Washington: Michael Selig is walking into more than just the usual policy challenges as he takes the helm of Wall Street’s main derivatives regulator.

The Commodity Futures Trading Commission is on the precipice of gaining new crypto oversight as lawmakers continue to negotiate major legislation, grappling with the departure of key staff and facing a wave of applications for prediction markets that pull the agency deeper into retail trading.

It’s no shortage of change for an agency designed more for overseeing corn and crude oil futures than cutting edge crypto technology. Established half a century ago to regulate derivatives trading, the CFTC has earned a reputation as an important but low-profile regulator often overshadowed by the Securities and Exchange Commission.

Now the chronically underfunded agency that traditionally deals with institutional players like CME Group Inc. and Intercontinental Exchange Inc. is tackling new products, some of which weren’t even around a few years ago.

Prediction Markets

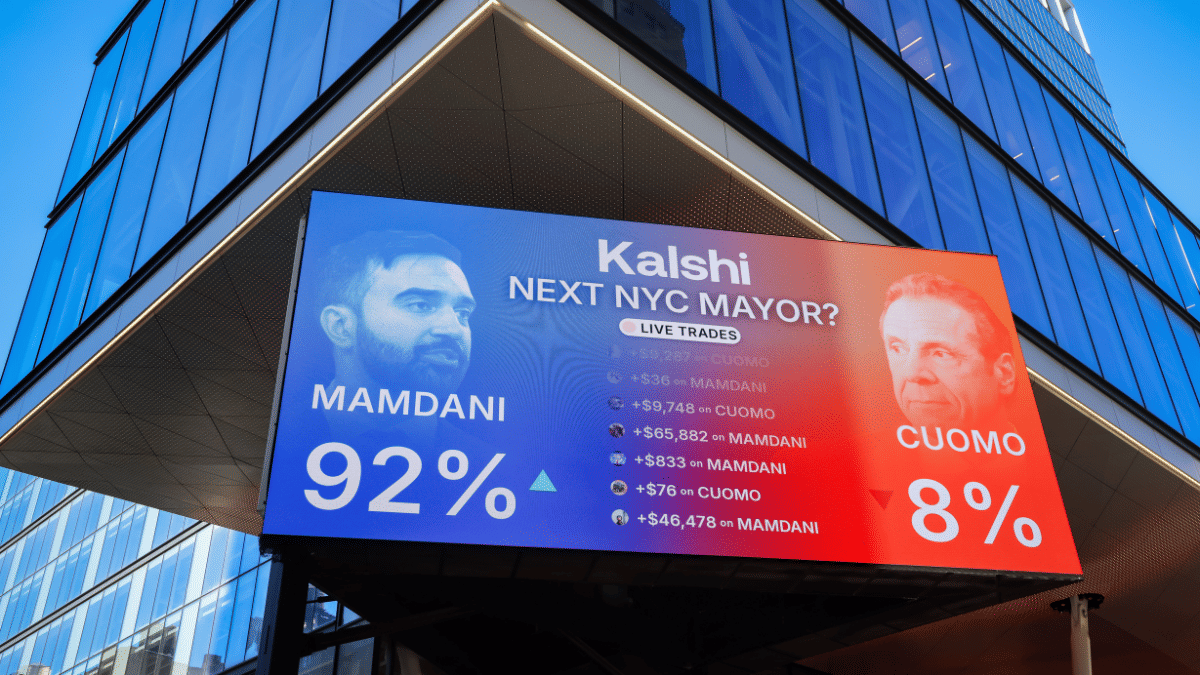

Perhaps the top challenge for Selig — who was sworn-in last month — is the fast-growing prediction markets sector, which was almost non-existent before the pandemic but has exploded into a multibillion dollar industry. That momentum is set to supercharge in 2026.

