Decades of sweeping industrial policies have afforded China a near-total monopoly over gallium, a critical mineral used to produce high-performance microchips that power some of the United States’ most advanced military technologies. Recent moves by Beijing to restrict the export of gallium have laid bare the need for Washington and its allies to de-risk their critical mineral supply chains. Failing to address glaring vulnerabilities in the gallium supply chain could pose serious national security and economic challenges for the United States and its allies.

Introduction

On July 3, 2023, a previously obscure mineral called gallium was thrust into the spotlight when China’s Ministry of Commerce announced plans to impose new restrictions on exports of the metal. These measures went into effect on August 1, 2023, and are already shaking up global supply chains. They are primarily a shot across the bow designed to showcase China’s capacity and willingness to weaponize critical minerals for geopolitical gain.

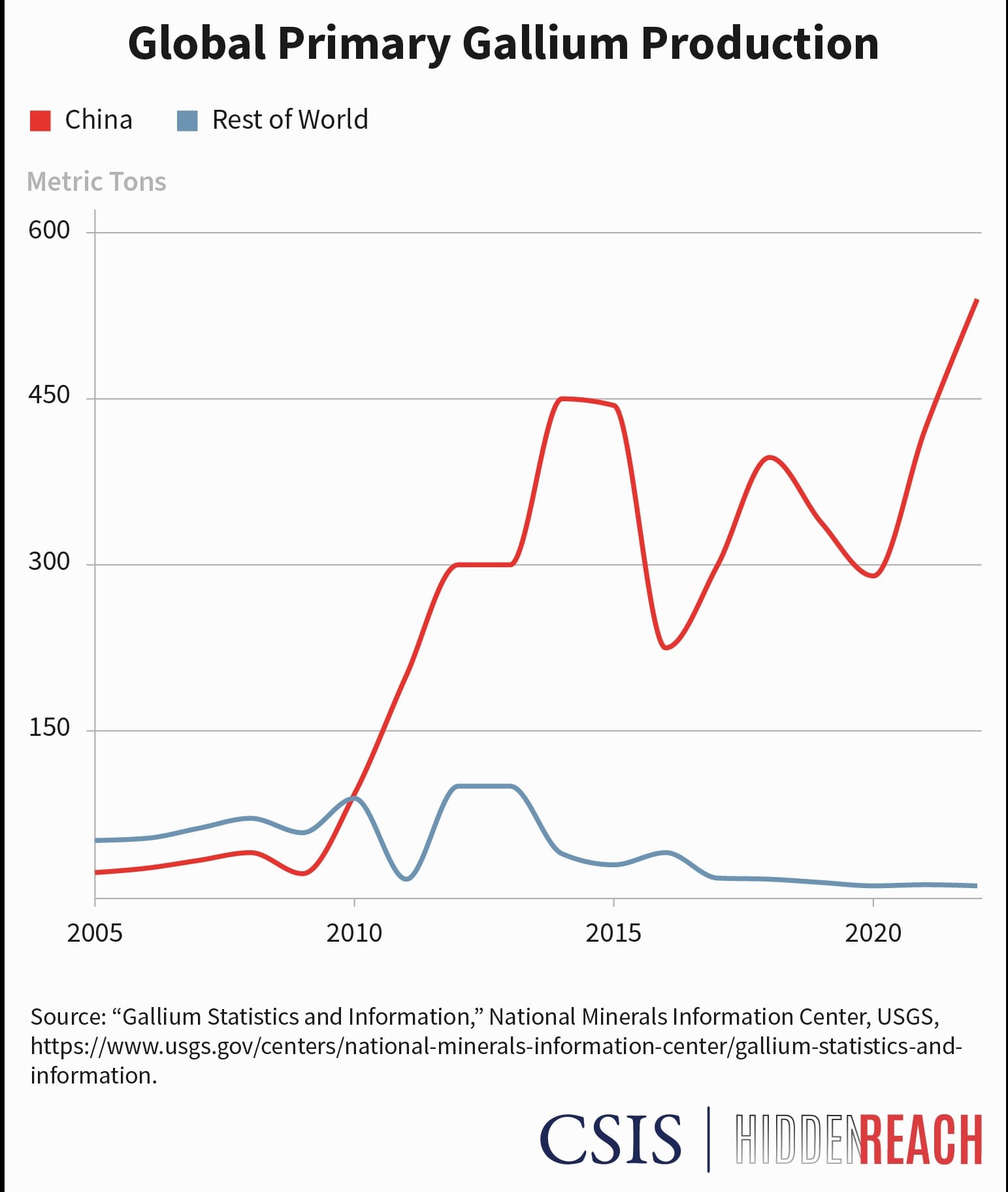

As of 2022, China produced a staggering 98 percent of the world’s supply of raw gallium. This virtual monopoly is largely a result of China’s position as the global leader in aluminum production—the process through which most gallium is extracted. Over the past few decades, deep government subsidies and tax incentives have fueled the rapid rise of China’s domestic metals industry, which has forced most global producers out of business, leaving China as one of the world’s only remaining producers of gallium.

