China’s shockingly low birthrate isn’t quite the calamity for overseas milk suppliers that some recent stock moves might suggest.

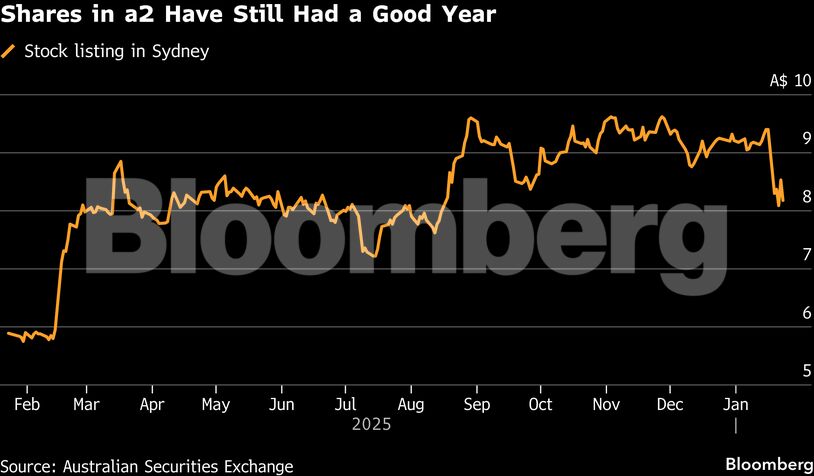

Foreign firms that make baby formula, from Swiss giant Nestle SA to France’s Danone SA, saw their shares fall after Beijing revealed last week that births in 2025 fell to the lowest since at least 1949. Worst hit was New Zealand’s a2 Milk Co., which plunged 14% immediately after the news as investors dumped a company notable for its bullishness on China. Chinese dairy companies, which are less keyed to the formula market, were relatively undisturbed.

Despite fewer Chinese babies, there’s evidence that firms with premium branding and international cachet can still grow their market share — and charge more for their products. Even after a2’s shellacking last Monday, analysts seemed optimistic on the company’s future, with a majority recommending a buy or hold on the stock in the wake of the decline.

The New Zealand company has made no bones about its reliance on China. Its stock skyrocketed twice in 2025 after announcements that revealed greater penetration or spending in the Chinese market. The purchase of a Chinese infant formula plant in August kicked off a rally that took its shares to their highest since 2021.

A2’s market value is still higher than it was before its Chinese investment. Chinese milk production, meanwhile, may be peaking, according to the US Department of Agriculture, while many local buyers remain wedded to established overseas brands because of their perceived quality.

China’s huge appetite for imports developed apace after the melamine scandal in 2008, when tainted domestic formula sickened thousands of children.

So, while China’s birthrate has roughly halved over the past decade, formula imports from New Zealand, the No. 2 supplier after the Netherlands, have ballooned, according to Chinese customs data. From 12 million kilograms in 2015, they peaked at 72 million in 2020 before dropping during the pandemic. They’ve crept higher since, to 64 million kg in 2025.

A2 declined to comment during the blackout period ahead of its half-yearly results next month. In November, Chief Executive Officer David Bortolussi listed capturing the full potential of China’s infant milk market as one his five strategic priorities.

Falling birthrates, a phenomenon across richer countries, are obviously a drag on firms that make products for children. But parents generally are willing to pay up for the health and nutrition of their kids, offering growth prospects even as fertility declines. International brands, meanwhile, often hold a strong appeal for China’s huge middle class.

According to NielsenIQ research last year, premium brands made up more than three-quarters of China’s infant formula market, compared to just over 20% for baby cereal and diapers. Moreover, the super-premium category of formula grew while other segments flattened or fell.

Of the country’s top five infant formulas, three are supplied by foreign companies: the Friso brand from privately held Dutch firm Koninklijke FrieslandCampina NV, Danone’s Aptamil, and a2 Milk, according to data from Kantar Worldpanel, which tracks consumer choices.

It means that, at the very least, birthrates and formula sales aren’t necessarily correlated, and that avenues for growth remain open for companies that lean toward the more expensive end of the market.

“Consumers in China are willing to pay up for the a2 brand,” Morningstar equity analyst Angus Hewitt said in a note last week. “This pricing power has driven market share growth despite unfavorable demographic conditions.”

On the Wire

A tale of two economies is driving China’s stock market, prompting investors to raise bets on the beneficiaries of an industrial export boom at the expense of firms mired in a consumption slump.

Export sales of US sorghum jumped to the highest since April 2021, with top importer China scooping up a bulk of the grain, government data showed Friday.

China will open 14 futures and options products, including nickel and lithium carbonate, to global investors, according to a statement from the China Securities Regulatory Commission. China is set to offer yuan-denominated liquefied natural gas futures as soon as next month, Reuters reported.

This report is auto-generated from Bloomberg news service. ThePrint holds no responsibility for its content.