Lending to Vijay Mallya was the bankers’ season ticket to corridors of power and glamour.

On 7 February 2010, at the peak of the modern makeover of State Bank of India, its aggressive chairman O.P. Bhatt (2006-11) was doing a show-and-tell at the launch of his new technology platform.

Unlike most PSU captains, Mr Bhatt loved ambition and scale. He was going to make his tech launch the year’s biggest corporate party.

He hired Mumbai’s Brabourne Stadium, invited every big name in business, and they all turned up, including the then finance minister Pranab Mukherjee.

Bhatt had personally called each of his guests (this writer included). He started the presentation with lasers. All lights in the stadium were turned off as his guests watched, spread over scores of round tables, and applauded. Then a distracting buzz came from the left.

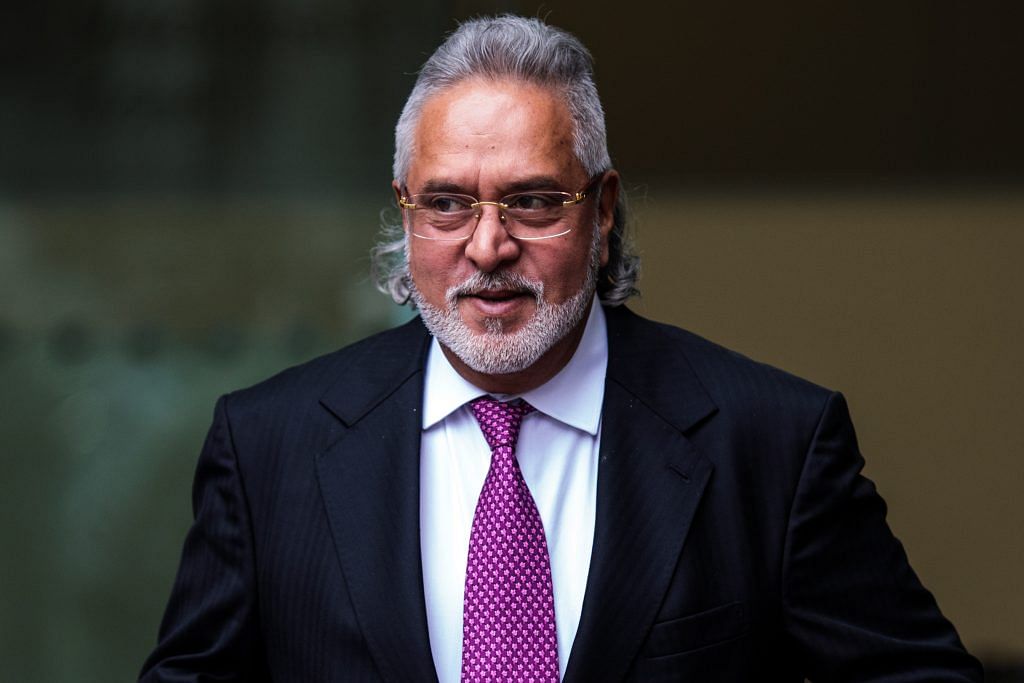

In the reflected laser glow you could see about a dozen very important looking silhouettes. It was Vijay Mallya making a typically grand entry — as he would into a home, a party, anywhere, with his flunkeys, factotums, retainers, bodyguards, one of them even carrying his two mobile phones on a silver tray.

Also read: Jaitley denies meeting Mallya after liquor baron’s claims outside London court

His boys were all muscular, tall, in dark suits (mostly the VVIP security safari types, if I remember correctly) and glowed in his power. Their collective aura was enough to force Mr Bhatt to halt his presentation and ask for the lights to be switched on.

As everybody realised who it was that stopped the show, there were whispers. Mostly of envy and admiration. “Boss, whatever you may say, you should be a borrower like VJM,” said a business leader at my table. “He has the power to disrupt his biggest lender’s party and yet be treated with izzat.” Such was Mallya’s power.

Remember, in 2010, he was already steeped in losses and debt. Remember also that 2010 was still the era of post-2008 stimulus packages, when rates were low and liquidity was plentiful. It was also when oil prices were rising, but nothing would contain his ambition.

I do not believe any of his lender PSU banks would have had the cheek to caution him. They were thrilled to be invited to his parties, and honoured when he came to theirs.

Mallya achieved something no Indian businessman had so far: He became, even as a repeat borrower, the banker’s most valued trophy. Even when he had prospective defaulter written all over his balance sheets.