While relatively unknown to most people, gallium plays a critical and unique role in modern electronics supply chains, especially within the defense industry. Its unique properties allow for the production of specialized semiconductors that are vital to advanced capabilities like next-generation missile defense and radar systems, as well as electronic warfare and communications equipment.

Disruptions in the gallium market could pose significant challenges for U.S. and allied defense industries and cost hundreds of billions of dollars in economic losses. China’s stranglehold on the supply of raw gallium is a critical vulnerability for the United States and its partners—one that Beijing appears poised to exploit. Fortunately, there are clear steps the United States and its allies can take to limit their exposure to China’s critical mineral monopolies.

Also read: Biden signs executive order restricting new US tech investments in China

Gallium’s Revolutionary Properties

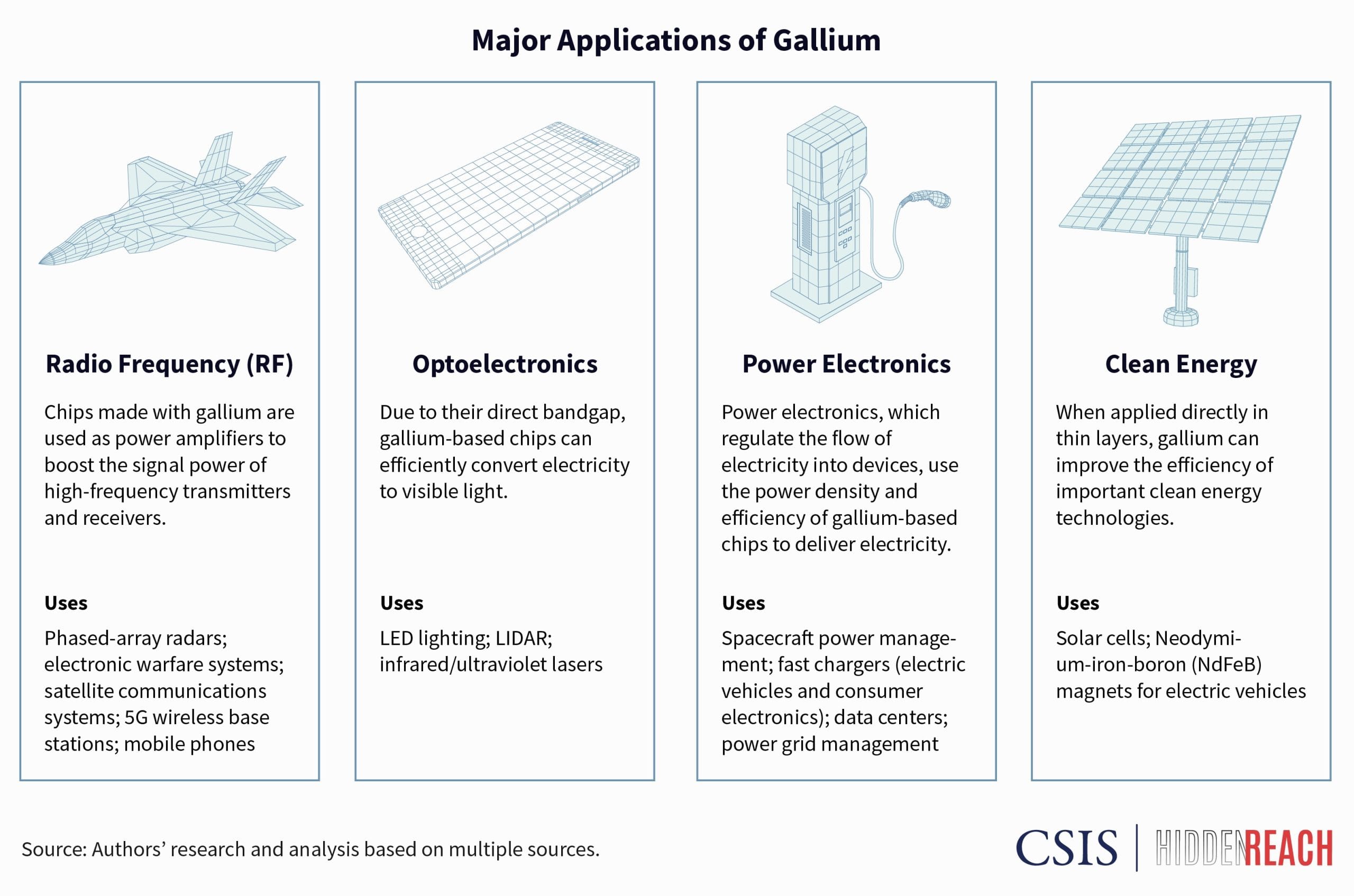

The chemical and physical properties of gallium make it well suited for use in high-performance applications such as advanced military equipment. Gallium may be combined with other materials to produce a special class of chips known as wide bandgap semiconductors. These chips can handle higher temperatures, voltages, and frequencies than conventional silicon chips, making them smaller, faster, and more efficient.