The platforms allow people to bet against each other on real world event outcomes, such as whether Federal Reserve Chair Jerome Powell will be charged with a federal crime this year or if President Donald Trump will buy at least part of Greenland. The agency – which views prediction markets as derivatives exchanges – initially prohibited them from offering election bets but lost a challenge in 2024 to keep the wagers at bay under former Chairman Rostin Behnam.

Since then, sports trades have fueled activity on some exchanges, accounting for more than 90% of trading volume on CFTC-regulated prediction market Kalshi Inc., according to Dune Analytics.

The regulator has been nearly silent on the proliferation of sports betting over the past year but Selig may provide clearer views on its position. As an attorney at Willkie Farr & Gallagher, he argued against the Biden-era CFTC’s efforts to limit sports gambling.

“It’s going to be impossible for the CFTC to do nothing” as prediction markets become more robust, said Aaron Brogan, founder of Brogan Law, a boutique firm specializing in crypto and novel financial products. Recent trading on the ouster of former Venezuelan leader Nicolás Maduro on Polymarket’s international exchange, which isn’t registered with the CFTC, has highlighted questions about potential insider trading on prediction markets.

A CFTC spokesperson said that Selig is committed to promoting market integrity and investor protection and he will engage with a broad array of stakeholders and policymakers to make informed decisions about the agency’s role in regulating new products.

Those decisions are going to take some time, the spokesperson said.

Despite big moves by firms like CME and ICE, some traditional financial companies have held back from entering prediction markets but that may also change under the new CFTC head.

In private discussions, leaders at traditional brokerages, including Fidelity Investments, have been open to learning more about event contracts, according to a person familiar with the matter who asked not to be identified discussing non-public information – though the Boston-based firm opted to wait at least until Selig’s installation at the CFTC before making a decision on whether it would allow any access for customers. A representative for Fidelity declined to comment.

One consideration for Wall Street firms eyeing the nascent industry could be to offer event contracts that are tied to economic issues, such as inflation or jobs numbers, rather than sports.

Charles Schwab Corp. Chief Executive Officer Rick Wurster told The Wall Street Journal that clients weren’t very interested in prediction markets and “it’s not currently high on our list.” Still, he added, “if we find out it becomes a competitive necessity” the company could reconsider.

Court Challenges

Selig is also inheriting a fight with states over the exchanges, as prediction market players like Crypto.com, Kalshi and Robinhood Markets Inc. face legal challenges across the country from state gaming regulators who say these sports bets shirk local laws and tax collection efforts.

State officials argue the sports contracts should be categorized as gambling wagers under their jurisdiction rather than financial instruments overseen by the CFTC. Firms like Kalshi have said the CFTC holds the ultimate power to decide what kind of wagers it can offer on its platform.

The issue could come before the US Supreme Court sooner rather than later, said Elliott Stein, senior litigation analyst at Bloomberg Intelligence. Kalshi and Robinhood are likely to appeal any losses blocking them from operating in certain states, he said.

Court issues aside, the confluence of potential new crypto authority and the sheer number of companies active in prediction markets may push the agency to provide greater protections for retail traders, said Peter Malyshev, a partner at Cadwalader, Wickersham & Taft LLP.

That pivot to regulating more amateur investors would be “a huge lift for the CFTC,” which has long overseen markets dominated by institutional firms, Malyshev said.

Staff Overhaul

But before Selig can forge ahead with marquee policymaking or legal questions, he will have to grapple with internal dynamics at the agency and fill several key vacancies after some top officials exited during former Acting Chairman Caroline Pham’s tenure. In December, Pham left the CFTC, joining crypto payments firm MoonPay Inc.

Near the end of Pham’s tenure, two senior managers were put on leave after they raised concerns about the adequacy of some prediction markets’ surveillance programs, according to people familiar with the matter. The officials included the acting director of one of the busiest units at the agency, the Division of Market Oversight, said the people, who asked not to be identified to discuss non-public information.

Pham had already removed some other senior employees earlier in 2025, including top administrative staff. An agency spokesperson said last year that the moves weren’t personal, but designed to address specific concerns about CFTC programs and making sure taxpayer money was being used efficiently.

