It is a malaise that lies at the root of corruption, income inequalities and the continuing hold of corrupt politicians over the levers of power through illicit money.

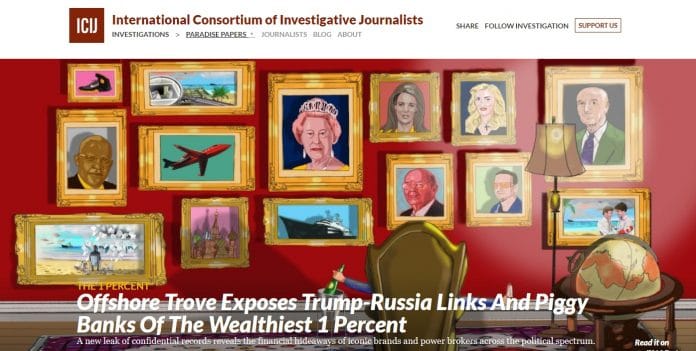

The Paradise Papers leak is the third large expose of tax haven data of just one company, which was setting up these companies on behalf of the high and mighty across the world. The Panama Papers also revealed the data of one particular company, which was doing a similar thing on a global level.

What these two exposes show is that there is a huge business of siphoning out money from domestic jurisdictions to tax havens through shell companies set up in tax havens. In most cases, the money is the product of siphoning off funds from domestic companies by over-invoicing and under-invoicing through intermediary shell companies. This device has been transparently visible in a number of big cases investigated recently by the Directorate of Revenue Intelligence, income tax department, the CBI and the Enforcement Directorate.

For example, the case of the DRI investigations of Adani Power company and Essar allegedly showed thousands of crores of rupees being siphoned off through over-invoicing of imported equipment. Similarly, in the case of Sterling Biotech, the CBI, I-T and ED allegedly detected more than Rs 5,000 crore of funds siphoned out again through over-invoicing and under-invoicing.

This siphoning out of funds is what is leading to non-performing assets since most of these companies take loans from public sector banks on the basis of over-invoiced costs as the Adani, Essar as well as Sterling cases show.

This also leads to the defrauding or cheating of electricity consumers by higher tariffs imposed upon them, as well as cheating of these public companies by their promoters. This is why we see this phenomenon of companies like Mallaya’s going into bankruptcy, while the promoters manage to have huge assets mostly abroad.

This phenomenon is widely used by large corporates, and known and understood by the politicians and bureaucrats. Unfortunately, no action has been taken because in most cases, the politicians, bureaucrats and tax officials are also allegedly paid out of these siphoned off funds as the CBI’s FIR and the I-T vigilance report in the Sterling case shows.

Siphoning off funds of corporations to tax havens in this manner is today arguably the biggest business in the world involving amounts in excess of $100 billion a year. It is a malaise, which lies at the root of corruption, black money, income inequalities and the continuing hold of corrupt politicians and their parties over the levers of power through this illicit money which they come to control.

In this way, therefore, it is perhaps the largest threat to democracy in the world today. But unfortunately, since the rulers in most countries are in power on the basis of money supplied by these corrupt crony capitalists, nothing has been done and nothing is likely to be done by the ruling class against this malaise.

Some of these funds could also be cases of tax evasion and not necessarily siphoning out by over-invoicing and under-invoicing and thereby corruption, cheating, among others. However, hardly any part of it is likely to be legitimate or above-board, because there was no reason to park it in tax havens. And it should have been declared upfront to the authorities.

It is time for another people’s movement against this crony capitalism and corruption.

Read ‘Paradise Papers’ leak: An exercise of naming and shaming, without even saying what the shame is’ by Sanjay Dixit.

Malaise is really deep rooted. Aur is hammam me sab hi nange hain.

Again Shri Prashant Bhushan has excelled in generalities. Has he read the entire set of documents leaked? Has he pointed out any particular shell company or businessman involved in illegal stashing of wealth abroad? No. Let him do some research and come out with specifics.