Gallium chips have long powered advances in military technology. In the 1970s the U.S. Defense Advanced Research Projects Agency (DARPA) played a leading role in incubating gallium as a material for a new generation of semiconductors. With DARPA’s backing, researchers developed a compound called gallium arsenide (GaAs), which powered advances in the U.S. Global Positioning System (GPS), precision-guided weapons, and radar. GaAs is highly versatile and remains widely used in modern consumer electronics, including smartphones.

The development of a more advanced compound called gallium nitride (GaN)—also nurtured by DARPA—is now enabling new technological breakthroughs. Most significantly, GaN is revolutionizing modern radar, allowing new radar modules to track smaller, faster, and more numerous threats from nearly double the distance. Many of these cutting-edge radar systems are powered by several thousand gallium-enabled chips.

U.S. and allied armed forces are swiftly incorporating GaN-enhanced radars into their most important platforms. In 2019 Raytheon was awarded a $383 million contract to build the first six GaN-enabled active electronically scanned array (AESA) radars for the U.S. Army’s Lower-Tier Air and Missile Defense Sensor (LTAMDS), which are being integrated into Patriot missile defense units and other systems. In June 2023 Poland secured the first foreign sale of the LTAMDS radar system, and other key U.S. allies are likely to follow.

Meanwhile, Northrop Grumman is developing the AN/APG-85, an advanced GaN-backed AESA radar for the F-35 Lightning II Joint Strike Fighter, and the U.S. Marine Corps has deployed Northrup’s AN/TPS-80 ground-based radar system since 2019. In 2022 the U.S. Department of Defense (DOD) awarded Raytheon a $3.2 billion contract to equip up to 31 vessels with GaN-powered AN/SPY-6 system radars, including the navy’s new Arleigh Burke–class Flight III destroyers, aircraft carriers, and amphibious ships. These upgrades are poised to bring about a sea change in the ability of U.S. and allied forces to defend against emerging threats like hypersonic missiles, next-generation stealth aircraft, and unmanned systems.

Gallium-based chips are also increasingly vital to the commercial sector. GaN’s value in powering radio frequency technologies has made it critical to 5G base station hardware, which requires efficient, high-frequency receivers. GaN’s density and efficiency are also turbocharging its adoption in power devices, which help rapidly supply electricity to devices like smartphones, laptops, electric vehicles, and data centers. Consumer electronics industry giants like Apple have recently begun to use GaN in next-generation chargers, signaling a broader shift in the industry. Gallium is also a key input in green technologies like solar cells and electric vehicles.

The importance of gallium is expected to grow. As continued advances in chip making push the limits of Moore’s law, industry experts see gallium compounds as a potential way to move beyond silicon-based chips. These trends are expected to drive 25 percent annual growth in the global market for GaN chips through 2030. Defense applications are expected to account for roughly half of this increase, underscoring gallium’s strategic value to U.S. and allied military modernization efforts. In 2023 a top executive at Raytheon, a leading producer of GaN radar systems, noted, “GaN is foundational to nearly all the cutting-edge defense technology that we produce.”

A Strategic Vulnerability

Increasing demand for gallium in critical industries has raised the stakes for securing a steady supply of the mineral. A sudden gallium supply shock would have consequences for defense manufacturers and broader economic security. A 2022 analysis by experts from the U.S. Geological Survey (USGS) found that a 30 percent supply disruption of gallium could cause a $602 billion decline in U.S. economic output, or 2.1 percent of gross domestic product (GDP).

The cascading impacts on industrial production could cause major setbacks to the manufacturing of key defense systems. Although defense manufacturers account for only a small share of the global end use of gallium, shortages and disruptions in the supply of semiconductors and other key electronics can pose long-term challenges for defense firms. Many of the U.S. military’s key suppliers of GaN chips also rely on revenue from substantial sales to civilian customers. Interruptions to their commercial operations may complicate their ability to meet the defense industry’s growing need for gallium-based systems.

