The year 2022-23 has been a difficult one for Krishi Bhawan, which houses the Ministries of Agriculture & Farmers’ Welfare, and Consumer Affairs. And the next year, 2023-24, may also prove to be as challenging.

Central pool stocks of wheat are only slightly above the buffer norms and at least 25 million tonnes must be procured in the Rabi Marketing Season (RMS) 2023-24 to meet the requirement of the public distribution system and welfare schemes.

To that effect, the government has taken aggressive steps to reduce the market price. It has increased the sale under Open Market Sale Scheme (OMSS) from 3 million tonnes to 5 million tonnes. In Madhya Pradesh, where wheat arrives in mandis (local markets) before Punjab and Haryana, the prices are already down to Rs 2,000 from Rs 2,200 per quintal for mill-quality wheat due to the launch of OMSS.

Wheat farmers would not be very happy at this turn of events.

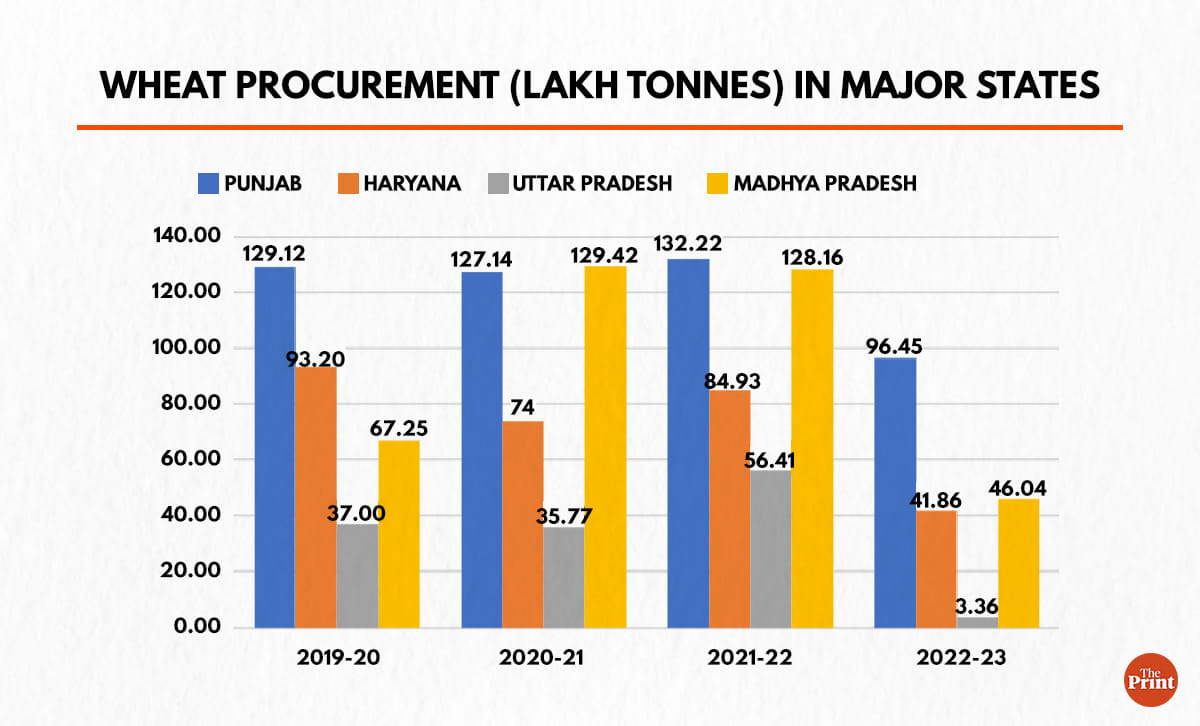

Normally, the wheat prices at the time of peak arrival in markets (April and May) fall below the Minimum Support Price (MSP) and the government ends up procuring much more than its requirement. Wheat procurement in 2019-20 was 34.13 million tonnes. In 2020-21, it rose to 40.7 million tonnes and in 2021-22 it reached an all-time high of 43.34 million tonnes.

Last year, due to a sudden rise in temperature in March 2022, wheat production fell and the government could only procure 18.8 million tonnes. The central pool stock on April 1 this year may be only about 9.5 million tonnes while the buffer norm is 7.4 million tonnes.

Also read: FCI sells 5.08 lakh tn wheat to bulk consumers in 3rd round of e-auction

OMSS reduces market price

One of the major instruments for reducing the market price of wheat has been the OMSS, under which the government allows the Food Corporation of India (FCI) to sell wheat to bulk users. The reserve price is fixed by the government. In the tenders floated by the FCI, the bidders can not quote less than the reserve price.

