The Union Budget 2025 has maintained a fine balance between boosting demand and sticking to the path of fiscal prudence. Despite revenue loss due to tax cuts, the fiscal deficit is projected at 4.4 per cent of GDP, down from 4.8 per cent in the revised estimates of the current year. The revenue deficit is pegged at 1.5 per cent of GDP, down from 1.9 per cent in the current year.

Focus on education, skilling and budgetary support for labour-intensive sectors are welcome steps to boost the country’s employment potential. Measures to support the Micro, Small and Medium Enterprises (MSMEs) such as revision in definition, and significant enhancement of credit, will also help generate greater employment opportunities.

Policy interventions to boost the production of pulses, oilseeds, vegetables, and fruits will help reduce sharp swings in prices and ease food inflation.

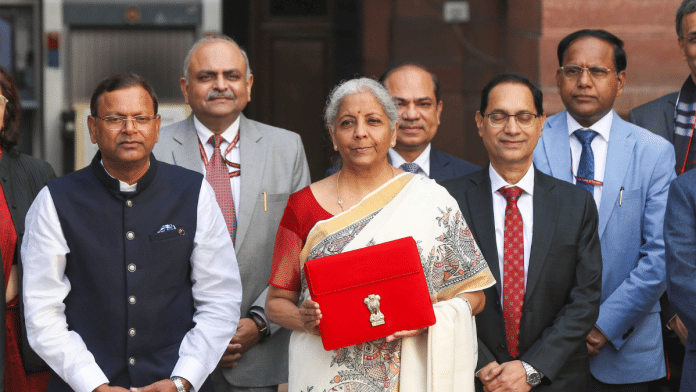

In July 2024, Finance Minister Nirmala Sitharaman had suggested a shift to debt-GDP ratio as the fiscal anchor in line with global thinking. The Budget has done well to unveil its fiscal consolidation path for FY 2026-27 to FY 2030-31, which reflects the shift to a debt-based fiscal anchor.

Tax relief for the middle-class

Amid concerns around subdued urban consumption, the Budget has announced substantial relief for the middle class. It has raised the limit of income tax rebate from Rs 7 lakh to Rs 12 lakh (Rs 12.75 lakh for salaried taxpayers with standard deduction ). The revised tax structure will reduce taxes for the middle class and leave more income in their hands. This will likely give a boost to household consumption and savings.

Despite income tax cuts, the government’s income tax receipts are budgeted at Rs 14.38 lakh crore, which is 14 per cent higher than the revised estimates of Rs 12.57 lakh crore for FY 25. Similarly, corporation taxes are estimated to grow by 10.4 per cent over the revised estimates of FY 25. Given the challenging global environment and threat of tariffs, corporate profitability is not likely to see a major turnaround. Thus, the projections on tax estimates appear optimistic.

Also read:

Push to public capex continues

In the current year, given the election-related restrictions and heavy monsoons in some regions, the government was likely to fall short of its budgeted capex. The revised estimates peg the government’s capital spending for the current year at Rs 10.18 lakh crore against the budgeted Rs 11.11 lakh crore. The push to capital spending as an engine of growth continues with the Budget allocating Rs 11.21 lakh crore toward capital expenditure in FY 26. To promote capital spending by states, the Finance Minister announced an outlay of Rs 1.5 lakh crore in 50-year interest-free loans to states.

To infuse capital in new projects, the Budget announced the launch of the second asset monetisation plan for 2025-30, with an aim to generate Rs 10 lakh crore. The execution bottlenecks should also be addressed to ensure the success of the asset monetisation plan.

The Budget has provided greater emphasis on public-private partnerships in infrastructure. While the public-private partnership model is pivotal for infrastructure growth, it has delivered mixed results on account of contract disputes, land acquisition delays, and a lack of a steady dispute resolution mechanism. The factors that inhibit the effectiveness of the PPP model would need to be addressed to encourage greater private sector involvement in infrastructure.

Light-touch regulation

In addition to uneven demand, the high cost of doing business and over-prescriptive regulations also impede private sector participation. A key theme underlying both the Economic Survey and the Budget is to reduce the regulatory burden to improve the ease of doing business.

The Budget has a number of welcome steps in this direction. It proposed setting up a high-level committee to review all non-financial sector regulations, licences, certifications and permissions. The Financial Stability and Development Council (FSDC) would oversee the impact of financial sector regulations. Notably, in 2013, the Financial Sector Legislative Reforms Commission (FSLRC) set up by the government recommended a blueprint for improved regulatory governance within the Indian financial regulatory regime. The governance-enhancing principles recommended by the FSLRC and approved by the FSDC should be implemented by all financial sector regulators. This will harmonise processes and standards across various sub-sectors of the financial system and reduce regulatory arbitrage.

Proposals such as the Investment Friendliness Index of States and Jan Vishwas 2.0 to decriminalise provisions are positive steps in the direction of reducing cost of doing business in India. However, the actual implementation and the impact on the ground will need to be seen.

Also read:

Medium-term fiscal consolidation

The government has articulated its fiscal strategy beyond FY 2025-26. It has unveiled its medium-term fiscal consolidation path to reflect the shift toward a debt-based fiscal anchor. According to the medium-term fiscal consolidation path, the government would endeavour to keep its fiscal deficit each year from FY 2026-27 to FY 2030-31, such that the central government’s debt is on a declining path, to attain a debt to GDP ratio of about 50 plus/minus one per cent by 31 March 2031. Under assumptions of nominal GDP growth varying from 10 per cent to 11 per cent, three scenarios of fiscal consolidation have been laid out.

The articulation of the medium-term fiscal consolidation roadmap imparts transparency to the government’s fiscal framework and provides certainty and clarity to stakeholders including investors.

Radhika Pandey is an associate professor at the National Institute of Public Finance and Policy. Views are personal.