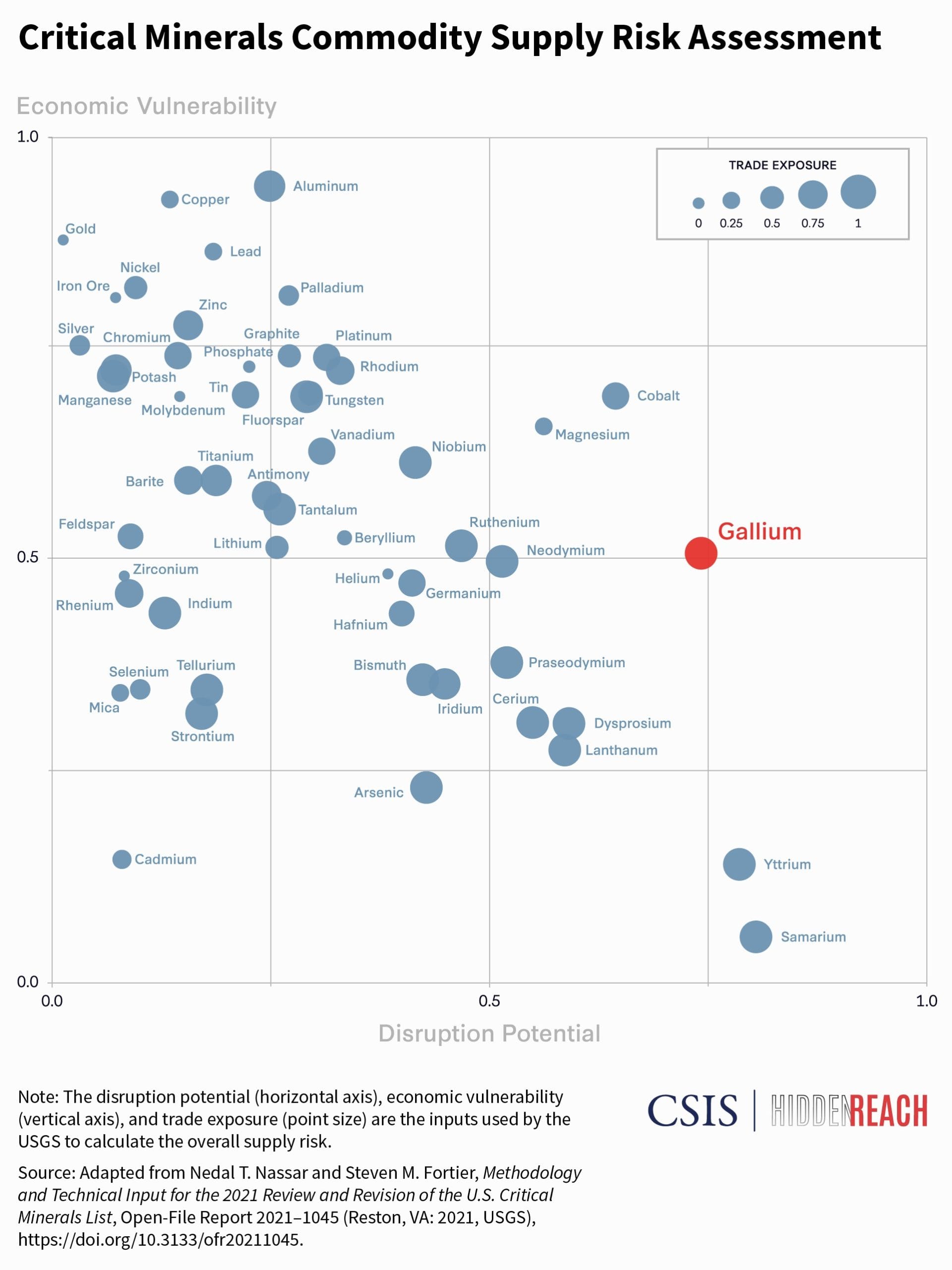

Both Washington and its allies have been aware of these risks for years. The USGS has included gallium on each iteration of its critical minerals list since 2018, and its most recent review of critical minerals ranked gallium number one of fifty in terms of supply risks. The European Union likewise identified gallium as a “strategic raw material” and in recent years has upgraded its supply risk assessment, citing “higher global production concentration in China.” The Japanese government has listed gallium as one of thirty-five minerals important to its national security.

Heightened U.S.-China tensions have further elevated concerns. In 2020 the Trump administration declared U.S. critical mineral dependencies (including on gallium) a national emergency. In 2021 the Biden administration published a 100-day supply chain review warning U.S. reliance on China for gallium risks disruptions that would have “far-reaching impacts on semiconductor production.” A 2023 draft critical mineral assessment report released by the U.S. Department of Energy also defines U.S. supply of gallium as “critical” in both the short and long terms, one of just six minerals to receive such designation.

Yet government policies on critical minerals in the United States and abroad have been heavily biased toward securing access to a select group of inputs needed for emerging green technologies, such as lithium and cobalt. For example, the Biden administration’s Inflation Reduction Act of 2022 provides a 10 percent tax credit for domestic producers of a set of key minerals needed for electric vehicles, but gallium is absent from the list. The lack of attention to lesser-known minerals like gallium has left government and industry leaders unprepared for the consequences of possible disruptions.

The Chinese government’s August 2023 export controls on gallium have made clear that Washington and its allies need to look beyond battery-making minerals to other strategically important resources. Chinese state media outlets framed the new rules as a direct response to export controls put in place by the United States, Japan, and the Netherlands to limit China’s access to advanced semiconductors and chip-making equipment.

