India’s unique welfare capitalism model has brought the country’s poverty prevalence down from 80 per cent in 1947 to less than 10 per cent in 2025. Along the way, India transformed from a primarily agrarian economy to a global player in pharmaceuticals, software, and digital infrastructure. However, a critical challenge persists: India’s chronically low technological innovation hinders its ability to compete as a net exporter of high-value goods and services.

What is RDI and why does it matter?

Research and Development Intensity (RDI) measures how much a country or company invests in innovation. At the national level, RDI is the ratio of R&D expenditure to Gross Domestic Product (GDP). At the corporate level, it’s a percentage of sales a company spent on R&D. Higher RDI signals a stronger commitment to technological advancement, essential for India’s Viksit Bharat 2047 vision—a goal to become a developed nation by 2047.

India’s RDI lag: A global comparison

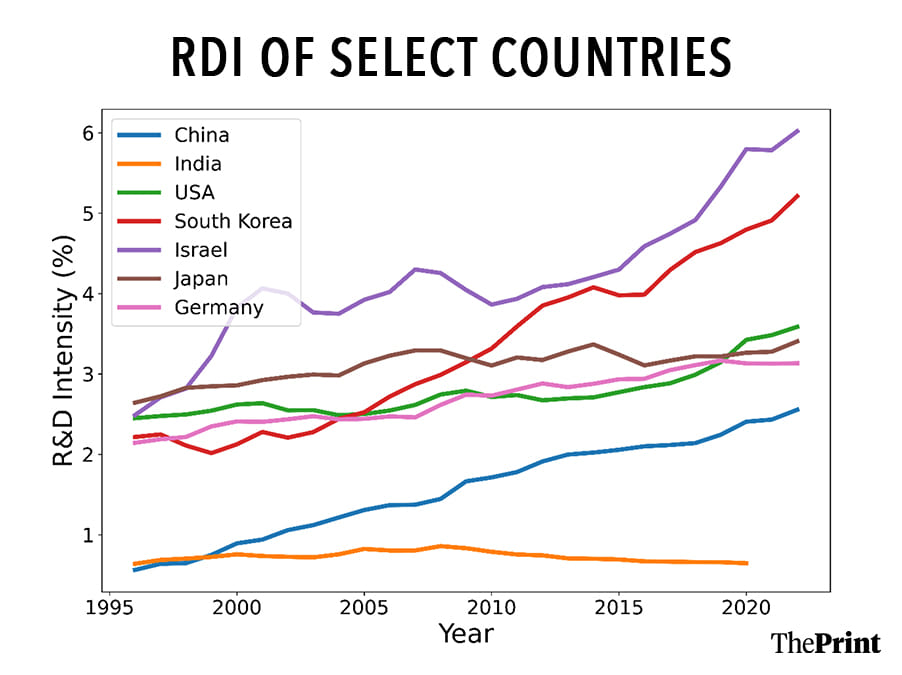

India’s national RDI in 2020 was just 0.65%, according to the World Bank. This is significantly lower than innovation leaders like Israel (5.8%), South Korea (4.8%), the US (3.42%), and China (2.41%). Before 1999, India’s RDI surpassed China’s, but China’s aggressive R&D investments have since outpaced India.

Furthermore, India’s RDI peaked at 0.86% in 2008 and has since declined, unlike peer countries that show steady RDI growth. This persistent shortfall could jeopardise India’s ambitions for Viksit Bharat 2047.

