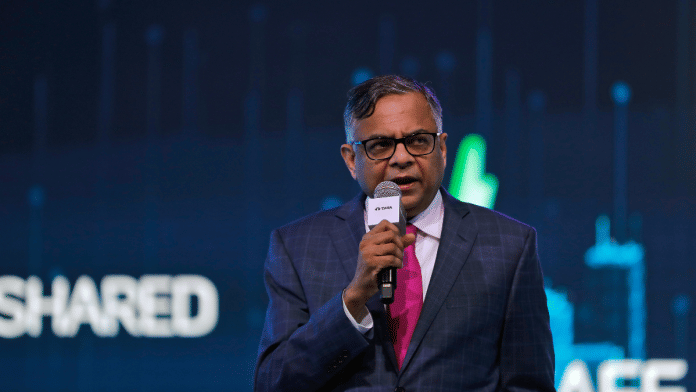

When Tata Trusts, the largest shareholder of Tata Sons, recently passed a resolution to extend the term of executive chairman N Chandrasekaran (Chandra, as he’s widely known) for another five years, the world took notice. There are several reasons for that. The first reason it surprised industry watchers was its timing. Chandra’s second term is until February 2027, which is still more than 18 months away. Why did Tata Trusts, which controls around 66 per cent in the holding company of the steel-to-software conglomerate, treat this matter with such urgency and so far ahead of time?

Was there anything similar when Chandra got a second term as executive chairman of Tata Sons in 2022? Not quite. On February 11, 2022, the Tata Sons board of directors reportedly reviewed the first five years of his tenure before reappointing him for another term. Ratan Tata, then chairman of Tata Trusts and chairman emeritus of the Tata Group, attended that Tata Sons board meeting as a “special invitee’’, and recommended the renewal of Chandra’s term for another five years. This happened just about 10 days before Chandra’s first term was to end. It seemed like business as usual. No Tata Trusts resolution preceded Chandra’s reappointment at that point.

In the case of Cyrus Mistry, who held the position of Tata Sons executive chairman before Chandra took charge in February 2017, there was no occasion for a renewal of term. Mistry was removed as Tata Sons chairman in October 2016 over alleged trust and performance issues. After removing Mistry, the Tata Sons board appointed Ratan Tata as interim non-executive chairman while a search committee was set up to look for the next executive chairman. It’s another matter that an internal candidate — Chandra, as Tata Consultancy Services chief executive officer — made the cut for the top job at Tata Sons. Before Mistry, Ratan Tata was the chairman of Tata Sons for 21 years from 1991 to 2012. He stepped down from that role on turning 75. Since Ratan Tata was both chairman of Tata Sons and Tata Trusts — the last time that the dual role was held by the same person — there was no question of any Tata Trusts resolution for appointment or reappointment to the top job. It was no different for JRD Tata, who was at the helm of the group for 53 years after succeeding Nowroji Saklatvala in 1938.

Returning to the subject of the recent resolution by Tata Trusts to extend the Tata Sons chairman’s term, what is its significance? As per the process, the resolution will be placed at the Tata Sons board for it to be considered for approval. Even without such a resolution, Tata Sons would have decided on the future course of action about the group’s leadership. Typically, across the corporate world in professionally run firms, there are three choices when a leader’s term is nearing its end: Extend the term of the incumbent if the rules permit; set up a search committee for selecting the next leader; or go for an internal candidate for the top job.

However, this is not just about the process of appointment or reappointment. In this case, the largest shareholder of Tata Sons seems to have sent out a message both internally and externally that it is backing the leadership of the current chairman. As the largest shareholder, Tata Trusts’ view can certainly not be ignored. But with Tata Trusts passing a resolution on another existential matter at the same meeting, things look somewhat complex. According to the resolution, Tata Trusts wants Chandra and the Tata Sons board to do two things — first, work towards the exit of the Shapoorji Pallonji Group as the second-largest shareholder of Tata Sons; and two, engage with the Reserve Bank of India (RBI) to ensure that Tata Sons is kept out of the ambit of public listing. Tata Sons was designated an upper layer non banking financial company by the RBI in September 2022 — a classification that mandates a stock market listing of Tata Sons within three years. Tata Sons’ request to the RBI, seeking a change of classification from an upper layer core investment company, is pending.

With the RBI deadline for listing Tata Sons closing in, industry watchers may end up reading all the three items in the Tata Trusts’ resolution together. That, in turn, could mean that the largest shareholder is not just seeking another term for the current Tata Sons chairman in isolation, but is also attaching additional clauses — shedding the Shapoorji Pallonji stake and keeping Tata Sons private — like adjuncts in the group’s leadership journey.

As the relationship between Tata Trusts, under Noel Tata as chairman, and Tata Sons evolves in the post-Ratan Tata era, there’s curiosity over whether the largest shareholder is speaking in one voice. If it is indeed one voice, with Noel Tata getting the full backing of the trustees, it will mean continuity in a broad sense. If not, there could be something brewing in terms of control competing with philanthropy — which should be at the core of Tata Trusts.

Nivedita Mookerji @nivmook is the Executive Editor of Business Standard. Views are personal.