The full effect of the restrictions remains to be seen and will ultimately depend on how much gallium China chooses to withhold from global markets. Nevertheless, the move demonstrates Beijing’s willingness to use its control over critical minerals as a tool in China’s intensifying technological competition with the United States and its allies.

Also read: European stocks fall on U.S. inflation uncertainty, China worries

How China Came to Dominate Gallium

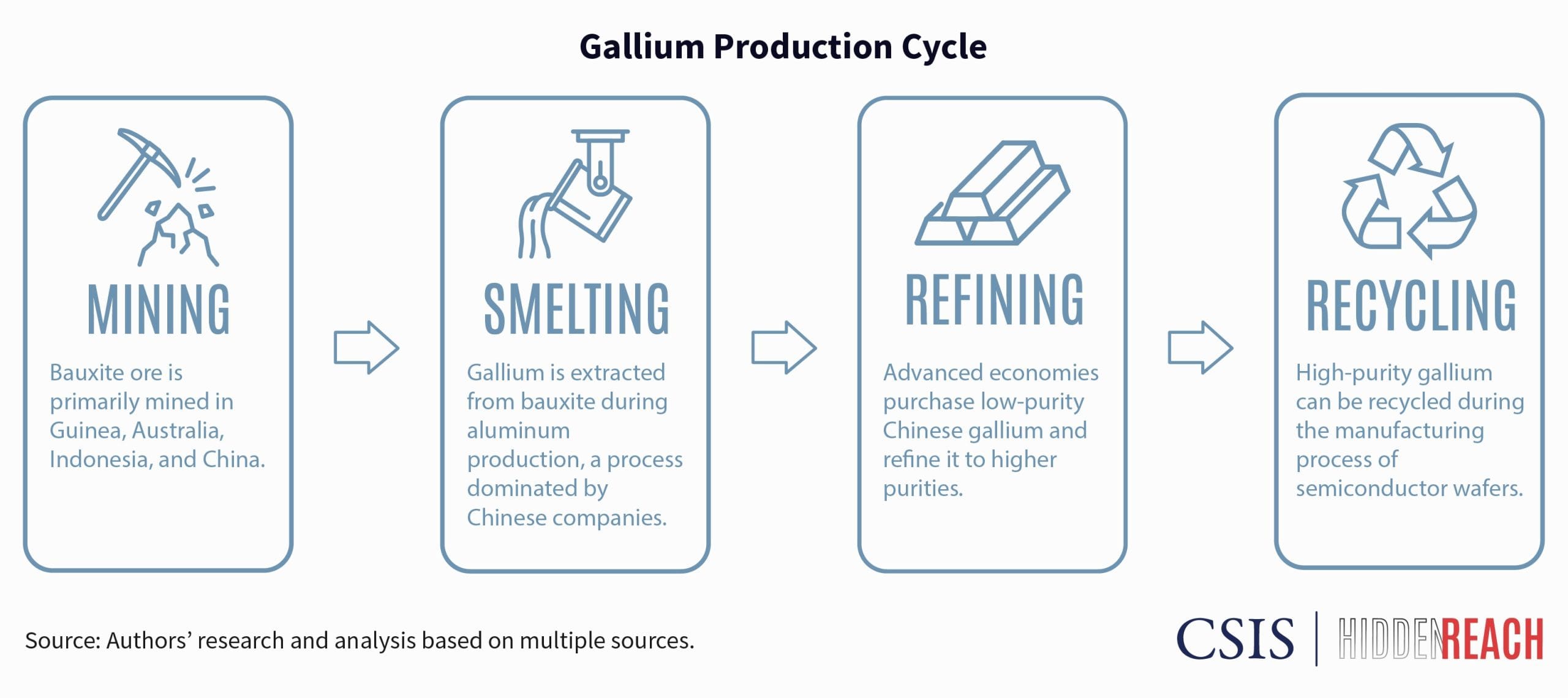

China’s control over gallium supply chains came about indirectly. Gallium differs from some other key minerals like lithium, nickel, and cobalt in that it is not recovered directly from the earth. Instead, gallium is largely a by-product of processing bauxite, the primary ore for aluminum. Gallium production is therefore closely tied to the dynamics of global aluminum markets.