Structural imbalance in India’s RDI

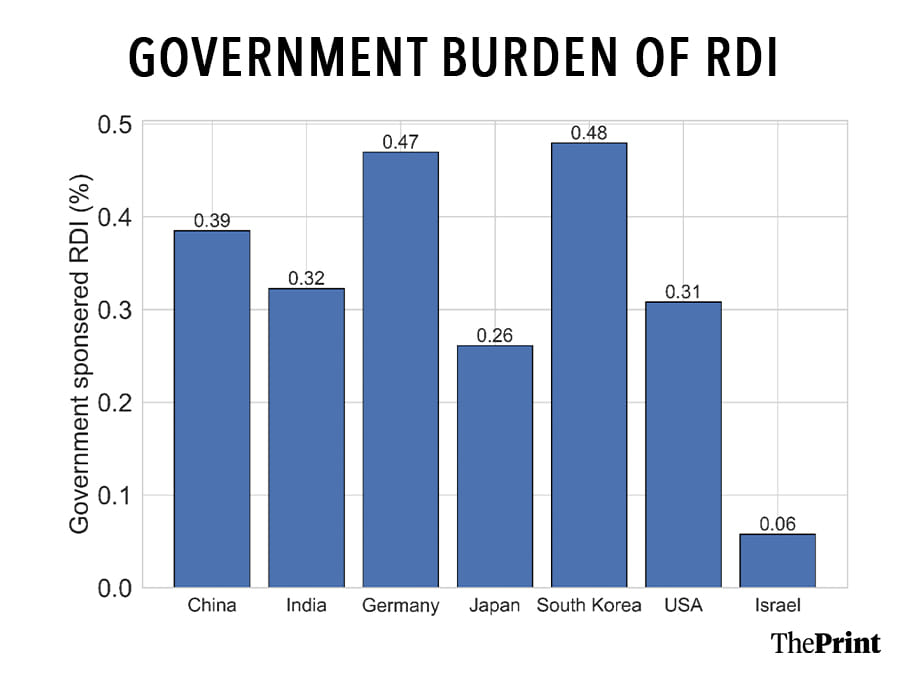

Among global innovation leaders, the private sector drives over 75% of national RDI. In India, however, the government funds about 50% of total RDI, per GERD data from the Economic Survey of India.

This might be construed as strong government participation, but it actually reflects weak participation from India Inc.

At 0.32% of GDP, the government’s RDI spending is on par with peer countries. The gap lies in the private sector’s weak contribution, which limits India’s ability to innovate at scale.

For example, India Inc.’s low R&D investment contrasts with global giants like Toyota or Volkswagen, which consistently allocate 5–6% of sales to R&D. Closing this technological gap requires India’s private sector to step up.

Also read: Creativity is a crime in India. Let’s accept vegan ice cream as the only honest innovation

Tata Motors: A shining exception

Not all Indian companies lag in RDI. A 2024 report by the Indian Institute of Corporate Affairs (IICA) reveals that Tata Motors stands out as a remarkable outlier.

In 2022–2023, Tata Motors invested Rs 20,226 crore in R&D, equivalent to 5.86% of its sales. This matches global automotive leaders like Toyota (5–6%) and Ford (5–6%), and approaches Volkswagen Group (6.8%). Remarkably, Tata Motors’ R&D budget exceeded the combined R&D spending of India’s other 30 largest companies by market capitalisation.

Inside Tata Motors’ R&D success

To understand what is happening at Tata Motors, just look under the hood of its consolidated entity, which comprises Tata Motors (India) and Jaguar Land Rover (JLR) in the United Kingdom. According to the 80th Integrated Annual Report for 2024-2025, the group spent Rs 33,569 crore on R&D, with Rs 2,089 crore from the Indian entity and the rest from JLR.

A sceptic might dismiss this as mere accounting magic, but that would be far from the truth. JLR’s continued investment in R&D has placed it at the forefront of the electric vehicle (EV) revolution, as evident by the early success of the Jaguar I-PACE. This sustained investment has enabled Tata Motors to dominate on two separate fronts: JLR competes at the high end of the global luxury EV market (alongside brands like Bentley), while Tata Motors leads India’s EV market, dominating the domestic segment. In this light, Tata Motors’ R&D spending has not only been defensible but also strategically prescient.

Did Tata Motors foresee in 2007–2008 that acquiring a distressed JLR would one day lead to its leadership in the EV space? Likely not. But what it did recognise was a legacy brand with deep engineering roots and a culture of bold technological bets. This strategy offers a blueprint for India Inc.

India’s private sector can learn from Tata Motors’ outward-looking, risk-tolerant acquisition strategy to improve their own technological innovation. With strong balance sheets and growing ambitions, now may be the right time to go shopping for global capabilities and close the technological gap.

Harsh Jagad is a materials engineer working in the US deep tech industry. He has a PhD from Brown University and MTech from IIT Bombay. Views are personal.

(Edited by Prashant)