The departure of some of the most experienced managers capped off a year of workforce reductions — down by about 15% to about 540 people in October.

“The biggest issue will be resources,” said Liz Davis, a partner at Davis Wright Tremaine and former CFTC enforcement attorney. “Those operating divisions are really going to be working Gensler-like hours — a return to the Dodd-Frank era,” she said, referring to the period after the 2008 financial crisis when the agency was led by Gary Gensler and writing a raft of rules to police markets.

The agency spokesperson said that Selig is in the process of hiring his leadership team and evaluating CFTC resources to make informed management decisions.

“Mike Selig is a highly qualified crypto and industry leader who is already doing an excellent job leading the Commodity Futures Trading Commission under President Trump,” said White House spokesman Davis Ingle.

In addition to the staff changes, Selig will have to chart his own course about how the agency interacts with companies. In the past year, some prediction markets and digital asset firms took some requests straight to the acting chairman’s office instead of going through career staff as they normally would, according to people familiar with the matter who asked not to be identified discussing agency deliberations. Pham’s office then at times urged rank-and-file staff to rapidly approve new applications, the people said.

Typically, exchange applications follow an iterative, back-and-forth process between agency staff and companies to demonstrate that their trading and surveillance systems meet core rules meant to prohibit manipulation, ensure resiliency during market stress, and other compliance measures. Generally, that process takes more than a year, particularly when staff are reviewing multiple exchange applications at the same time.

In one instance of an accelerated process, Pham’s office pressed staff to speed up its review of Gemini Space Station Inc.’s application, said some of the people familiar, who asked not to be identified discussing agency deliberations. The exchange, co-founded by Trump donors Tyler and Cameron Winklevoss, applied for CFTC approval in May and received it in December.

Another firm, Polymarket, was also fast-tracked under Pham. The president’s son, Donald Trump Jr., is both an adviser to Polymarket and partner at a firm that has invested in the company.

During the government shutdown in 2025, two furloughed CFTC analysts came back to assist with data processing related to Polymarket’s early trading launch, according to people familiar with the matter who asked not to identified discussing non-public information. It’s unclear if the two staffers worked on any other companies’ applications or other matters when they were brought back from furlough, the people said. Government-wide rules for shutdowns typically preclude all but a skeleton staff of essential employees from working.

After the shutdown, Pham’s office pressed staff to rapidly issue approval for Polymarket to offer intermediated trading through partnerships, said people familiar with the matter, who also asked not to be identified discussing internal agency decisions.

“Under Chairman Selig’s leadership, the CFTC will be responsive to market participants’ matters and handle those matters in an efficient manner while ensuring compliance with our statute and regulations,” the agency spokesperson said in a statement.

Pham, MoonPay, Gemini and a spokesperson for Trump Jr. didn’t respond to requests for comment. A representative for Polymarket declined to comment.

As chairman, Selig will have to wear three hats: a lawyer, a politician and the less glamorous role of an administrator at a time when morale is low, said Malyshev.

“That will be a pretty significant lift for him to navigate as well since this role is not visible to the public, but is just as important as his other roles,” he said.

Solo Commission

Selig will also have to figure out how to lead what’s intended to be a consensus-driven, five-member commission by himself after a series of departures. Pham navigated the solo situation through numerous staff-issued no-action letters, guidance and statements, but little in the way of rulemaking.

The White House is considering a bipartisan slate of CFTC nominations but no final decisions have been made, Bloomberg News reported earlier this month. Trade groups such as the Futures Industry Association and key lawmakers have called for a fully staffed commission.

“The diversity of expertise, the diversity of opinions, the durability of the policy that it will create, is incredibly important for safety and soundness,” Alicia Crighton, a senior executive at Goldman Sachs Group Inc., said at a House hearing while testifying on behalf of the FIA.

Disclaimer: This report is auto generated from the Bloomberg news service. ThePrint holds no responsibility for its content.