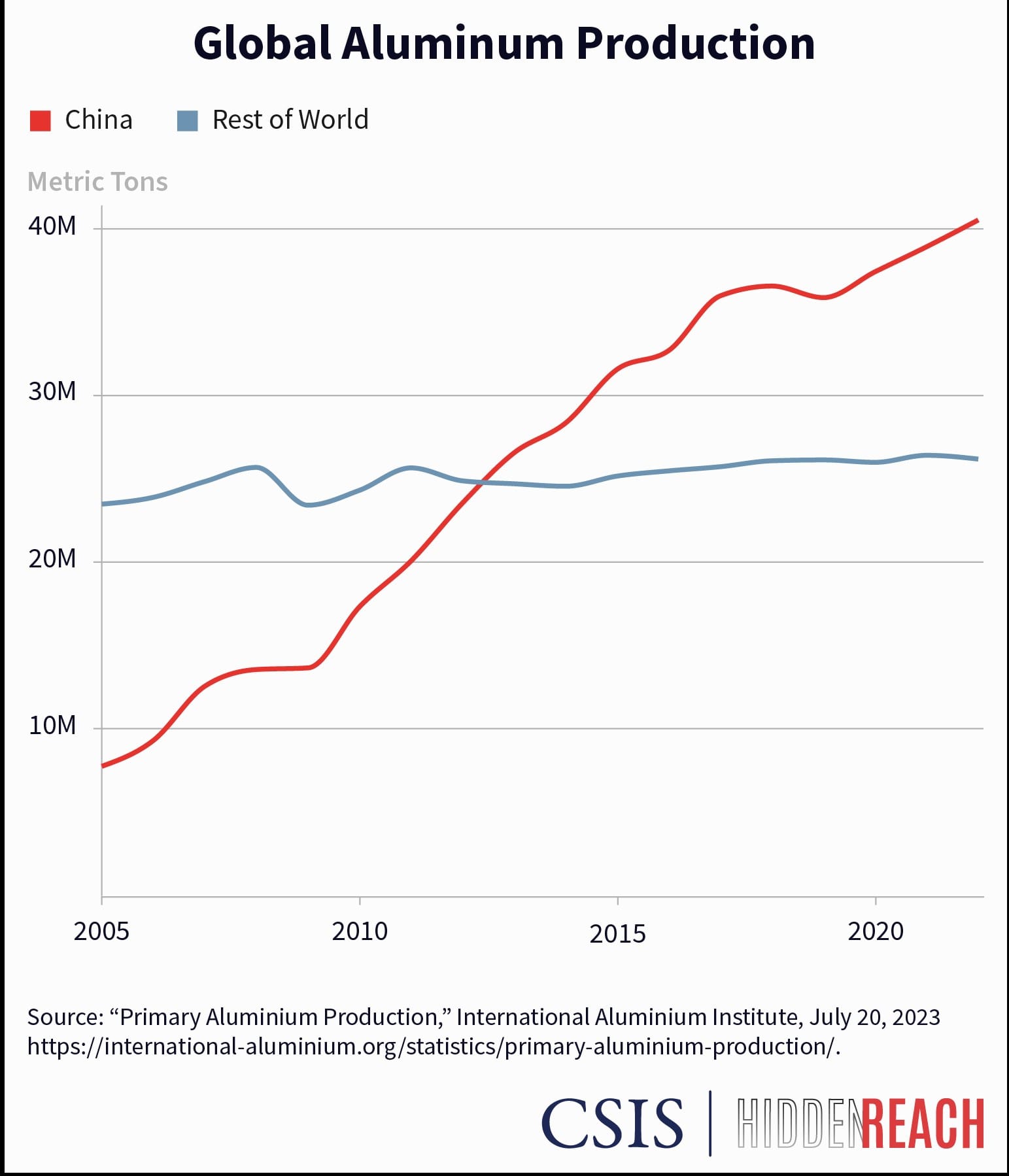

China’s emergence as an industrial powerhouse has driven explosive growth in its aluminum industry. Assisted by extensive government subsidies and tax incentives, China experienced a tenfold increase in aluminum production (from 4.2 to 40.2 million tons) between 2000 and 2022. Today China supplies approximately 59 percent of the world’s aluminum.

China has plentiful reserves of bauxite within its borders, but due to the high environmental costs and low profit margins involved with bauxite mining, the country has gradually shifted toward imports of the ore to meet domestic demand. Major Chinese firms, led by the Aluminum Corporation of China (Chalco), have increasingly looked abroad to places like Guinea, Australia, and Indonesia to supply the raw bauxite ore for domestic aluminum processing.

China’s Involvement in Guinea’s Bauxite Sector

China has paid particular attention to cultivating its relationship with the West African country of Guinea, which leads the world in known bauxite reserves. Chinese entities have used a range of diplomatic, financial, and developmental inducements to gain access to the country’s mines, including the construction of a railway system from the country’s bauxite-rich Boké region to the port of Dapilon, overseen by Chinese state-owned enterprises including China Railway Construction Corporation (CRCC).[26] These investments have paid off for Chinese firms: in 2022 Guinea provided 56 percent of China’s total bauxite imports.

China’s leading position in aluminum has allowed it to establish a dominant share of global gallium production. Moreover, China’s government has implemented strategic policies to boost production, including a requirement for the country’s aluminum producers to create the capacity to extract gallium. The results are clear: from 2005 to 2015 China’s production of low-purity gallium exploded from 22 metric tons to 444 metric tons.

