. But they have all but given up on emergency stockpiling, people familiar with the matter said.

In fact, the people added, Beijing has signaled that anyone ordering more than their production needs will be suspected of smuggling the goods for military purposes or to the US.

Berlin Reacts

Berlin is awakening to the problem. But officials and business leaders seem to be speaking past each other.

The German economy ministry sent out questionnaires to companies to better understand what China was collecting and to obtain similar information. Those went unanswered, said officials familiar with the matter.

It then summoned business leaders to the ministry to discuss the issue. That also yielded little information, according to people familiar with the meeting.

Yet imposing binding commitments to hand over the data would be politically fraught. German companies already say they’re buried under bureaucracy – and Merz’s coalition came to power promising to slash paperwork.

Still, business groups say they’re being ignored. When Germany’s major industry lobby, BDI, sent Economy Minister Katherina Reiche an urgent letter over the summer asking for a meeting on the matter, it never heard back, people familiar with the interactions said.

“The economy ministry is in close and regular contact with the companies and associations affected, including the BDI, particularly with regard to their business in China,” Spoo said.

That’s left the two sides stuck. Companies are hesitant to diversify their sources without government compensation. Politicians, on the other hand, stress that the private sector has a responsibility to secure its own supply chains.

Merz insists the issue tops his agenda.

“Dependencies make us susceptible to blackmail,” he said in September. “For our security and our competitiveness, it must therefore be a priority to diversify our raw-material and trade supply chains.”

Talking Trade

China likely sees its maximalist approach as a way to extract concessions, said people familiar with Beijing’s thinking. Beijing has already proposed rolling back some limits if Germany also loosens high-tech export restrictions, they added.

One Berlin priority will be convincing Beijing to issue licenses for longer than six months as it seeks to weaken the overall restrictions. China is also discussing the controls with the European Union as the bloc’s executive arm readies retaliatory options.

“The goal remains de-risking in line with the China strategy and the diversification of our supply chains and trade relations,” said Spoo, the economy ministry spokeswoman. “The aim is to achieve a coordinated European approach.”

Beijing has indicated it prefers bilateral negotiations with Merz over an EU dialogue, said people familiar with the deliberations – adding extra pressure on Merz’s team. The chancellor’s advisers say he won’t continue Berlin’s lax China policies, but his leverage is limited given supply chain swaps can add costs.

“It would be better to find a kind of an agreement,” Bundesbank President Joachim Nagel told Bloomberg Television’s Francine Lacqua at the Berlin Global Dialogue conference on Friday. But if retaliation is a last resort, he added, “I would say, ‘OK, we have to be strong and have to take a bold decision.’”

Some business executives privately worry Berlin is too preoccupied with domestic turmoil and other topics to make supply chain progress before jobs are lost. At the same time, the executives admit it’s difficult to give up the benefits they reap from China.

A German official conceded that businesses need reliability – but expressed concerns about companies accepting Beijing’s terms. Still, it’s hard to criticize China as long as Germany doesn’t have credible alternatives, added the official, granted anonymity to speak candidly.

But none of the recent developments should surprise anyone in Berlin.

“This is something China’s leaders have been saying for a very long time,” said MERICS’ Arcesati. “It is very important for European politicians to take the Chinese government’s stated strategic objectives at face value.”

(Reporting By Jenny Leonard with assistance from Arne Delfs and Kamil Kowalcze.)

Disclaimer: This report is auto generated from the Bloomberg news service. ThePrint holds no responsibility for its content.