This isn’t an insight into the life and times of “Dr” (honoris causa) Vijay Mallya. I do not have the skills to unravel his business dealings, mergers and de-mergers. Nor, I suspect, did our fawning banks, which is less defensible.

His creativity was never to be doubted. At the peak of the go-go years in 2007-08, for example, when he bought over the dud Air Deccan at an enterprise value of Rs 2,100 crore, it was Deccan that “merged” Kingfisher into it. Everybody knew why.

Also read: Indian prisons and prime-time media may just save Vijay Mallya from extradition

He was bypassing the civil aviation ministry’s idiotic rule (which persists) that to fly abroad an airline should have been in operation for five years. Kingfisher had only started in 2005 and Mallya was in a hurry. So he bought Deccan but merged his airline into it, to claim overseas flying rights. Very creative, you’d say, and applaud both his cheek, and sense of humour in showing up the bureaucracy for its regulatory incompetence. But would you lend him money for this?

Put yourself, however, in the shoes of the bankers, particularly the public sector ones. Mallya wasn’t just an entrepreneur, but a prominent member of Parliament (MP) on first-name terms with most of the Cabinet members through Atal Bihari Vajpayee’s NDA and Manmohan Singh’s UPA.

As a second-term MP, he was a member of key consultative committees including, no surprises, civil aviation and fertilizers (Mallya’s UB Group also owned Mangalore Chemicals & Fertilizers).

If Indian Parliament is so unmindful of conflict of interest, why blame poor bankers for being starry eyed? They vied to be invited to his parties and events, including IPL matches, where he rubbed shoulders with the sexiest, and the most powerful and famous in the country, from film stars and models to politicians and civil servants and indeed, top journalists and media barons.

Lending to Mallya was the bankers’ season ticket to corridors of power and glamour. Borrowing from them was like a favour Mallya did to them. This, when every diagnostic told you Indian aviation was nose-diving. In fairness, we also must note that this was exactly the period of competitive, hyper-endocrinological blundering in corporate India.

Also read: The playboy with a penchant for diamonds & paintings – The rise & fall of Nirav Modi

Jet Airways, too, in the kamikaze fight for market share, acquired Sahara, a dud of Deccan dimensions, also for Rs 2,000 crore on borrowed money. This competitive stupidity nearly killed Indian aviation. Kingfisher choked on its acquisition. Jet had a near-death experience.

But its promoter had one attribute in deep contrast with Mallya: Endless, if exaggerated, humility, and the ability to say, “I screwed up”. Without these, you should never take other people’s money, as debt or equity.

The Mallya story is more about our easy embrace of cronyism. Parliament, politics, bureaucracy, media, banks were all complicit not just in the rise and fall of Vijay Mallya, but of many others.

In the name of socialist protectionism, we have built a giant, permanent nexus of the powerful where contacts and networks matter more than balance sheets.

Postscript: Bank distress is not new to post-reform India. The last such crisis came in 2002-03 and, The Indian Express, which I then edited, started an investigative series anchored by Samar Halarnkar and called ‘The Great Indian Bank Robbery’. Check out the archives. Many of the names that featured in that 30-plus part series are also in today’s “hall of fame”.

Like the Khans of Bollywood, our stressed borrowers are also evergreen, and like their fans, the bankers equally starry-eyed. That series was causing the NDA government discomfiture. A few messages came from “higher-ups”, complaining that we were overdoing it.

Then, one afternoon, the big man called himself. “Arrey, kitney din chalayenge is series ko aap, poora varsh (For how long will you run this series, a whole year)?” he asked.

I said, “No Atalji. Minimum qualification to make it to the list is that you should be defaulting on more than Rs 500 crore, so may be a few more.”

“Then why have you put Baaluji there? His default is just Rs 35 crore,” he asked.

“Because he is an MP and a minister, Atalji. So he qualifies with much less. Because the bar for MPs must be much lower in such cases.” I talked my way out of admonition. T.R. Baalu of the DMK was the environment and forests minister in the NDA Cabinet and owned a sick business defaulting on Rs 35 crore of loans.

We now have a Rt Hon. MP with a Rs 9,000 crore default on 17 public banks and when he talks down to us all from London on Twitter, we listen. And when he speaks a line to reporters outside his courtroom, he throws our national politics into a tizzy.

We’ve come a long way indeed.

A version of this was published on 11 March, 2016