China’s rapid rise in the industry created oversupply in the global market, triggering severe fluctuations in gallium prices throughout much of the 2010s. As a result, leading suppliers in the United Kingdom, Germany, Hungary, and Kazakhstan suffered and were forced to shutter their production. The United States, which began offshoring much of its domestic mining capacity in the 1970s and 1980s, saw one of its last remaining refined gallium production facilities shut down in 2020. China was left as virtually the only supplier in the world.

Also read: US investors flag retaliation risks after Biden’s China tech curbs

Climbing the Value Chain

While holding sway over raw gallium production affords China leverage over its competitors, the country’s leaders understand that long-term advantage is won at the cutting edge of innovation. To achieve this, Beijing is actively supporting Chinese firms in overtaking the United States and its allies to become global leaders in gallium-based semiconductor production.

The 14th Five-Year Plan, China’s top national economic blueprint released in 2021, identifies wide bandgap semiconductors—namely GaN and another compound called silicon carbide—as a key focus area. Taking up this call, China’s powerful Ministry of Science and Technology launched a special project to encourage the development of “third-generation semiconductors and frontier electronic materials and devices.”

Making headway in the development of gallium-based semiconductors could offer China unique opportunities to advance its drive for technological self-sufficiency. Compared to silicon-based chips, which have been around for more than half a century, GaN semiconductors are still maturing, and new markets are emerging. If China can make breakthroughs in the initial phases of GaN semiconductor development, it can potentially lock in early-mover advantages in ways similar to its success at capturing the lead in producing advanced batteries for electric vehicles.

Chinese experts specializing in third-generation semiconductors have signaled that Beijing’s efforts to develop gallium-based chips are aimed at technologically leapfrogging the United States, Europe, and Japan. According to one state-backed industry group, China should use GaN to “seize the historic opportunity to overtake the car by changing lanes.” A prominent researcher at a State Key Laboratory similarly asserted, “As the semiconductor industry shifts from silicon to gallium, China is preparing to take the lead position.”

As the semiconductor industry shifts from silicon to gallium, China is preparing to take the lead position.

— Hao Xiaopeng, State Key Laboratory of Crystal Materials

China began setting its sights on gallium-based semiconductors in 2008 when it rolled out plans for massive subsidies to become a global leader in LED manufacturing, which uses GaAs and GaN chips. Supported by these subsidies—which accounted for as much as 85 percent of some firms’ revenues—Chinese LED makers poured $16.7 billion into wafer and chip production between 2009 and 2010. By 2014, however, China was forced to scale back its investments in the industry as oversupply and quality issues hampered the profits of its fledgling firms.

Undeterred by these frustrations, Chinese leaders shifted toward a campaign to acquire foreign gallium semiconductor technology. Over the past decade, Chinese individuals, firms, and entities, including those linked with the People’s Liberation Army (PLA), have been engaged in a systematic campaign of corporate espionage and strategic acquisitions to target GaAs and GaN technologies from companies in the United States and other advanced economies.

These efforts have paid dividends for China’s military modernization and exemplify Beijing’s military-civil fusion strategy, a sweeping push to fuse together the country’s security and development goals. Top personnel at China’s leading military radar manufacturer, China Electronics Technology Group Corporation (CETC), claimed in 2018 to have developed state-of-the-art radar technologies “comparable in performance to those used by the [U.S.] F-22 and F-35.”

In 2021 CETC released a family of next-generation GaN-backed radar systems called Lingdong (灵动), which it claims can easily detect stealth aircraft and cruise missiles. Then, in 2023, Chinese academics published a paper outlining plans for an advanced naval radar system that would likely use GaN technology. Reportedly, the new system will improve China’s ability to detect targets as far away from China as Australia or Guam.

Growing momentum in commercial applications of GaN, including 5G, have also helped propel Chinese firms into global leadership in gallium-based chips. While U.S., European, and Japanese firms maintain a technological edge, several Chinese companies are beginning to close the gap. Buoyed by billions of dollars of government investment and a slew of preferential tax, land, and procurement policies, several Chinese companies are becoming competitive on the world stage.

Innoscience, a leading manufacturer of gallium-based chips, operates two of the world’s largest GaN fabrication facilities and has expanded overseas with offices in the United States, Europe, and South Korea. It has benefited from capital and partnerships from major Korean and European firms, like SK Group and ASML, while also receiving investment from AVIC Trust, the venture capital arm of China’s military aerospace giant, the Aviation Industry Corporation of China (AVIC).

Other Chinese GaN firms, like Suzhou Nanowin, HiWafer, and Sanan IC, are following closely. An executive from Suzhou Nanowin boasted recently that the company had aims to capture 30 percent of the global market share for GaN substrate production.

China’s patenting activities related to GaN semiconductors have also been rapidly accelerating, reflecting a deepening push to develop the technology. Between 2019 and 2020, Chinese organizations (including telecommunications giant Huawei) accounted for over 40 percent of all patent applicants, surpassing the United States (23 percent), Japan (10 percent), and Europe (3 percent).By 2019 Huawei alone had filed 2,000 patents on GaN technology.