Despite high inflation in cereals, the government’s decision to sell wheat under OMSS came rather late. It was only on 26 January this year that the sale of 3 million tonnes of wheat under OMSS was announced. The reserve price was fixed at Rs 2,350 per quintal for Fair Average Quality (FAQ) and Rs 2,300 per quintal for wheat procured under relaxed specifications (URS).

In addition, the freight from either Ludhiana or Bhopal to the FCI warehouse, from which the sale was to take place, was to be added to the reserve price. For example, the reserve price at Bengaluru was Rs 2,600 per quintal for FAQ wheat.

But the element of freight was removed from the reserve price on 10 February.

It was further reduced on 17 February from Rs 2,350 to Rs 2,150 per quintal for FAQ and from Rs 2,300 to Rs 2,125 per quintal for URS wheat. This price became applicable for the entire country, irrespective of the distance from Ludhiana or Bhopal.

The government decided to sell another 2 million tonnes of wheat on 21 February under OMSS. Thus, the total quantity of wheat to be sold under OMSS became 5 million tonnes.

As a result of these decisions, the reserve price for bulk users has come down from Rs 2,600 per quintal to Rs 2,150 per quintal for FAQ wheat. But due to the poor availability of wheat in the open market in non-wheat growing states, they have been quoting a higher price in FCI’s tenders of OMSS. For example, in the last tender on February 22, 2023, the bulk users bid Rs 2,400 per quintal in Bengaluru.

Outlook for Procurement

In most of February 2023, the temperature in wheat-growing states has been 3-6 degrees Celsius higher than normal. If the same pattern continues in March also, there is a fear that last year’s story of lower yield will repeat. This is not good news for the farmers as well as the government. In addition, there is a possibility of lower rainfall due to El Nino in the coming monsoon season.

Despite all this, the prices in Punjab’s open market are likely to fall below the MSP of Rs 2,125 per quintal as most of the wheat crop arrives in a short period of just three weeks. Punjab procures about 13 million tonnes of wheat every year. Last year, due to lower yield, procurement fell to 9.6 million tonnes.

Private trade does not buy its requirement from Punjab due to high market fees and rural development cess of 3 per cent each and Arhatiyas commission of 2.5 per cent. This adds up to 8.5 per cent.

In Haryana, the procurement was 9.3 million tonnes in 2019-20, 7.4 million tonnes in 2020-21 and 8.5 million tonnes in 2021-22. But in 2022-23, it fell to 4.2 million tonnes. Haryana is also not a preferred state for the purchase of wheat by private trade as the market fee and other charges add up to 6.5 per cent.

In the last few years, Madhya Pradesh has emerged as an important wheat-procuring state. The procurement increased from 6.7 million tonnes in 2019-20 to about 13 million tonnes in the next two years. But in 2022-23, it fell to only 4.6 million tonnes. The market fee and other charges are only 3.57 per cent and the private trade prefers to buy from Madhya Pradesh as the freight to southern and western states is also lower. The success of wheat procurement for the central pool will depend on what happens in Madhya Pradesh.

Uttar Pradesh is the largest wheat-producing state but due to its large population, it is also a big consumer. It has been a preferred destination for purchase by the private trade as the market fee and other charges are 3.87 per cent only. However, the procurement is not stable and it fell from 5.6 million tonnes in 2021-22 to 0.33 million tonnes in 2022-23.

Also read: Modi govt has 2 goals to rescue India from another wheat crisis. Export ban should go next

Threat of EC Act

The biggest weapon to discourage private trade from stocking too much wheat in the open market is the threat of imposition of the Essential Commodities Act,1955. It was one of the three farm laws amended by the government through an ordinance in 2020. The EC Act was not to be used unless the retail prices rose by 50 per cent over the average of the last three years. However, a ban on the export of wheat and wheat products was imposed in May 2022 and there is little possibility of a relaxation. So, we can expect that large corporates will not be enthusiastic about buying and storing wheat from the open market.

Hence, the government is likely to procure 25 million tonnes of wheat or more.

Under the Pradhan Mantri Garib Kalyan Yojana, the Modi government has used additional allocations to alleviate the impact of the loss of income during the Covid-19 pandemic. So, it will be happy to procure more than 30 million tonnes and use some of the stock for additional allocations in the run-up to the Lok Sabha elections in 2024.

At the end of the day, Punjab will again save the day for the government and its critical role in providing food security may again be acknowledged.

The author is a former Union Agriculture Secretary. He is Advisor Food Processing FICCI.