GST rate cut will help formalisation and boost business. Relaxation of return filing procedures should help smaller firms embrace the tax reform.

The significant rate rationalisation exercise is more a reversal of fiscal tightening than a fiscal boost, in our view, as we explain below. But more importantly, the exercise shows a reformist intent. The relaxation of return filing requirements is a welcome even if belated introduction of change management best practices into what is the most significant tax reform ever undertaken by India. Over-complicated return filing requirements were forcing smaller firms away from GST and these steps should help.

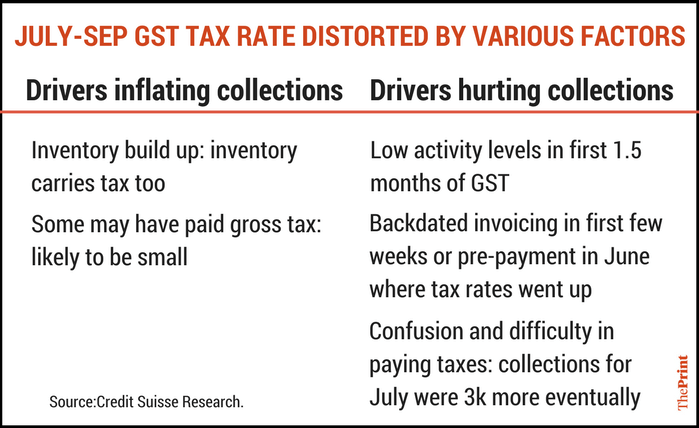

If GST collections are ahead of revenue neutrality, it would be fiscal tightening, and vice-versa. Several factors may have distorted July-September collections. But if undistorted, they indicate better-than-budgeted collections, in our view.

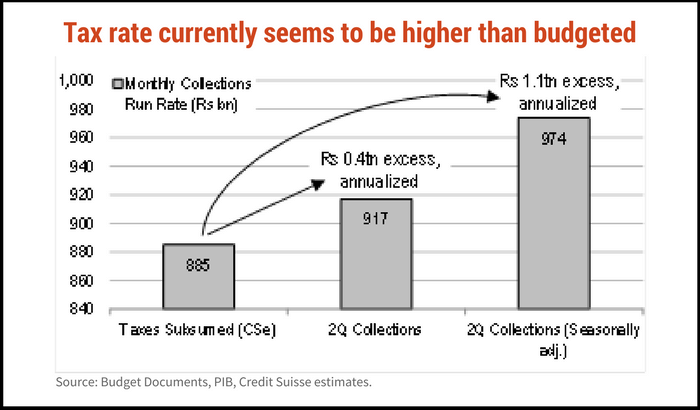

If the Rs 10.6 trillion of taxes subsumed under GST were spread equally over the months, the excess would be Rs 400 billion annualised. However, the second quarter is seasonally weaker, implying a financial year excess of Rs 1.1 trillion (Rs 825 billion for nine months).

Ex-GST, the central government’s revenue is Rs 394 billion behind the Financial Year 2018 Budget, with slippages on RBI’s dividend and telecom offset by higher direct taxes and disinvestment. If the second quarter GST take is representative, it was causing unintended fiscal tightening. The government retains a surplus, even after Rs 200 billion GST rate cuts.

The cuts in rates will help formalisation: It is easier to help the formal sector to compete than to catch tax evaders. It should help taxes as well. Tax cuts also increase sectoral opportunity (price cuts drive volume gains; here government bears the price cuts).

The author is India Equity Strategist at Credit Suisse. This analysis originally appeared as an India Market Strategy note of Credit Suisse.

This is novel Mr Mishra! First create a wrong, then right it, get CreditSuisse stamp of approval! Or is it just your stamp of approval as an individual, and you are using CreditSuisse for credibility?