Looking Ahead

Losing ground to Chinese firms in the race for more capable and powerful compound semiconductors will put the United States on the back foot in developing next-generation technologies crucial to military power and economic competitiveness. Beijing’s active role in creating a flourishing domestic ecosystem for gallium-based chips has already benefited China’s military development.

Moreover, if China continues to dominate the raw supply of gallium while also achieving the leading edge of gallium-based chip production, the country can largely insulate itself from global supply chain shocks in the field. China’s recent export restrictions on gallium suggest an increased level of confidence that Beijing can inflict pain on others while limiting blowback on Chinese companies.

At a May 2023 meeting, the United States and other leading Group of Seven (G7) economies jointly called for “de-risking” from economic competitors like China. De-risking has quickly become a buzzword within policy circles, but there is little consensus on how to practically de-risk from China.

Gallium represents a clear-cut area in which Washington and its allies can take concrete steps to protect their supply chains by reducing their reliance on China. No country can be fully self-reliant in natural resources, and China will remain a key player in critical minerals markets. Yet by making targeted investments at home and working strategically with allies, the United States can reduce its reliance on China and de-risk critical supply chains from disruptions.

To this end, the United States can take several steps, both on its own and in conjunction with its allies and partners:

- Invest in gallium extraction and refinement capabilities in the United States. The U.S. government should invest in reestablishing domestic capacity to mine bauxite and extract gallium. Targeted public-private agreements based on investment, tax incentives, or other tools could provide the necessary conditions for firms to establish and maintain gallium production facilities. There is currently one active plant in the United States that processes bauxite into aluminum, based in Louisiana. Given the proper incentives, this plant could install the equipment needed to extract gallium.The DOD can use its authority under the Defense Production Act to support this effort. Following China’s announcement of the new restrictions on gallium, a DOD spokesperson said the department was taking steps “to increase domestic mining and processing of critical minerals for the microelectronics and space supply chain.” The department and its relevant offices should work across the interagency and with the private sector to support these efforts. Washington has already shown it can invest in mining for critical minerals. In 2022 the Biden administration awarded $2.8 billion under the Bipartisan Infrastructure Law to build and expand facilities in 12 states to extract and process lithium, graphite, and other materials and to scale up battery-making manufacturing capabilities. While these are laudable investments, much of the attention to critical minerals has been focused on battery manufacturing, while fewer resources have gone to other important minerals like gallium.

- Collaborate with allies and partners to scale up overseas gallium extraction and refinement capacity. Germany was a major producer of raw gallium as recently as 2018, before shutting down its production. Australia is one of the leading global exporters of bauxite ore. The United States should establish new partnerships or build on existing frameworks to help governments in these countries create the conditions needed for firms to scale up gallium production. This could include agreements similar to the recently announced Australia-United States Climate, Critical Minerals and Clean Energy Transformation Compact, wherein the United States agreed to invest directly in Australian minerals suppliers and consider Australian suppliers to be domestic suppliers under the Defense Production Act.

- Promote gallium recycling. Bringing online new mining and refining capacity may be a long-term process. Ramping up recycling of gallium may offer a way of alleviating supply chain issues in the short or medium term. Significant quantities of gallium can be recycled at various stages of the manufacturing process. The United States and its partners should invest in building on existing recycling capabilities.

- Maintain a minimum one-year stockpile of gallium for the defense industry. The U.S. government has long maintained a National Defense Stockpile containing key materials critical to national security, overseen by the DOD’s Defense Logistics Agency (DLA). While DLA lists gallium as a “material of interest,” the agency’s public reports indicate it has not made any purchases of gallium for stockpiling within the past decade. The U.S. defense industry does not currently use enormous quantities of gallium, so relatively small stockpiles could suffice. However, in its pure metal form, gallium has a shelf life of about one year, suggesting that stockpiles would need to be well maintained Consulting with Congress, DLA should add gallium to the National Defense Stockpile, working with private industry and foreign partners to ensure U.S. defense needs are covered for at least one year.

- Enhance data collection and transparency in U.S. gallium production and consumption. Prior to China’s decision to enact export controls on gallium, there was very little discussion in policy circles about the mineral and China’s influence over its supply, partially because publicly available data on global gallium markets are sparse. The United States and other major economies publish data only on trade of low-purity gallium and GaAs wafers, omitting figures on other important steps in the supply chain such as refined gallium and GaN wafers. Greater data transparency both globally and within the United States would help improve the ability of policymakers, defense officials, and private sector actors to better assess the state of the market and U.S. vulnerabilities.

Matthew Funaiole is vice president of the iDeas Lab, Andreas C. Dracopoulos Chair in Innovation, and senior fellow of the China Power Project at the Center for Strategic and International Studies (CSIS) in Washington, D.C. Brian Hart is a fellow with the China Power Project at CSIS. Aidan Powers-Riggs is a research associate for China analysis with the iDeas Lab at CSIS. Views are personal.

This article was originally published on CSIS website.