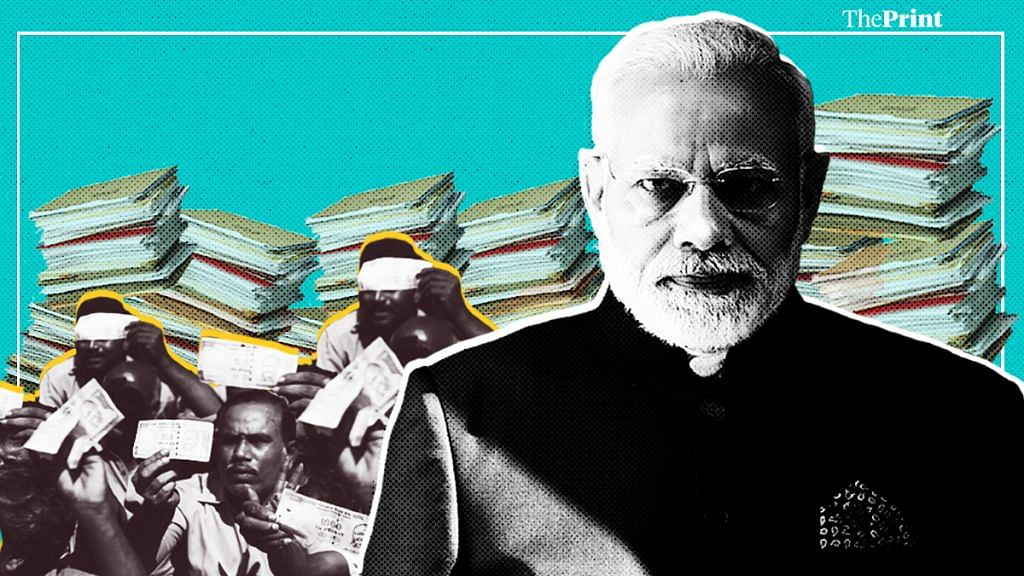

There is talk in the business circles that the Narendra Modi government will introduce the inheritance tax again in his second term. An earlier version, called Estate Duty, was abolished in 1985. It levied taxes on immovable and movable property passed on to successors after death.

ThePrint asks: Is it a good idea to re-introduce inheritance tax in India or a regressive step?

Inheritance tax could contribute to bringing down inequalities of wealth, across generations

Economic analyst and senior journalist

I believe the imposition of an inheritance tax – which was earlier called estate duty – would be an excellent idea that could contribute to bringing down inequalities of wealth in our country, and across generations. If a rich individual dies and his/her successors don’t pay any tax on the wealth bequeathed on them, that would then perpetuate the glaring inequalities of wealth that have grown in India over recent decades. However, an important rider needs to be attached here. The mere imposition of an inheritance tax will be of no use unless it is accompanied by a commensurate gift tax. If wealth can be gifted away after paying little or no tax on it, then the purpose of an inheritance tax would be defeated.

Whether or not the forthcoming Union Budget will impose an inheritance tax will be known only on Friday. Remember, estate duty was abolished in 1985 because tax collections were negligible. This was partly because of the inefficiency and corruption in the income tax department. I don’t believe sincere efforts were made to levy this tax with any degree of diligence. Given how easy it was to bribe officials to reduce the incidence of estate duty, the exchequer ended up getting very little revenue. This could continue to be a problem, but the overall principle and logic behind the tax remain valid.

We shouldn’t look for ways to reduce inequality— we should instead focus on wealth creation

Entrepreneur and writer

The only purpose an inheritance tax will serve is ensuring employment of our chartered accountants and lawyers, who will find loopholes to help the rich escape having to pay this tax. It will also give increased powers to the income tax officers to harass people.

God help if you are a widow who has just lost her husband, or, if you are the child of an NRI—you will be left to run from pillar to post because of this tax. Not only will you have to cope with the trauma and pain of losing a loved one, but you will also now be taxed for their wealth.

V.P. Singh abolished this tax precisely because the government was earning hardly any revenue through it.

The really rich transfer their wealth to trusts— it’s the ones in the middle of the wealth ladder who will really be harassed through this. Ideally, we shouldn’t be looking for ways to reduce inequality in today’s India— we should instead be focusing on increasing wealth and aiding wealth creation. Such taxes don’t help with wealth creation, they only take us back. Instead of creating wealth, we will be spending time and effort on redistributing poverty.

If we want to go back to old-fashioned socialism and the permit-license raj, why stop at inheritance tax? Let’s bring back wealth tax, gift tax, 97 per cent marginal income tax, industrial licensing and so on.

Also read: Modi’s new budget key to unleashing Indian economy’s animal spirits

Inheritance tax should be implemented in a manner that it can’t be evaded – like being coupled with gift tax

Senior lawyer, Supreme Court

I believe inheritance tax would be a great idea. I prepared a document called Reclaiming the Republic, where we had proposed inheritance tax as well as wealth tax—wherein the inheritance tax would be at 20 per cent and the wealth tax at 1-2 per cent. It is one of the most legitimate ways of taxation because if you are inheriting something you have not earned or created, why shouldn’t the state get some part of the tax for its special welfare functions. There is no reason on earth why people who inherit a lot of wealth should not be taxed.

However, it should be implemented in a manner where it cannot be evaded. Otherwise, it is very easy to evade these things. Therefore, the inheritance tax should also be coupled with a gift tax, or else people will start gifting their wealth to their children before they die.

The estate tax was abolished in 1985, as part of neo-liberal policies because it was felt that the wealthy should not be taxed. Gradually many taxes were abolished and income tax reduced, which was not correct. Initially, the direct taxes and income tax were a lot, even up to 97.75 per cent, and that was, of course, wrong. But you can have income tax going up to 50 per cent, as is the case in most countries. Similarly, inheritance tax also exists in most countries and should be replicated in India too.

Also read: GST proved to be both consumer and business friendly, says Arun Jaitley

Inheritance tax scrapped by most countries because it has not brought back much revenue

Managing Partner and International Tax lead, Ashok Maheshwary & Associates

While I do believe that in principle India should have an inheritance tax, I am extremely sceptical about how it will roll out. My scepticism has to do with the implementation of the inheritance tax and its timing.

First of all, unlike developed countries, which have a very good public social security net, we lack social security measures in our country. The money in my provident fund cannot take care of my retirement needs. Taxing inheritance money in a country like ours, which relies on family money is not a good idea.

Also, I believe that the timing of introducing the inheritance tax now would be wrong because it will discourage the generation of wealth in India. The economy is currently going through a strain and the real estate sector is going through a slump, therefore we need more investment in India. The introduction of an inheritance tax will result in wealthy people moving their assets abroad. If I know I am going to be taxed, I will start investing out.

The introduction of the tax will not bring much revenue back into the country, which is why it has also been scrapped in most countries and has not been very successful.

By Fatima Khan and Revathi Krishnan.