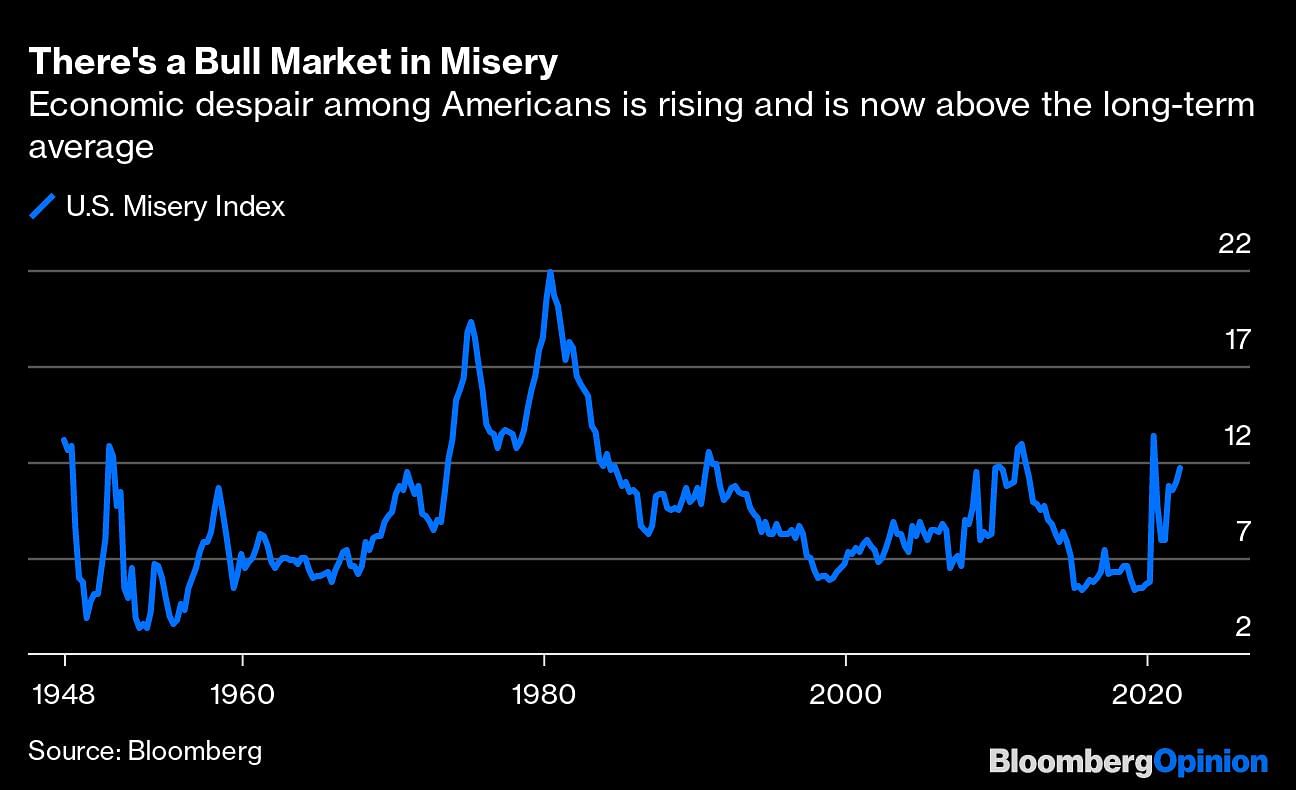

In economics, the misery index is obtained by taking the current rate of inflation and adding the unemployment rate. By this measure, there was a lot of misery in the 1970s, and not so much in the 2010s, as both inflation and unemployment fell to negligible levels. But a misery index that I informally developed years ago that looks at the ratio of financial assets to hard assets is suggesting that despair is probably worse than most economists realize.

Financial assets such as stocks and bonds are things that we want. Hard assets, taken to mean things along the lines of fossil fuels oil, agricultural products and other commodities, are things that we need. When the price of the things that we need go up and the price of things that we want go down, it creates economic misery. It would be fairly easy to construct such an index by taking a linear combination of the S&P 500 Index and the Bloomberg U.S. Aggregate Bond Index divided by one of the popular commodity indexes. To give a sense of where things stand, the S&P 500 was down more than 6% this year through last week . The Bloomberg Bond Index is having perhaps its worst start ever, tumbling more than 6%. The Bloomberg Commodity Spot Index has soared, surging about 25%.

This is being reflected in the various consumer confidence metrics, which are plummeting even though the economy is expanding and the labor market is as tight as ever. What the consumer confidence numbers are capturing is this sentiment around the things we want versus the things we need. We need gasoline, beef and clothing, and the price of all three is much higher than it was six months ago. We want stocks, but the stocks that we possess are down anywhere from 10% to 20% from their peaks. Wealth has evaporated and the cost of living has increased.

To the extent that policy makers care about such things, a marker of economic success would be to have expensive financial assets and cheap hard assets. We enjoyed such a state of bliss for a number of years, but for some reason it wasn’t enough. We had little to no inflation, stable economic growth, high standards of living, the price of many goods declining in real terms and low unemployment. And yet, it was all aboutgetting inflation rates just a little higher to increase nominal wages so people would feel richer. So, throughout the 2010s and the early 2020s, Federal Reserve policy focused on sparking some inflation. Although it was slow to happen, most knew the Fed would ultimately be successful. After all, the Fed creates inflation when it is not trying. And now, inflation is surging and the Fed can’t put the whipped cream back in the can.

My concern is that we are at the beginning of this increase in economic misery, not the middle or the end. Trapped by its own ideology, the White House is trying to encourage the use of renewable energy, which will only serve to keep the price of fossil fuels high. I have seen discussions about how price controls might be beneficial to tame inflation, but that would only serve to create a black market in certain commodities and cause nationwide shortages.

The solution is obvious: raise interest rates aggressively. But policy makers only see boosting its target rate, currently just 0.5%, to 1.9% this year and to about 2.8% by the end of 2023 even though the rate of inflation is 7.9%. There are some silly conversations around how this Fed tightening campaign will hinder growth. I hope it does. In order to stop inflation, the Fed will have to engineer a recession.

If these conditions persist for a long period of time, with the prices of things we need staying high and the prices of things we want staying low, the result may well be social and political upheaval. It is already probably going to result in Democrats losing power come the mid-term elections in November. As for the pain in the capital markets, it is just beginning. Imagine a situation where inflation tops 10%, The S&P 500 is down 30% and benchmark interest rates are 3%. People would be very unhappy, and ready to vote for just about anyone other than an incumbent.

How the Fed operates is that it will only get serious about tightening monetary policy when the political pain of inflation exceeds the political pain of recession. The Fed isn’t serious about fighting inflation at the moment, as shown by its projections for how high it expects to boost its key rate. The only way to stop inflation is to raise rates enough to engineer a recession. And people have to be so sick of inflation that they will accept a recession in exchange for getting rid of the inflation. We’re not there yet, but we will be. –Bloomberg

Also read: Tech billionaires back nuclear power as alternative to carbon emissions, Russian gas