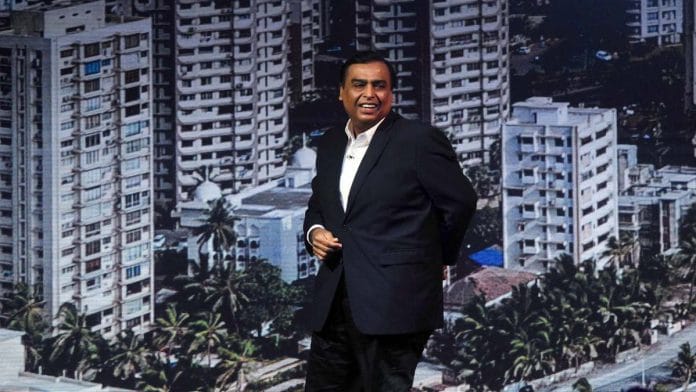

It used to be said, with some truth, that what was good for General Motors was good for the US of A. In India, the equivalent comment (rather less truthfully) used to be that what was good for Birla Brothers was good for the country. That is history. GM now sells more cars in China than in its home market, and the Birlas have fallen apart, their pride of place taken by Mukesh Ambani.

Mukesh’s deals over the last month have made headlines around the world — five stake sales in Jio Platforms, a Reliance Industries subsidiary, have netted Rs 78,500 crore (more than $10 billion), the latest deal valuing the digital behemoth at a staggering $65 billion. Meanwhile the mother company, Reliance, is in the middle of a rights issue, which seems small by comparison but is the biggest in India’s history: Rs 53,000 crore. Other stake sales are at various stages of closure: In the telecom tower business for Rs 25,000 crore, plus Rs 7,000 crore from BP for a 49 per cent stake in petroleum marketing.

Even if a planned 20 per cent stake sale in the oil and petrochemical businesses to Saudi Aramco for $15 billion falls through, this will be the biggest cash-in ever by an Indian businessman. Mukesh seems set to cross his target of raising $20 billion and achieving zero net-debt status, and do it with the ease of a Usain Bolt. He may even end up being cash-surplus, despite having invested a staggering $40 billion or thereabouts in the telecom and associated digital businesses of the future. Overall, Reliance is valued on the market at close to Rs 10 lakh crore ($127 billion).

Also read: Mukesh Ambani is a man on a mission and even a pandemic or lockdown can’t stop him

Many had believed that the outsize investment in an already competitive business like telecom could never yield a proper return. But Mukesh’s anticipation of the future, his execution capabilities, and now his string of deals have shown up the sceptics (including this writer). And the game has just begun, with Mark Zuckerberg as an e-commerce partner to take on Walmart-Flipkart and China’s Alibaba.

Mukesh has thus wheeled around his gigantic enterprise, and re-imagined it, in a manner that has few parallels in business history. What was begun by the founder and Mukesh’s father, Dhirubhai Ambani, as a synthetics textile company in the 1970s, had already gone through one transformation when Dhirubhai pulled Mukesh out of Stanford and asked him to help take the business upstream by building giant petrochemical complexes at Patalganga and Hazira. There followed a technologically brilliant move even further upstream, with the building of the world’s largest, most complex refinery that could use even the worst-quality crude — and yield industry-beating refining margins.

Still, despite scale efficiencies, the business had always depended on favourable government policies. The son once recalled his father’s allegory about the householder who had to feed the pundit, the cow, the pet dog, and the crow that had hopped closer before he could eat himself. This is truer of commoditised products like PVC or polyester fibre, where government decisions on taxes, tariffs, licences and such can make or mar a business. In Dhirubhai’s case, it was usually (but not always) the former. Hence the old joke that had the Arab wanting to buy the Air India stewardess. On being told she belonged to Air India, he offered to buy the airline. And if that belonged to the government, he would like to buy the government. That, he was told, had already been sold to Dhirubhai.

The government matters less in brand and technology businesses, where consumer preferences and the building of a franchise are autonomous of policy, though policy helps (to block rivals, for example). Hence Mukesh’s fresh re-focusing of his company. His initial entry into retailing was botched but re-strategised, and the initial foray into telecom was a marketing flop; in any case it had to be given away to younger brother, Anil. Finally today there is the all-encompassing Jio, whose 385 million customers are manifestly worth a fortune. Reliance, which once made saris, has thus been re-invented yet again. Dhirubhai may or may not have owned the government; it would seem his son wants to own the market.

By Special Arrangement with Business Standard

Also read: With Ambani by his side, Zuckerberg has finally made his Mark in India’s telecom space

No hate. Though the vocab could’ve been much simpler and straightforward. I can’t understand why Indian writers try to use complex English words!!

Because Indian writers act like fake detergent advertisements; fairer & whiter than white!!

With the help of his Sheru.

proud to have this entrepreneur in India.

These leftist communists will not talk of American companies or the Chinese; some having market caps of a trillion dollars. But they do have problems with Indian businessmen!!! Indians especially the leftist/communists do have the self & nation hating syndrome!!

Mukesh ambani in the name of productiin sharing contract agreement aipjoned enough money from govt of india and gave nothing in return to indian govt like ONGC..politikal connection made him to divert money to Retail Jio IPl etc…if the same leeway given to ONGC ..they also would have created entrrprise like jio…. This is realty .no paid up compliments

Can we all look at positivity. MDA has laid president for our young generation to think big in digit world.

No old companies could do what Mukeshbhai has done, that to in these covid 19 scenerio.

Hats off to you sir,

From a national monopoly with government patronage, Mukesh has entered the global big boys club. He will now face off with Alibabas and Amazons of the world. This may not be a money game alone, and he needs exceptional talent on his side. For example, he CEO of his standout digital arm should be a household name like Satya, Sundar, Dorsey, et al. It cannot be another Ambani drummed up by PR. Fortunately, meritocracy still wins in tech and Reliance is not a place that one would associate with that.

People in powerful positions get so drunk on power that they forget the basic rule of life: Any sin you commit never goes unpardoned. While Dhirubhai could have been successful in managing the “external environment”, he died at a not-so-old age of 69. Mukesh bhai needs to think whether he too is going his father’s way by influencing government policies and creating monopolies.

JIO enterted telecom market where Airtel,Vodafone,Idea,Docomo were making a killing with virtual monopoly.Jio entered this market and took over the business with price and other digital services that drove prices down.Next phase for Jio would be to design and build 5G phones made in India and because of market size investors will put money.

Please help me.sir.ji.ham.kesan.ha

Jio’s business model , whatever it is , does not seem to be generating a lot of ROE , castles in air are being built at a frenzied pace , will a firm foundation be formed in the future or will it be like the tech frenzy of the 1990s.

Nice article. Mukesh AAmbani has succeeded in transforming his company twice in his lifetime. This is a great achievement. But there is another angle to this feat. The current scenario has compelled even Mukesh Ambani to go debt-free. He is playing it safe. While the stake .sales appear to be big in absolute numbers, Mukesh retains his hold on group. This is a brilliant strategy in face of growing uncertainties and looming recession or should we say depression. Hope that he succeeds in his endeavours.

Yes, Ninan nothing will stop Mukesh in the present scenario. Good analysis. Hopefully, he will sail through.

Thanks

Nagesh Rao

The Great Reliance India firewall will benefit only one entity – Jio and the data digital monopoly will be theirs to the detriment of innovation, startup and entrepreneurs focused on addressing challenges in the market.

Reliance monopoly will only feed the pockets of its owners and limit that results from the impact of digitization benefits accruing to India of frictionless commerce, lower costs and wide choices.