Financial markets often respond to subtle indications rather than explicit announcements. This phenomenon was evident on 29 October 2025, when the U.S. Federal Reserve reduced interest rates by 25 basis points. Typically, a reduction in interest rates weakens the dollar, decreases bond yields, and renders non-yielding assets like gold more attractive.

However, on this occasion, the price of gold did not experience a significant increase; instead, it remained stable or even declined. All because of one line by Chair of the Federal Reserve of the US Jerome Powell, who said that a rate cut in December “is not a foregone conclusion.” This single statement altered market expectations, and given that gold prices are influenced as much by anticipations as by actual policy changes, the price adjusted immediately.

This moment captures a fundamental yet powerful idea: financial markets do not wait for central banks to act; they anticipate and react in advance.

The power of one sentence

For months leading up to the October meeting, investors anticipated that the Federal Reserve would engage in a predictable and gradual easing cycle through the end of the year. This expectation disproportionately benefited gold. As yields were projected to decline, the opportunity cost of holding gold decreased, leading to a corresponding rally in the metal’s value. By late October, gold was trading comfortably above levels observed earlier in the month, a rise attributed more to collective anticipation than to any specific data point or event.

However, market dynamics are often influenced by marginal changes. A minor shift in the perceived trajectory of policy can outweigh a significant, fully expected policy action. Chairman Powell’s carefully phrased caution regarding December represented such a shift. It indicated that the Federal Reserve did not see itself on an automatic path of rate cuts. This subtle re-framing was sufficient to prompt a broad repricing across various asset classes.

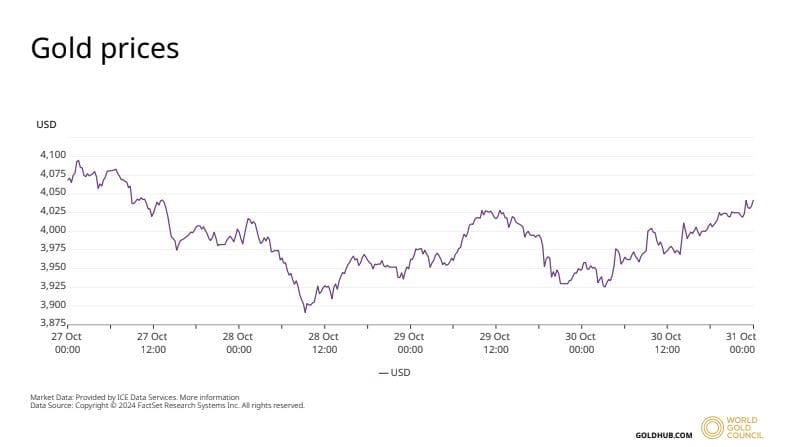

The intraday behaviour of gold from 27 to 31 October illustrates this phenomenon. Prices that had strengthened leading up to the Federal Open Market Committee meeting reversed course almost immediately following the press conference, registering a noticeable dip. Although the underlying rate cut should, in theory, have supported gold, the erosion of confidence in subsequent easing proved to be more significant. It was expectations, rather than the policy rate in isolation, that dictated the outcome.

The figure above illustrates the trend of gold prices firming before the rate cut announcement, reaching a peak concurrent with the decision, and subsequently experiencing a sharp decline following Powell’s indication that a December decision was not guaranteed. The timing of the movement highlights the extent to which gold prices are closely linked to the anticipated trajectory of policy rather than the policy action itself.

Unconventional economic theory

To numerous analysts, the situation may have appeared paradoxical. Conventional economic theory suggests that lower policy rates diminish the yield advantage of alternative assets, thereby bolstering gold. However, traditional models often assume that rate decisions are discrete, unexpected, and independent of expectations. Modern monetary policy operates differently. Market participants engage in extensive analysis of data, speeches, and tone to deduce the trajectory of a policy well in advance of a meeting’s conclusion.

By the time the Federal Reserve reduced rates in October, this action had already been factored into both bond and gold markets. What remained unanticipated was the indication that further rate reductions were not guaranteed. Gold, therefore, responded not to the rate cut itself, but to the change in expectations about the future cuts. When Powell modified the narrative, the market adjusted almost instantaneously.

Gold’s behaviour did not break the textbook; rather, it highlighted the textbook’s limitations. Modern markets are forward-looking, continuous, and highly sensitive to changes in signalling. Central bank communication now holds as much significance as central bank action. At times, a single clause in a press conference can move markets more than a 25-basis-point adjustment.

Also read: Govt shutdown, rate cut — US policy paralysis has created an opportunity for India

Why India should pay close attention?

India, as one of the largest global consumers of gold, is particularly sensitive to these international dynamics compared to other economies. For Indian households, gold serves not only as an investment but also as a savings mechanism, a cultural asset, and a safeguard against economic uncertainty. Increases in global gold prices directly influence domestic prices, while fluctuations in the dollar and rupee worsen these effects.

When expectations of monetary easing by the United States intensify, gold prices typically appreciate, leading to an increase in India’s expenditure. Conversely, when such expectations diminish, the dollar often strengthens, causing the rupee to depreciate and thereby increasing the domestic price of gold, even if international prices remain stable. That means a change in the Federal Reserve’s communication—even in the form of a single sentence—can significantly impact Indian household budgets, demand during festive seasons, and the external sector within a short period.

For Indian policymakers, the events of October underscore the necessity of closely monitoring not only the Federal Reserve’s actions but also the evolving discourse surrounding it. Global monetary policy now operates as much through expectation channels as through interest rate channels.

The October 2025 meeting provided a rare live demonstration of the mechanisms by which contemporary financial markets process information. Before the Fed’s decision, gold prices increased as investors anticipated a cycle of monetary easing. The actual rate cut exerted minimal additional impact. However, when Powell expressed uncertainty regarding the December outlook, gold prices reversed with precision timing.

The implication is clear: in modern markets, expectations are not merely peripheral; they constitute the central transmission mechanism of monetary policy. Asset prices adjust in anticipation and respond rapidly to any revisions in the expected trajectory.

The decline in gold prices following a rate cut was not paradoxical; rather, it was a rational response to altered future expectations. The true surprise lay not in the behaviour of gold, but in the rapidity with which a single statement could alter the entire trajectory of an asset so closely linked to the global perceptions of the future.

Bidisha Bhattacharya is an Associate Fellow, Chintan Research Foundation. She tweets @Bidishabh. Views are personal.

(Edited by Ratan Priya)